Preparing legal paperwork can be cumbersome. In addition, if you decide to ask a lawyer to draft a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Tarrant Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Income to Trustee, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case accumulated all in one place. Consequently, if you need the latest version of the Tarrant Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Income to Trustee, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Tarrant Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Income to Trustee:

- Glance through the page and verify there is a sample for your region.

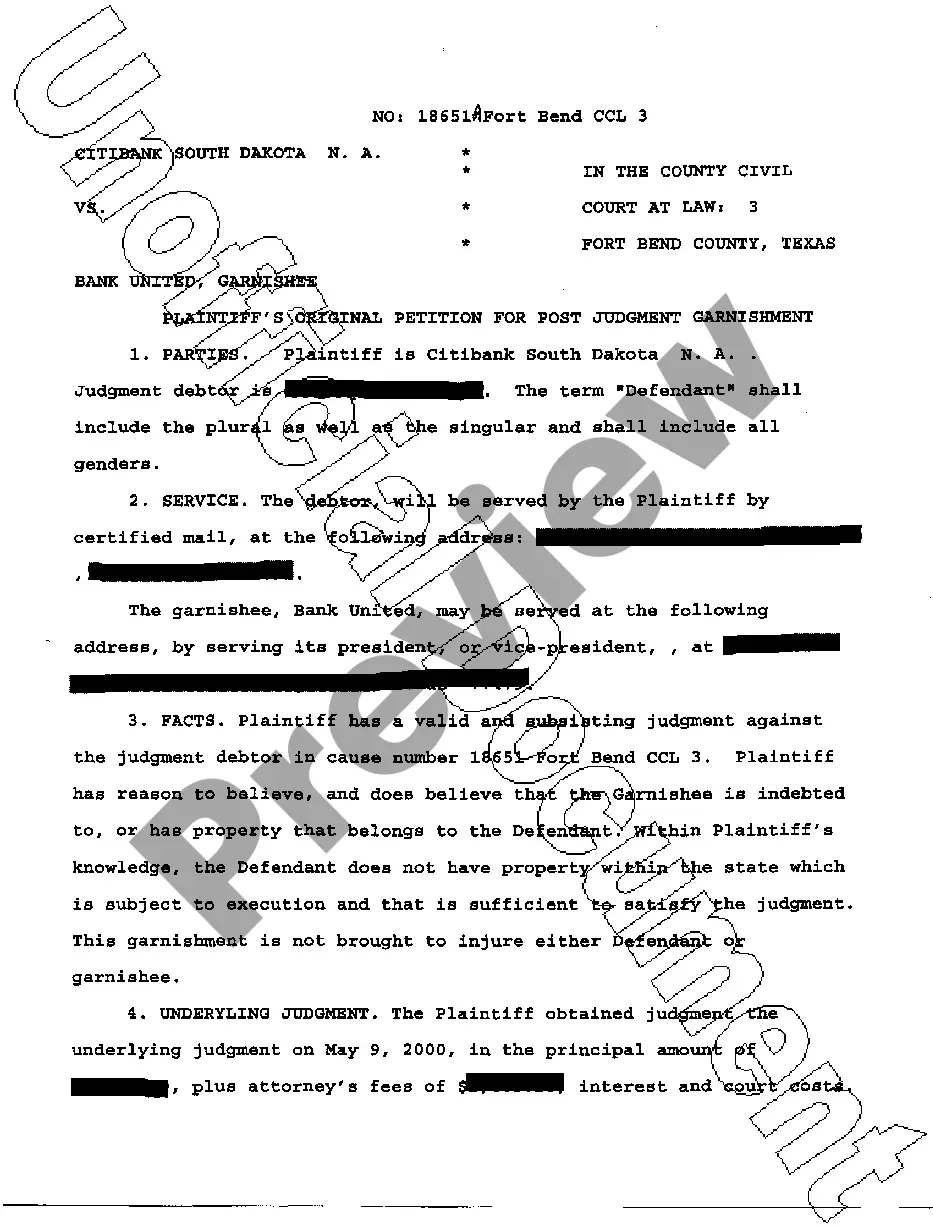

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Tarrant Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Income to Trustee and download it.

When done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

He focuses on bankruptcy and bankruptcy litigation on behalf of debtors, debt- ors-in-possession, trustees, creditors, and creditor committees. And committed attorneys in the State of Texas.Creditor's Remedies: Charging Order, Turnover Order, Garnishment.

Barbara C. Brink man, Esq. CPA This is an international firm that handles an array of personal and business tax, trust, estate, and partnership matters. Cox Law Firm LLC This international firm handles real estate, corporate and business affairs work in Texas. Kathy & Kevin Fans, LLP This team of professionals has been involved in numerous local, state, federal and international legal actions across Texas and the United States.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.