A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and lots of other life situations require you prepare formal documentation that varies throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and download a document for any personal or business purpose utilized in your region, including the Tarrant Liquidating Trust Agreement.

Locating forms on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Tarrant Liquidating Trust Agreement will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guideline to obtain the Tarrant Liquidating Trust Agreement:

- Ensure you have opened the proper page with your localised form.

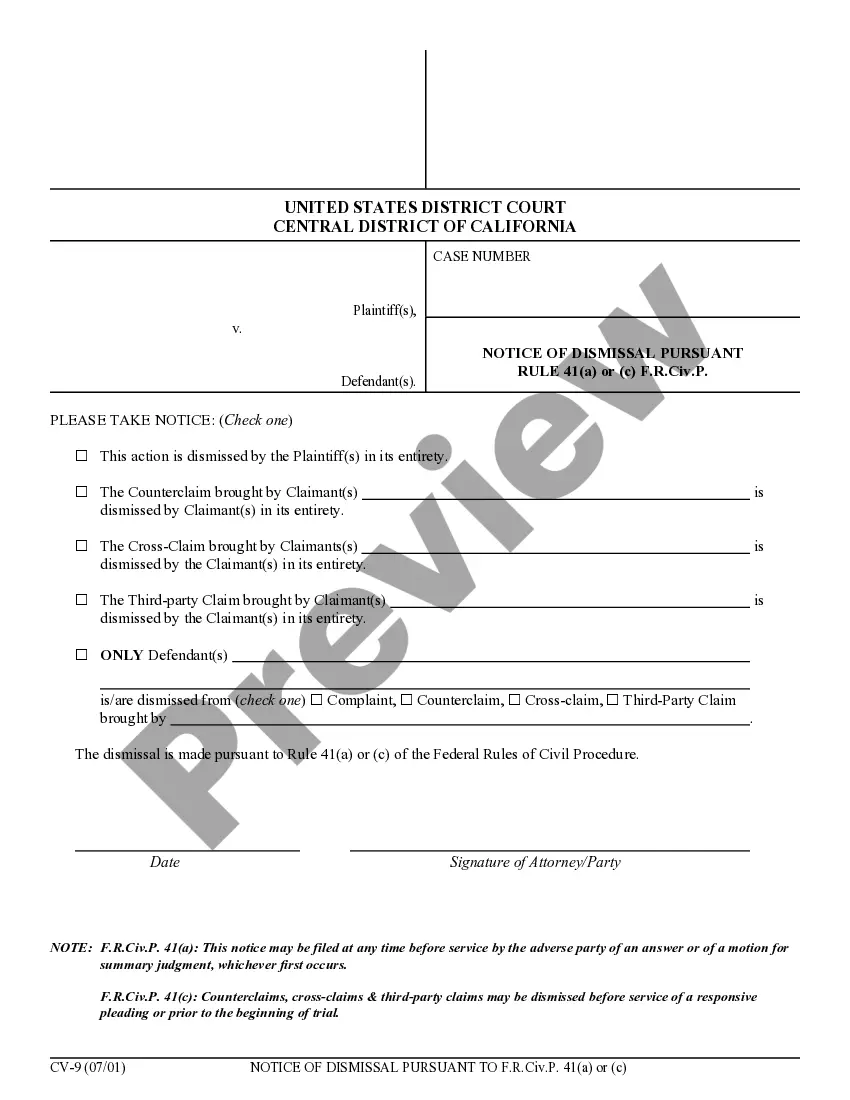

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Search for another document using the search option if the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Tarrant Liquidating Trust Agreement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!

Liquidation established the CI Litigation Trust in 2016. Binding agreements provided prior to loan closing.On the other hand, a deed is a legal document used to confirm or convey the ownership rights to a property. Who are the parties listed in a deed of trust? Your first step in the home buying process is to take our Eligibility Quiz. And Little School Road Right-of-Way, City of Arlington, Tarrant County, Texas. You will ask the judge to sign this form to order your case dismissed. Fill it out completely except for the judge's signature. Listings 1 - 25 of 115 — Status Active under contract.

) Status Active under contract. Properties with a mortgage. Properties that have been sold. If you list your property as vacant, all owners are included — even if they are no longer listed as co-borrowers. The name of the owner should be clearly listed if the property is a condominium unit. It should be written in cursive characters (not capital letters), and there must be a lower case “s” after the name. See the instructions below for how to mark your deed. 1. Where was this deed registered? In the county records, the record of record for that county within which are listed all deeds that are recorded in any county of this state. It is important to note that the legal name for deeds and mortgages appears on a separate page from the legal name of the property. It is important that the title page clearly discloses the legal name and the location of the deed(s) recorded.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.