Liquidating trusts can be established in various circumstances. Among the more common are where business assets are placed in trust for the benefit of creditors of an insolvent business or where the sole owner of a going business dies leaving no heir capable or willing to continue it. If the primary purpose of the trust is to liquidate the business in orderly fashion by disposing of the assets as soon as is reasonably possible, the liquidating trust will be taxed as an ordinary trust and not as a corporation.

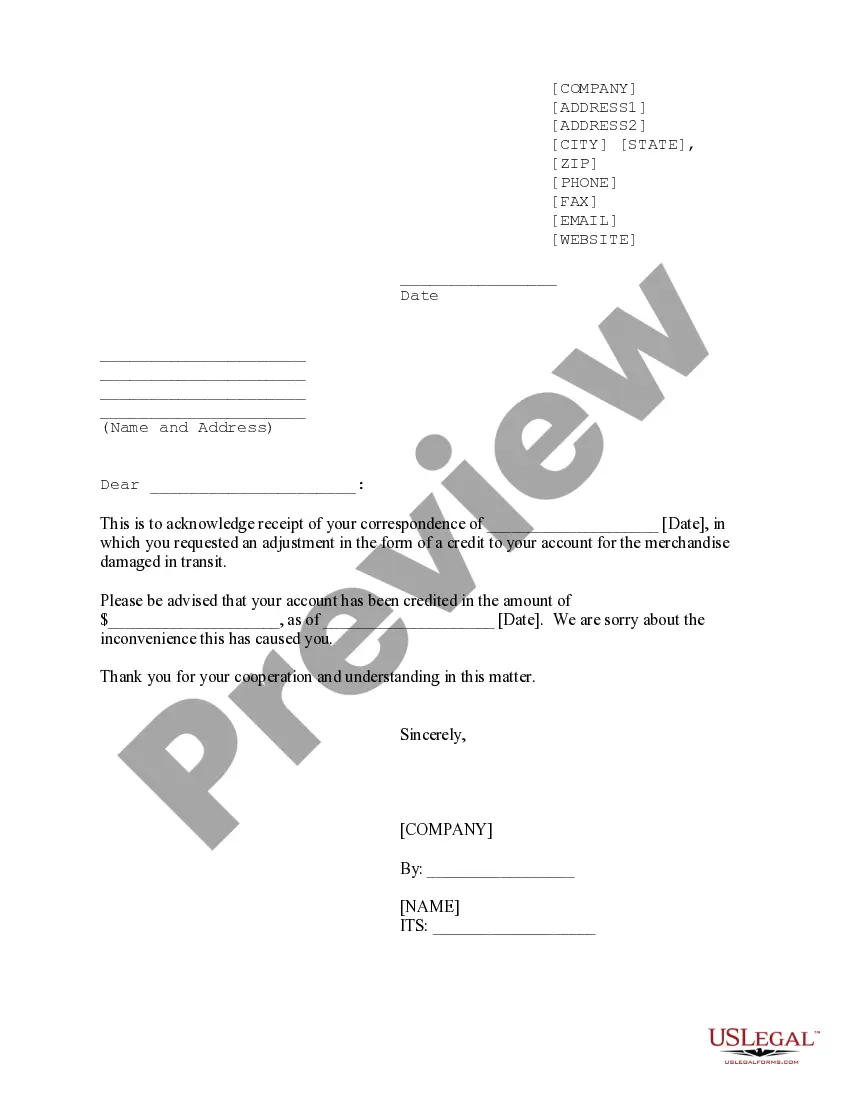

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Allegheny Pennsylvania Liquidating Trust Agreement is a legally binding document that outlines the terms and conditions for the liquidation of assets in Allegheny County, Pennsylvania. This trust agreement is specifically designed for the purpose of overseeing the liquidation process and ensuring that all stakeholders involved are treated fairly and equitably. The Allegheny Pennsylvania Liquidating Trust Agreement can be categorized into different types based on the specific circumstances it addresses. Some different types of liquidating trust agreements include: 1. Corporate Liquidating Trust Agreement: This type of trust agreement is utilized when a corporation or a company in Allegheny County, Pennsylvania is going through a liquidation process. It outlines the steps and procedures to be followed to wind up the affairs of the corporation and distribute the assets to the creditors and shareholders in an orderly manner. 2. Real Estate Liquidating Trust Agreement: When a real estate holding company or an investment trust specializing in real estate is being liquidated in Allegheny County, Pennsylvania, this type of trust agreement comes into play. It establishes the framework for selling off the properties and distributing the proceeds to the beneficiaries or investors. 3. Bankruptcy Liquidating Trust Agreement: In cases where a bankrupt entity in Allegheny County, Pennsylvania needs to liquidate its assets to repay creditors, a bankruptcy liquidating trust agreement is utilized. It outlines the allocation of funds and the order of priority for the repayment of debts. 4. Estate Liquidating Trust Agreement: When an individual's estate in Allegheny County, Pennsylvania is being liquidated, this type of trust agreement is employed. It guides the process of selling the estate assets, settling any outstanding debts or taxes, and distributing the remaining assets to the beneficiaries or heirs. The Allegheny Pennsylvania Liquidating Trust Agreement includes essential provisions such as the purpose of the trust, the powers and duties of the trustee, the identification and valuation of the assets, the priority of payments, and the distribution plan for the proceeds. In conclusion, the Allegheny Pennsylvania Liquidating Trust Agreement is a