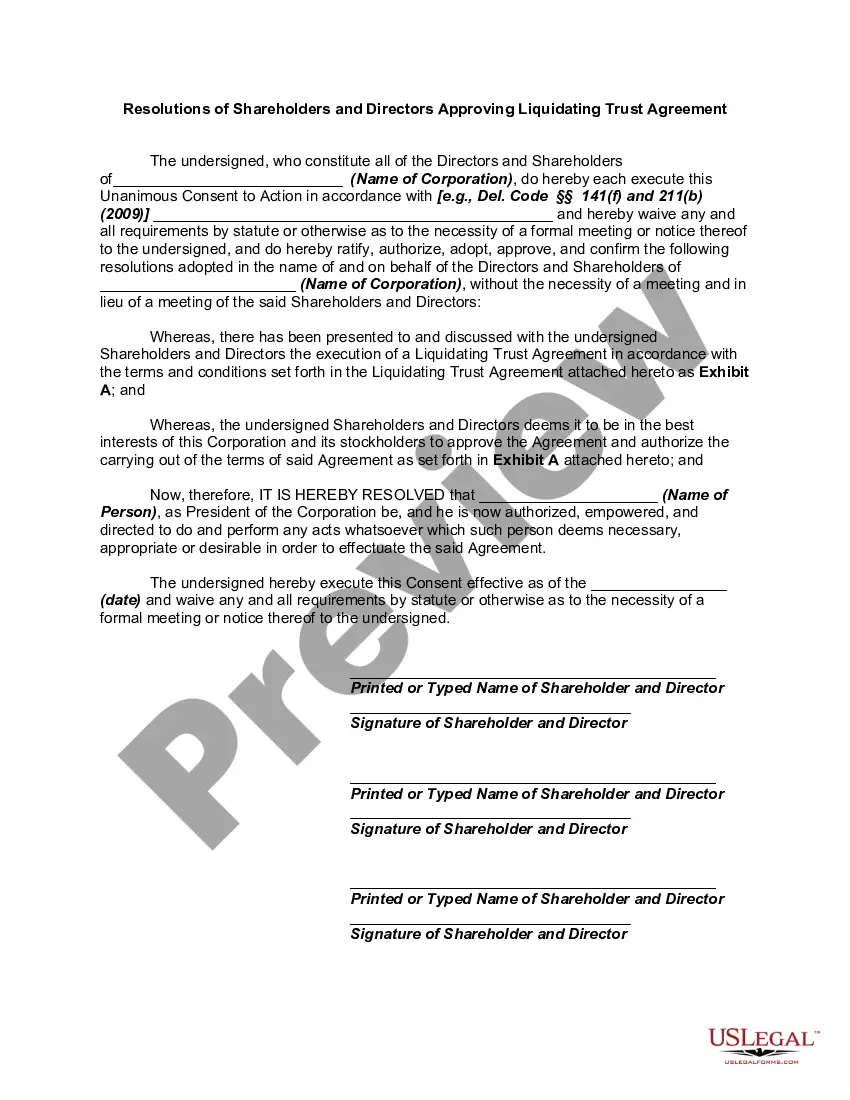

Both the Model Business Corporation Act and the Revised Model Business Corporation Act provide that any action required or permitted by these Acts to be taken at a meeting of the shareholders or a meeting of the directors of a corporation may be taken without a meeting if the action is taken by all the shareholders or directors entitled to vote on the action. The action should be evidenced by one or more written consents bearing the date of signature and describing the action taken, signed by all the shareholders and/or directors entitled to vote on the action, and delivered to the corporation for inclusion in the minutes or filing with the corporate records.

Oakland, Michigan is a county located in the state of Michigan, United States. It is home to numerous businesses and organizations, including corporations that may need to undertake various resolutions concerning their liquidating trust agreements. When it comes to Oakland Michigan Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement, there are different types based on the specific nature and circumstances of the agreement. Some of these types may include the following: 1. Extraordinary Resolution: An extraordinary resolution is passed when a liquidating trust agreement requires a significant decision or action beyond the ordinary course of business. This may involve substantial asset sales, distribution of proceeds, or special considerations for shareholders and creditors. 2. Unanimous written consent: In some cases, shareholders and directors may have the option to provide their approval in writing, without holding a physical meeting. Unanimous written consent allows for a streamlined process of approving the liquidating trust agreement, ensuring all parties are in agreement. 3. Special Meeting Resolution: A special meeting may be called when a liquidating trust agreement entails matters that necessitate dedicated attention and discussion. Shareholders and directors gather during this meeting to review and authorize the terms of the liquidating trust agreement, ensuring alignment and compliance. 4. Annual Meeting Resolution: If the liquidating trust agreement falls within the routine decisions of a company's operations, shareholders and directors may pass a resolution during the annual meeting, reflective of their agreement and collective decisions. 5. Shareholder Vote Resolution: In certain situations, shareholders are required to vote on the liquidating trust agreement. This resolution involves shareholders casting their votes in favor or against the agreement, with the outcome determining its approval or rejection. 6. Director Resolution: Directors play a crucial role in approving the liquidating trust agreement. They might pass a director resolution during a board meeting to give their official consent, ensuring compliance with corporate bylaws and legal requirements. These various types of resolutions pertaining to Oakland Michigan's liquidating trust agreements are crucial for defining the terms, conditions, and processes involved in completing the liquidation process. They provide a framework for all shareholders and directors to authorize and guide the actions taken during this crucial phase, assuring transparency, regulatory adherence, and the best interests of all parties involved.Oakland, Michigan is a county located in the state of Michigan, United States. It is home to numerous businesses and organizations, including corporations that may need to undertake various resolutions concerning their liquidating trust agreements. When it comes to Oakland Michigan Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement, there are different types based on the specific nature and circumstances of the agreement. Some of these types may include the following: 1. Extraordinary Resolution: An extraordinary resolution is passed when a liquidating trust agreement requires a significant decision or action beyond the ordinary course of business. This may involve substantial asset sales, distribution of proceeds, or special considerations for shareholders and creditors. 2. Unanimous written consent: In some cases, shareholders and directors may have the option to provide their approval in writing, without holding a physical meeting. Unanimous written consent allows for a streamlined process of approving the liquidating trust agreement, ensuring all parties are in agreement. 3. Special Meeting Resolution: A special meeting may be called when a liquidating trust agreement entails matters that necessitate dedicated attention and discussion. Shareholders and directors gather during this meeting to review and authorize the terms of the liquidating trust agreement, ensuring alignment and compliance. 4. Annual Meeting Resolution: If the liquidating trust agreement falls within the routine decisions of a company's operations, shareholders and directors may pass a resolution during the annual meeting, reflective of their agreement and collective decisions. 5. Shareholder Vote Resolution: In certain situations, shareholders are required to vote on the liquidating trust agreement. This resolution involves shareholders casting their votes in favor or against the agreement, with the outcome determining its approval or rejection. 6. Director Resolution: Directors play a crucial role in approving the liquidating trust agreement. They might pass a director resolution during a board meeting to give their official consent, ensuring compliance with corporate bylaws and legal requirements. These various types of resolutions pertaining to Oakland Michigan's liquidating trust agreements are crucial for defining the terms, conditions, and processes involved in completing the liquidation process. They provide a framework for all shareholders and directors to authorize and guide the actions taken during this crucial phase, assuring transparency, regulatory adherence, and the best interests of all parties involved.