Liquidating trusts can be established in various circumstances. Among the more common are where business assets are placed in trust for the benefit of creditors of an insolvent business or where the sole owner of a going business dies leaving no heir capable or willing to continue it. If the primary purpose of the trust is to liquidate the business in orderly fashion by disposing of the assets as soon as is reasonably possible, the liquidating trust will be taxed as an ordinary trust and not as a corporation.

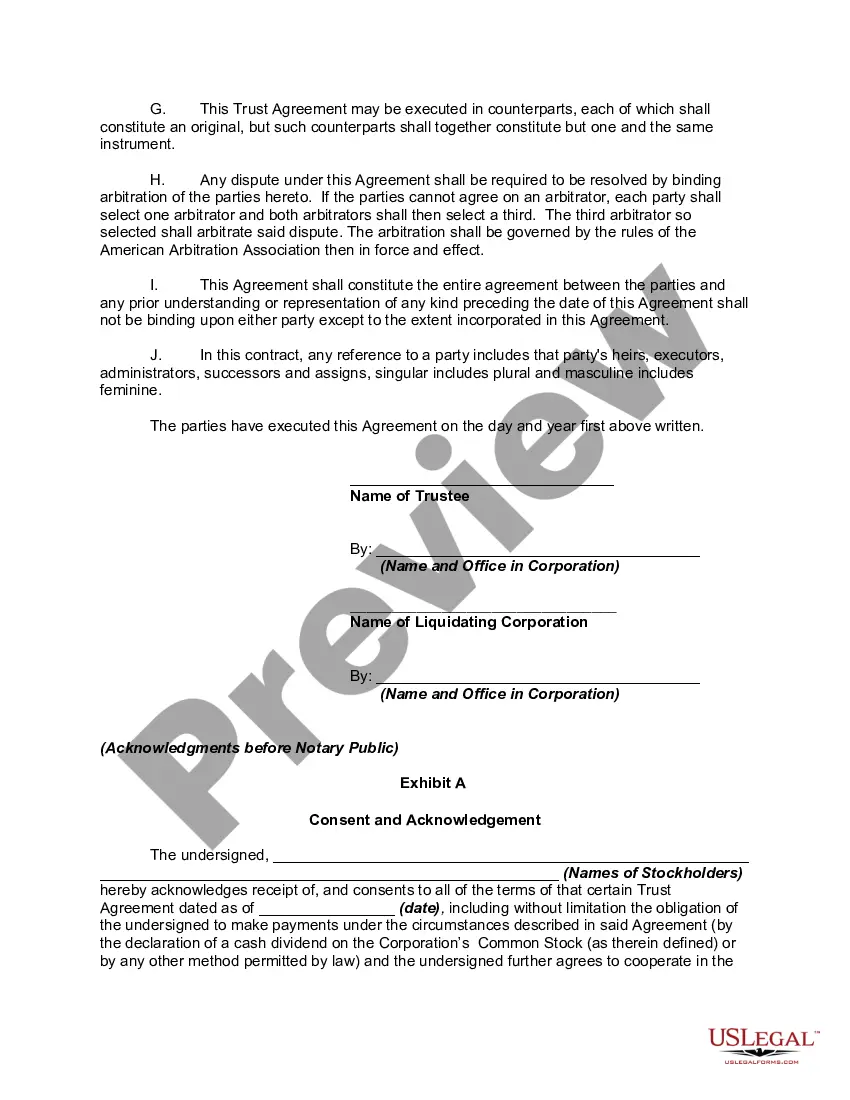

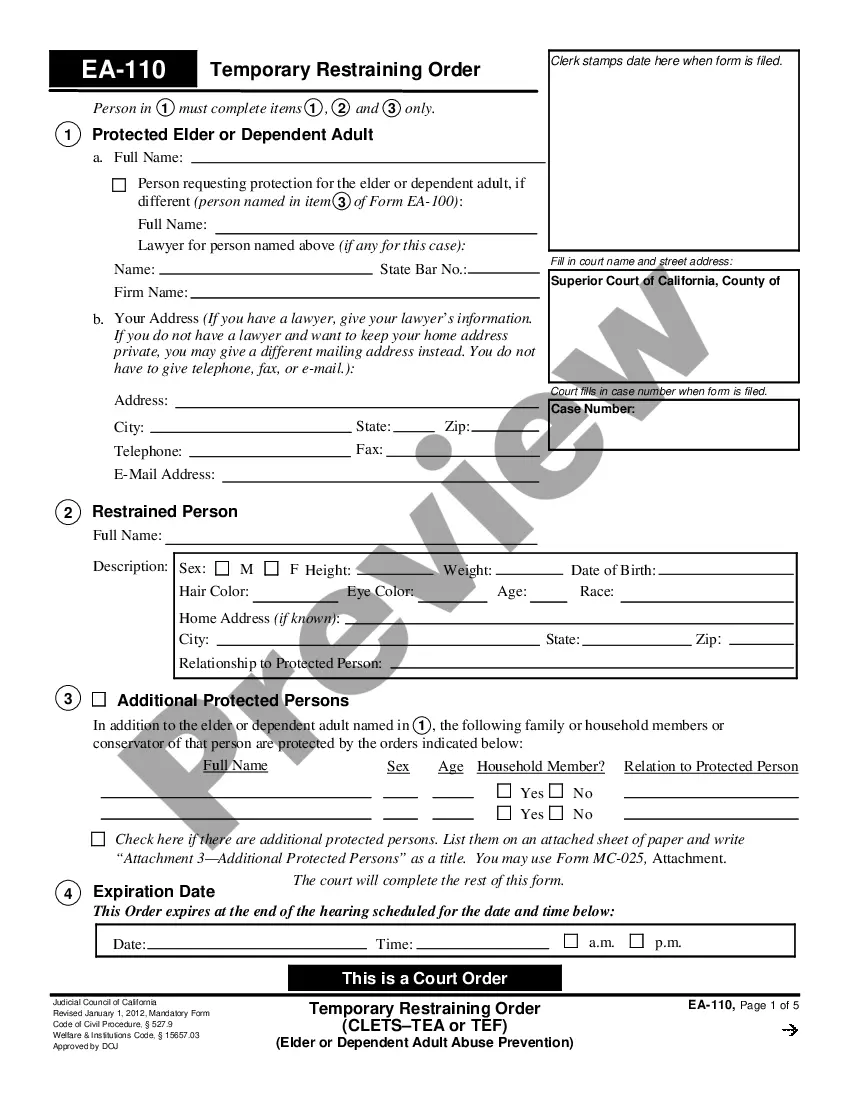

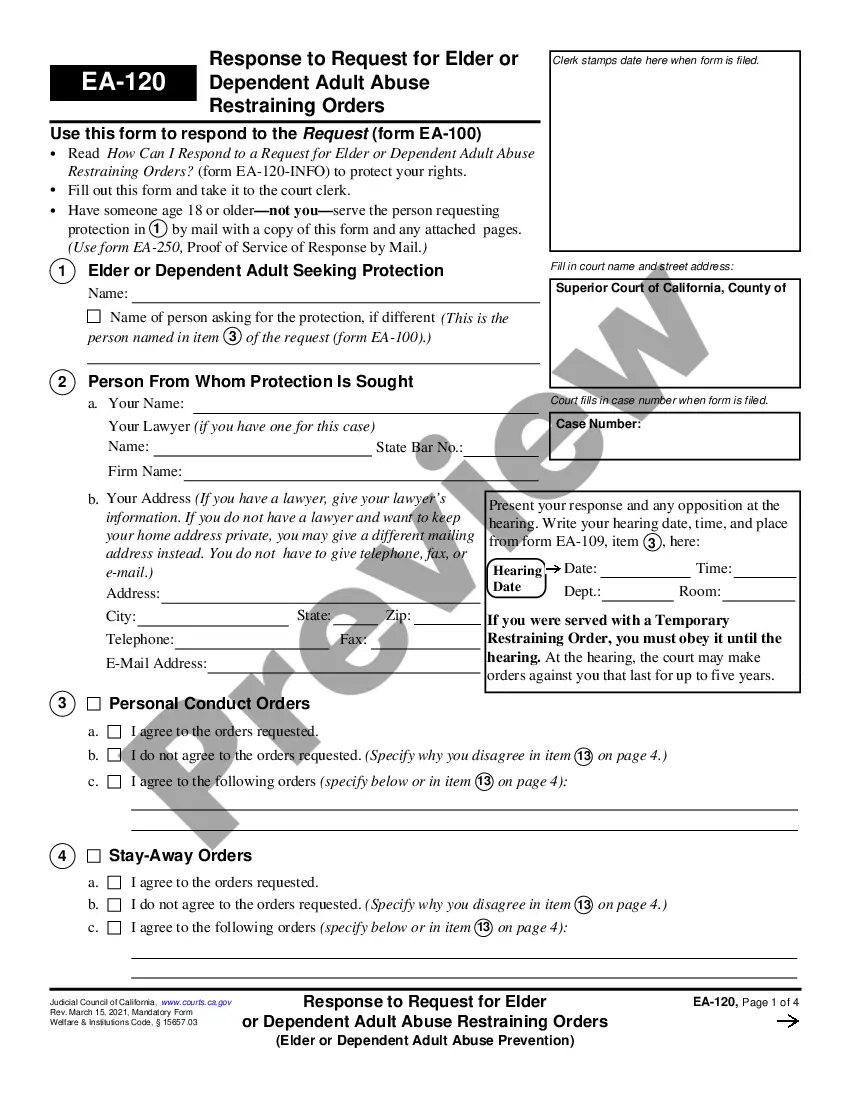

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.