Alameda, California Proof of Residency for Credit Card: A Comprehensive Guide If you are a resident of Alameda, California, and want to apply for a credit card, you will typically be required to provide proof of residency. This documentation serves as verification of your address and ensures that you meet the criteria set by the credit card issuer. In this guide, we will provide a detailed overview of what constitutes valid proof of residency in Alameda, California, for credit card applications, highlighting essential keywords for easy reference. 1. Utility Bills: One of the most common forms of proof of residency accepted by credit card issuers is utility bills. These include gas, water, electricity, or landline telephone bills. Ensure that these bills feature your name and address, and they should be recent (usually within the past 30-60 days). 2. Lease or Rental Agreement: If you are a tenant in Alameda, California, a lease or rental agreement can serve as proof of residency for your credit card application. This document should prominently display your name, address, and signature, and it should be current and valid. 3. Mortgage Statement: For homeowners in Alameda, California, providing a mortgage statement can establish proof of residency. The statement should confirm your ownership, clearly mention your name and address, and be issued by a recognized financial institution within the past few months. 4. Property Tax Bill: If you own property within Alameda, California, a property tax bill can be used as proof of residency. This official document should show your name, address, and be issued by the local tax authority. 5. Government-issued ID: Another common requirement for credit card applications is presenting a government-issued identification document. This can include a valid California driver's license, ID card, or passport. Although it does not explicitly state your residency, it validates your identity, which indirectly supports your residency claim. 6. Bank Statement: Some credit card issuers may accept bank statements as proof of residency. Ensure that the statement includes your full name and Alameda address, and it should be recent and generated by a reputable financial institution. It's important to note that the specific requirements for proof of residency may vary among credit card issuers in Alameda, California. Always refer to the guidelines provided by the credit card company to determine which documents they deem acceptable. By providing accurate and up-to-date proof of residency, you increase your chances of successfully obtaining a credit card in Alameda, California. Ensure that the documentation you submit matches the issuer's requirements and guidelines, enabling a smooth and efficient application process.

Alameda California Proof of Residency for Credit Card

Description

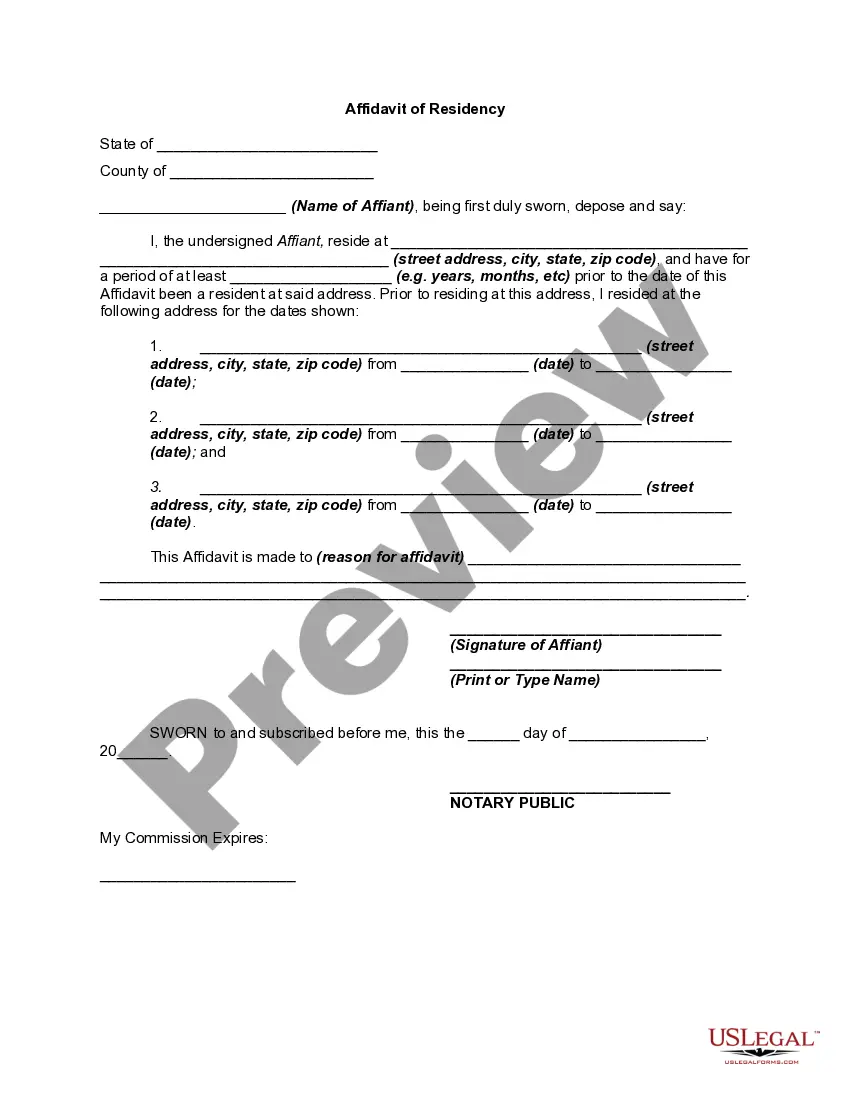

How to fill out Alameda California Proof Of Residency For Credit Card?

If you need to find a reliable legal paperwork provider to find the Alameda Proof of Residency for Credit Card, consider US Legal Forms. No matter if you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate template.

- You can select from over 85,000 forms categorized by state/county and case.

- The intuitive interface, number of learning materials, and dedicated support team make it easy to find and execute various papers.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

You can simply type to look for or browse Alameda Proof of Residency for Credit Card, either by a keyword or by the state/county the document is created for. After locating needed template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to get started! Simply find the Alameda Proof of Residency for Credit Card template and check the form's preview and short introductory information (if available). If you're confident about the template’s legalese, go ahead and hit Buy now. Register an account and choose a subscription option. The template will be immediately available for download as soon as the payment is completed. Now you can execute the form.

Handling your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes this experience less expensive and more affordable. Set up your first business, organize your advance care planning, create a real estate contract, or execute the Alameda Proof of Residency for Credit Card - all from the convenience of your home.

Join US Legal Forms now!