Both the Model Business Corporation Act and the Revised Model Business Corporation Act provide that any action required or permitted by these Acts to be taken at a meeting of the shareholders or a meeting of the directors of a corporation may be taken without a meeting if the action is taken by all the shareholders or directors entitled to vote on the action. The action should be evidenced by one or more written consents bearing the date of signature and describing the action taken, signed by all the shareholders and/or directors entitled to vote on the action, and delivered to the corporation for inclusion in the minutes or filing with the corporate records.

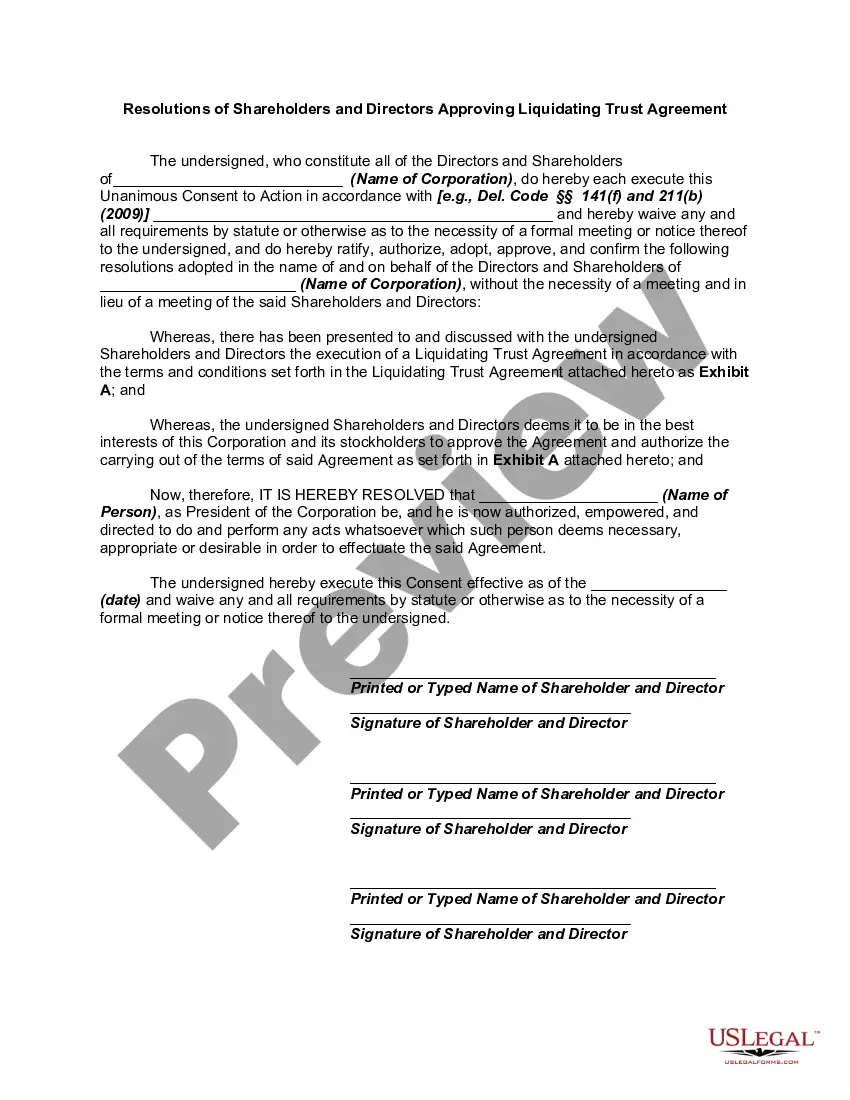

Nassau New York Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement are legal documents that govern the process of liquidation and distribution of assets among the shareholders and directors of a company based in Nassau, New York. These resolutions are crucial when a company decides to dissolve and wind up its operations, ensuring a fair and orderly distribution of the remaining assets. The Nassau New York Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement outlines the specific terms, conditions, and procedures for the creation and operation of a liquidating trust. This legal entity serves as a vehicle for managing and disposing of the company's assets in an efficient and transparent manner. Keywords: Nassau New York, resolutions, shareholders, directors, approving, liquidating trust agreement. There can be different types of Nassau New York Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement, including: 1. General Liquidating Trust Agreement Resolution: This resolution approves the creation of a liquidating trust, outlining the primary responsibilities and authorities of the trust and establishing guidelines for asset transfer and distribution. 2. Asset Distribution Resolution: This specific resolution identifies and outlines the assets that will be transferred to the liquidating trust, along with the method and timeline for their distribution among the shareholders and directors. 3. Reporting and Accounting Resolution: This resolution mandates regular reporting and accounting procedures for the liquidating trust, ensuring transparency and accountability throughout the liquidation process. It may include requirements for financial statements, tax obligations, and communication with stakeholders. 4. Dissolution and Winding Up Resolution: This resolution signifies a company's decision to dissolve and cease its operations, formalizing the intent to initiate the liquidation process. It outlines the steps and legal requirements for winding up the company's affairs, settling outstanding debts, selling assets, and distributing proceeds. 5. Approval of Liquidating Trustee Appointment Resolution: In this resolution, shareholders and directors approve the appointment of a liquidating trustee who will oversee the liquidation process. It may detail the trustee's powers, duties, compensation, and any safeguards to protect the interests of the stakeholders. Nassau New York Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement play a fundamental role in ensuring an organized and fair distribution of assets during the liquidation process. By adhering to such resolutions, companies can effectively manage their financial obligations, protect the rights of shareholders and directors, and lay a strong foundation for closing their business affairs.Nassau New York Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement are legal documents that govern the process of liquidation and distribution of assets among the shareholders and directors of a company based in Nassau, New York. These resolutions are crucial when a company decides to dissolve and wind up its operations, ensuring a fair and orderly distribution of the remaining assets. The Nassau New York Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement outlines the specific terms, conditions, and procedures for the creation and operation of a liquidating trust. This legal entity serves as a vehicle for managing and disposing of the company's assets in an efficient and transparent manner. Keywords: Nassau New York, resolutions, shareholders, directors, approving, liquidating trust agreement. There can be different types of Nassau New York Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement, including: 1. General Liquidating Trust Agreement Resolution: This resolution approves the creation of a liquidating trust, outlining the primary responsibilities and authorities of the trust and establishing guidelines for asset transfer and distribution. 2. Asset Distribution Resolution: This specific resolution identifies and outlines the assets that will be transferred to the liquidating trust, along with the method and timeline for their distribution among the shareholders and directors. 3. Reporting and Accounting Resolution: This resolution mandates regular reporting and accounting procedures for the liquidating trust, ensuring transparency and accountability throughout the liquidation process. It may include requirements for financial statements, tax obligations, and communication with stakeholders. 4. Dissolution and Winding Up Resolution: This resolution signifies a company's decision to dissolve and cease its operations, formalizing the intent to initiate the liquidation process. It outlines the steps and legal requirements for winding up the company's affairs, settling outstanding debts, selling assets, and distributing proceeds. 5. Approval of Liquidating Trustee Appointment Resolution: In this resolution, shareholders and directors approve the appointment of a liquidating trustee who will oversee the liquidation process. It may detail the trustee's powers, duties, compensation, and any safeguards to protect the interests of the stakeholders. Nassau New York Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement play a fundamental role in ensuring an organized and fair distribution of assets during the liquidation process. By adhering to such resolutions, companies can effectively manage their financial obligations, protect the rights of shareholders and directors, and lay a strong foundation for closing their business affairs.