San Diego California Affidavit of Loss regarding Negotiable Instrument: A Comprehensive Guide In San Diego, California, an Affidavit of Loss regarding Negotiable Instrument is a legally binding document that individuals can use to report the loss or theft of a negotiable instrument such as a check, promissory note, money order, or bank draft. This affidavit is essential in safeguarding an individual's financial interests and preventing fraudulent use of the lost or stolen instrument. The San Diego California Affidavit of Loss regarding Negotiable Instrument provides a detailed description of the circumstances of the loss or theft, acting as an official record of the incident. It typically includes essential information such as the individual's name, contact details, and legal identification, as well as the details of the lost or stolen instrument, such as its date, amount, number, and issuer. Different Types of San Diego California Affidavit of Loss regarding Negotiable Instrument: 1. Lost Check Affidavit: This type of affidavit is used when an individual loses a check issued to them or when their own issued check goes missing. It serves as proof that the check was indeed lost, ensuring that the person reporting the loss is not held liable for any unauthorized use of the check. 2. Stolen Promissory Note Affidavit: In cases where a promissory note, a legal document containing a written promise to pay a specific amount of money, is stolen, individuals can complete a Stolen Promissory Note Affidavit. The affidavit provides a detailed account of the circumstances of the theft, protecting the individual from any potential financial liability. 3. Missing Money Order Affidavit: If an individual misplaces a money order purchased from a financial institution, filling out a Missing Money Order Affidavit is crucial. This affidavit documents the loss, enabling the issuer to initiate an investigation and potentially issue a replacement or reimbursement if deemed appropriate. By filing a San Diego California Affidavit of Loss regarding Negotiable Instrument, individuals take necessary steps to protect themselves from potential financial losses and fraudulent activities. It is advisable to contact the appropriate issuing authority promptly and follow any specific instructions they provide to ensure a smooth resolution of the situation. Keywords: San Diego California, Affidavit of Loss, Negotiable Instrument, Check, Promissory Note, Money Order, Bank Draft, Lost Check Affidavit, Stolen Promissory Note Affidavit, Missing Money Order Affidavit, legally binding document, safeguarding financial interests, prevent fraudulent use, detailed description, documentation, unauthorized use, financial liability, replacement, reimbursement, financial institution.

San Diego California Affidavit of Loss regarding Negotiable Instrument

Description

How to fill out San Diego California Affidavit Of Loss Regarding Negotiable Instrument?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and many other life situations demand you prepare official paperwork that differs throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and get a document for any personal or business purpose utilized in your county, including the San Diego Affidavit of Loss regarding Negotiable Instrument.

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Afterward, the San Diego Affidavit of Loss regarding Negotiable Instrument will be accessible for further use in the My Forms tab of your profile.

