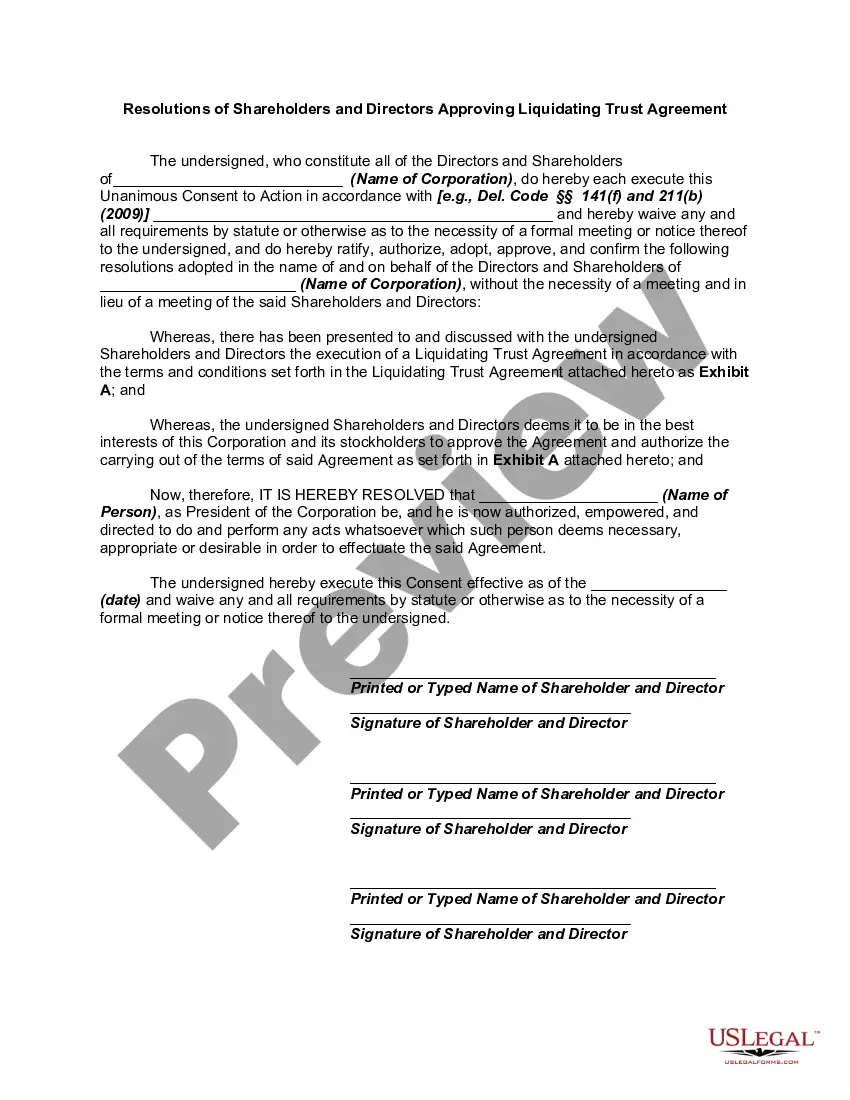

Both the Model Business Corporation Act and the Revised Model Business Corporation Act provide that any action required or permitted by these Acts to be taken at a meeting of the shareholders or a meeting of the directors of a corporation may be taken without a meeting if the action is taken by all the shareholders or directors entitled to vote on the action. The action should be evidenced by one or more written consents bearing the date of signature and describing the action taken, signed by all the shareholders and/or directors entitled to vote on the action, and delivered to the corporation for inclusion in the minutes or filing with the corporate records.

