Liquidating trusts can be established in various circumstances. Among the more common are where business assets are placed in trust for the benefit of creditors of an insolvent business or where the sole owner of a going business dies leaving no heir capable or willing to continue it. If the primary purpose of the trust is to liquidate the business in orderly fashion by disposing of the assets as soon as is reasonably possible, the liquidating trust will be taxed as an ordinary trust and not as a corporation.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

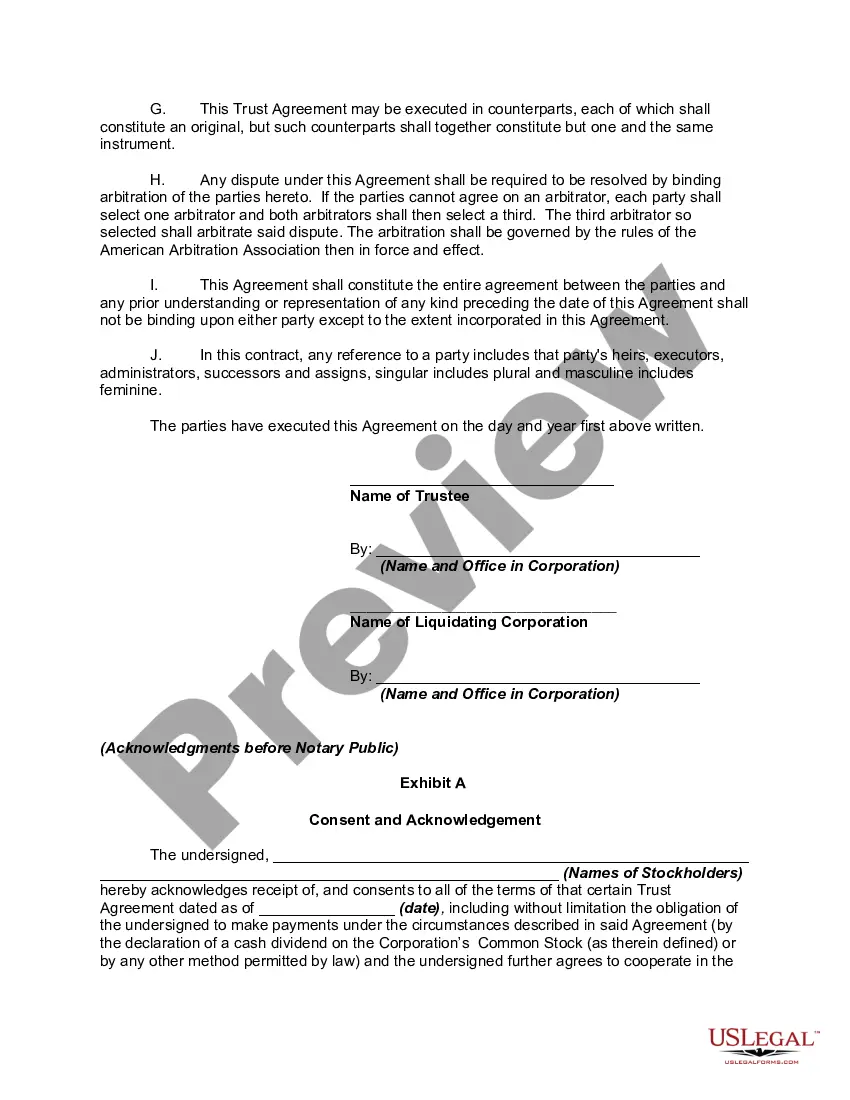

The Santa Clara California Liquidating Trust Agreement is a legal document that outlines the terms and conditions related to the liquidation process of a company or entity based in Santa Clara, California. This agreement is put in place when a company decides to wind down its operations, distribute its assets, and settle its outstanding obligations. The liquidating trust agreement is designed to provide a framework for the orderly liquidation of the company's assets in an efficient and fair manner. It outlines the responsibilities and duties of the trustee, who is appointed to oversee the liquidation process on behalf of the company and its stakeholders. There are different types of Santa Clara California Liquidating Trust Agreements that may be used based on the specific circumstances of the company. These may include: 1. Chapter 7 Liquidation: This type of liquidating trust agreement is utilized when a company is unable to meet its financial obligations and files for bankruptcy under Chapter 7 of the United States Bankruptcy Code. The agreement defines the process of liquidating the company's assets and distributing the proceeds to creditors in accordance with the bankruptcy laws. 2. Dissolution Trust Agreement: When a company voluntarily decides to cease its operations, it may establish a dissolution trust agreement. The agreement outlines the process of winding down the company's affairs, selling its assets, and distributing the proceeds to its shareholders and creditors. 3. Assignment for the Benefit of Creditors (ABC): In some cases, a company may choose to assign its assets to a liquidating trust through an Assignment for the Benefit of Creditors. This type of trust agreement is an alternative to bankruptcy and allows for an orderly liquidation of the company's assets under the supervision of a trustee. The Santa Clara California Liquidating Trust Agreement is a crucial legal document that provides a comprehensive framework for the liquidation of a company's assets and settlement of its liabilities. It is essential for all parties involved to thoroughly review the agreement and ensure compliance with applicable laws and regulations.The Santa Clara California Liquidating Trust Agreement is a legal document that outlines the terms and conditions related to the liquidation process of a company or entity based in Santa Clara, California. This agreement is put in place when a company decides to wind down its operations, distribute its assets, and settle its outstanding obligations. The liquidating trust agreement is designed to provide a framework for the orderly liquidation of the company's assets in an efficient and fair manner. It outlines the responsibilities and duties of the trustee, who is appointed to oversee the liquidation process on behalf of the company and its stakeholders. There are different types of Santa Clara California Liquidating Trust Agreements that may be used based on the specific circumstances of the company. These may include: 1. Chapter 7 Liquidation: This type of liquidating trust agreement is utilized when a company is unable to meet its financial obligations and files for bankruptcy under Chapter 7 of the United States Bankruptcy Code. The agreement defines the process of liquidating the company's assets and distributing the proceeds to creditors in accordance with the bankruptcy laws. 2. Dissolution Trust Agreement: When a company voluntarily decides to cease its operations, it may establish a dissolution trust agreement. The agreement outlines the process of winding down the company's affairs, selling its assets, and distributing the proceeds to its shareholders and creditors. 3. Assignment for the Benefit of Creditors (ABC): In some cases, a company may choose to assign its assets to a liquidating trust through an Assignment for the Benefit of Creditors. This type of trust agreement is an alternative to bankruptcy and allows for an orderly liquidation of the company's assets under the supervision of a trustee. The Santa Clara California Liquidating Trust Agreement is a crucial legal document that provides a comprehensive framework for the liquidation of a company's assets and settlement of its liabilities. It is essential for all parties involved to thoroughly review the agreement and ensure compliance with applicable laws and regulations.