crucial legal document that governs the liquidation process in Allegheny County. By providing a comprehensive framework and guidelines, it ensures a fair and orderly distribution of assets in various scenarios like corporate liquidations, real estate liquidations, bankruptcy cases, and estate settlements.The Allegheny Pennsylvania Liquidating Trust Agreement is a legally binding document that outlines the terms and conditions for the liquidation of assets in Allegheny County, Pennsylvania. This trust agreement is specifically designed for the purpose of overseeing the liquidation process and ensuring that all stakeholders involved are treated fairly and equitably. The Allegheny Pennsylvania Liquidating Trust Agreement can be categorized into different types based on the specific circumstances it addresses. Some different types of liquidating trust agreements include: 1. Corporate Liquidating Trust Agreement: This type of trust agreement is utilized when a corporation or a company in Allegheny County, Pennsylvania is going through a liquidation process. It outlines the steps and procedures to be followed to wind up the affairs of the corporation and distribute the assets to the creditors and shareholders in an orderly manner. 2. Real Estate Liquidating Trust Agreement: When a real estate holding company or an investment trust specializing in real estate is being liquidated in Allegheny County, Pennsylvania, this type of trust agreement comes into play. It establishes the framework for selling off the properties and distributing the proceeds to the beneficiaries or investors. 3. Bankruptcy Liquidating Trust Agreement: In cases where a bankrupt entity in Allegheny County, Pennsylvania needs to liquidate its assets to repay creditors, a bankruptcy liquidating trust agreement is utilized. It outlines the allocation of funds and the order of priority for the repayment of debts. 4. Estate Liquidating Trust Agreement: When an individual's estate in Allegheny County, Pennsylvania is being liquidated, this type of trust agreement is employed. It guides the process of selling the estate assets, settling any outstanding debts or taxes, and distributing the remaining assets to the beneficiaries or heirs. The Allegheny Pennsylvania Liquidating Trust Agreement includes essential provisions such as the purpose of the trust, the powers and duties of the trustee, the identification and valuation of the assets, the priority of payments, and the distribution plan for the proceeds. In conclusion, the Allegheny Pennsylvania Liquidating Trust Agreement is a crucial legal document that governs the liquidation process in Allegheny County. By providing a comprehensive framework and guidelines, it ensures a fair and orderly distribution of assets in various scenarios like corporate liquidations, real estate liquidations, bankruptcy cases, and estate settlements.