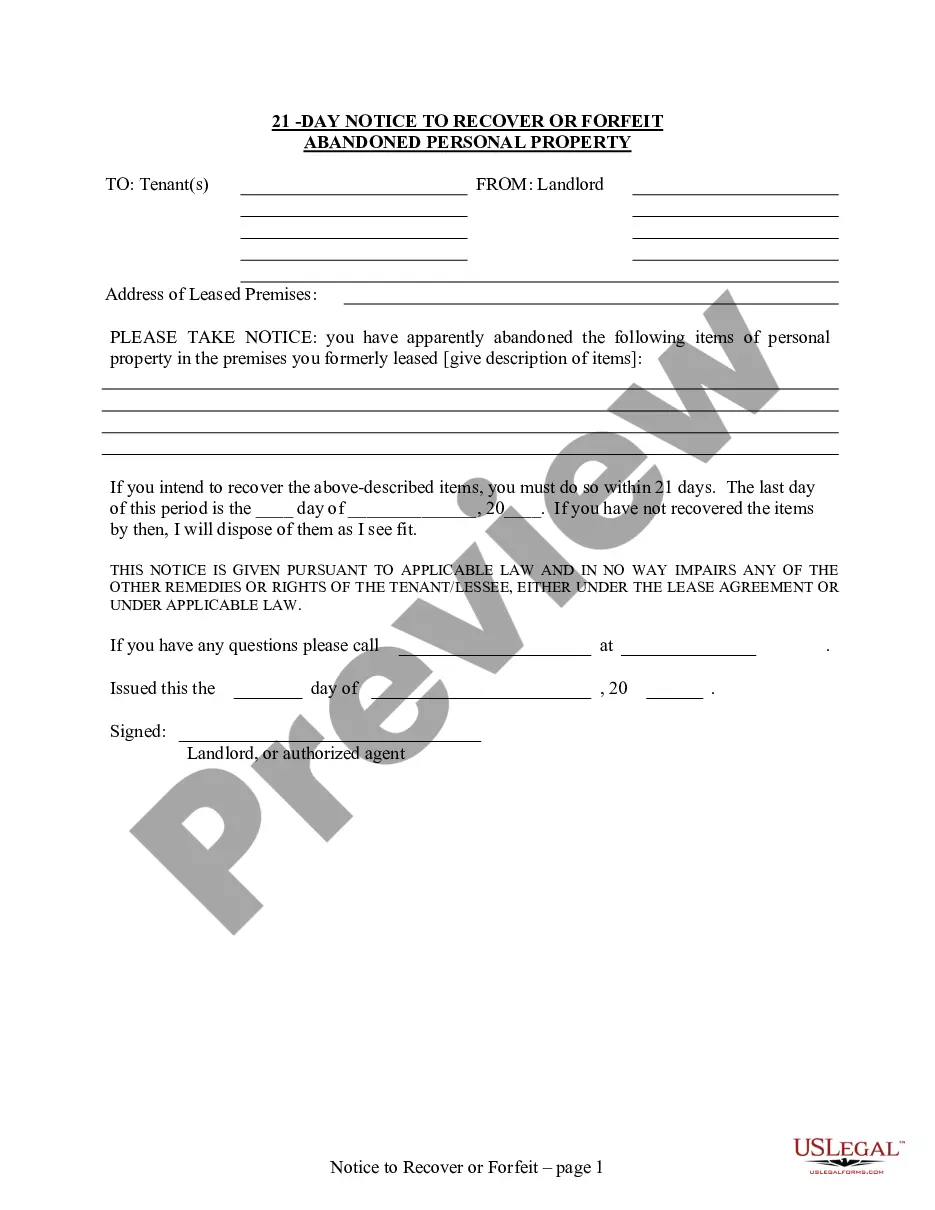

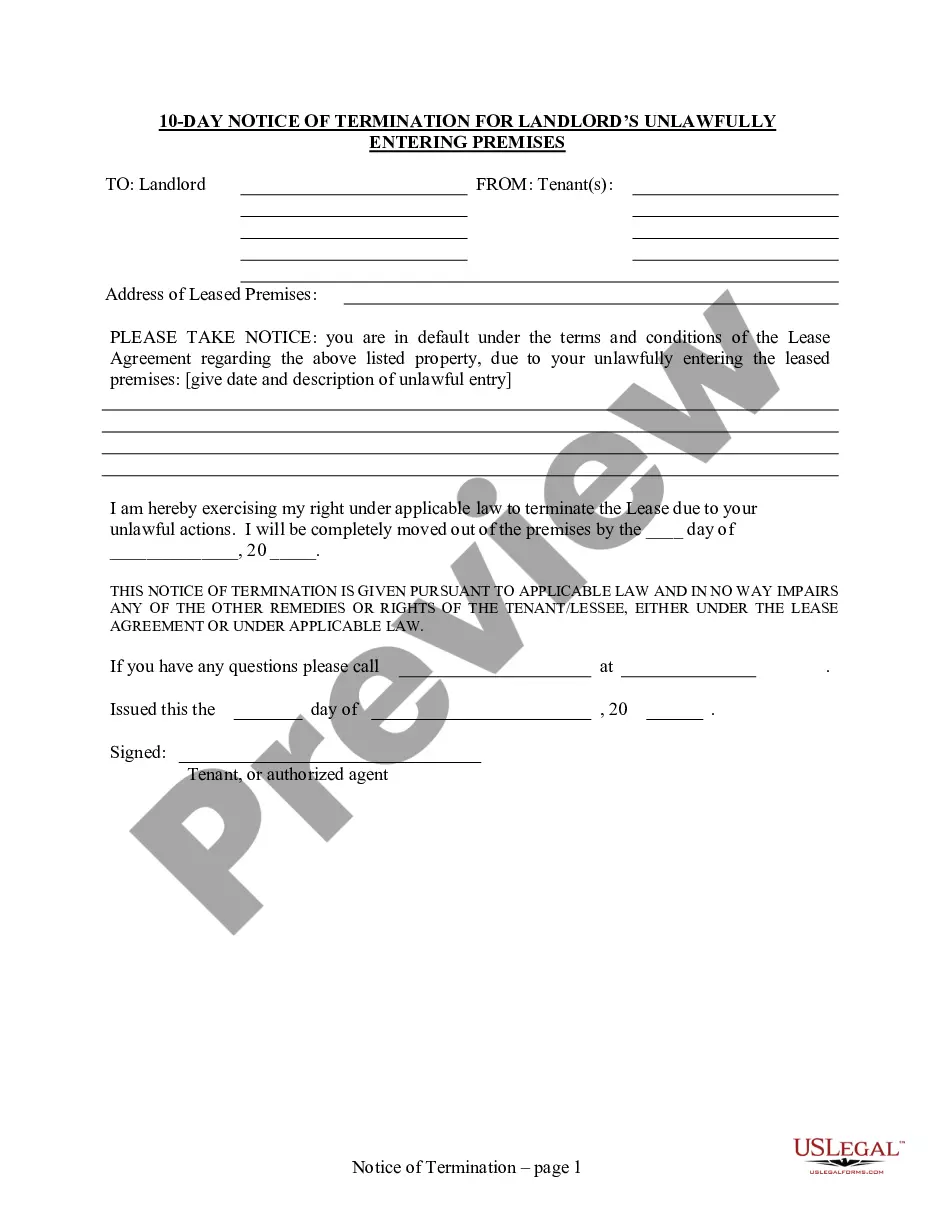

If you are using US Legal Forms for the first time, follow this quick guideline to obtain the San Diego Affidavit of Loss regarding Negotiable Instrument:

- Make sure you have opened the correct page with your regional form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template meets your requirements.

- Look for another document using the search tab if the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Select the suitable subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the San Diego Affidavit of Loss regarding Negotiable Instrument on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!