Salt Lake Utah Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement pertain to the formal procedures and actions taken by the shareholders and directors of a company based in Salt Lake City, Utah, to approve the establishment and execution of a liquidating trust agreement. This agreement outlines the plan and framework for the orderly winding down and distribution of assets of a company that has ceased its operations or is undergoing dissolution. Below are different types of Salt Lake Utah Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement: 1. General Resolution: The general resolution is the most common type of resolution passed by the shareholders and directors. It encompasses the overall approval and acceptance of the liquidating trust agreement as proposed. 2. Special Resolution: In certain circumstances, a special resolution may be required for specific aspects of the liquidating trust agreement. This resolution focuses on critical provisions, such as the appointment of trustees or the determination of distribution priorities among various classes of shareholders. 3. Approving Liquidation Plan: This resolution specifically authorizes the liquidation plan, which serves as the foundation for the liquidating trust agreement. It outlines the steps to be taken, the order of asset sale, and the distribution process for the proceeds realized from the liquidation. 4. Appointment of Trustees: Shareholders and directors may pass a resolution to appoint trustees responsible for overseeing the liquidating trust and managing the winding-down process. This resolution typically specifies the composition, qualifications, and responsibilities of the appointed trustees. 5. Determining Distribution Modalities: When multiple parties hold shares or entitlements in the company, a resolution may be passed to determine the methodology for distributing the trust assets, specifying the order and priority of payments to creditors and shareholders. 6. Authorization of Legal Actions: In certain situations, resolutions may be required to authorize the liquidating trust to take specific legal actions, such as initiating lawsuits, responding to claims, or settling disputes arising during the liquidation process. 7. Approval of Reporting and Communication Guidelines: Resolutions can also establish guidelines for reporting and communication between the liquidating trust and its stakeholders, including shareholders, directors, creditors, and regulatory bodies. These resolutions help ensure transparency and proper documentation throughout the wind-down. It is essential for shareholders and directors to follow applicable company bylaws, articles of incorporation, and regulations while passing these resolutions. It is recommended to consult legal professionals with expertise in corporate law, liquidation, and trust agreements to ensure the proper and lawful implementation of Salt Lake Utah Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement.Salt Lake Utah Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement pertain to the formal procedures and actions taken by the shareholders and directors of a company based in Salt Lake City, Utah, to approve the establishment and execution of a liquidating trust agreement. This agreement outlines the plan and framework for the orderly winding down and distribution of assets of a company that has ceased its operations or is undergoing dissolution. Below are different types of Salt Lake Utah Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement: 1. General Resolution: The general resolution is the most common type of resolution passed by the shareholders and directors. It encompasses the overall approval and acceptance of the liquidating trust agreement as proposed. 2. Special Resolution: In certain circumstances, a special resolution may be required for specific aspects of the liquidating trust agreement. This resolution focuses on critical provisions, such as the appointment of trustees or the determination of distribution priorities among various classes of shareholders. 3. Approving Liquidation Plan: This resolution specifically authorizes the liquidation plan, which serves as the foundation for the liquidating trust agreement. It outlines the steps to be taken, the order of asset sale, and the distribution process for the proceeds realized from the liquidation. 4. Appointment of Trustees: Shareholders and directors may pass a resolution to appoint trustees responsible for overseeing the liquidating trust and managing the winding-down process. This resolution typically specifies the composition, qualifications, and responsibilities of the appointed trustees. 5. Determining Distribution Modalities: When multiple parties hold shares or entitlements in the company, a resolution may be passed to determine the methodology for distributing the trust assets, specifying the order and priority of payments to creditors and shareholders. 6. Authorization of Legal Actions: In certain situations, resolutions may be required to authorize the liquidating trust to take specific legal actions, such as initiating lawsuits, responding to claims, or settling disputes arising during the liquidation process. 7. Approval of Reporting and Communication Guidelines: Resolutions can also establish guidelines for reporting and communication between the liquidating trust and its stakeholders, including shareholders, directors, creditors, and regulatory bodies. These resolutions help ensure transparency and proper documentation throughout the wind-down. It is essential for shareholders and directors to follow applicable company bylaws, articles of incorporation, and regulations while passing these resolutions. It is recommended to consult legal professionals with expertise in corporate law, liquidation, and trust agreements to ensure the proper and lawful implementation of Salt Lake Utah Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement.