Allegheny Pennsylvania Partnership Agreement Involving Silent Partner is a legally binding contract that outlines the rights, responsibilities, and obligations of two or more individuals or entities wishing to collaborate and establish a partnership in Allegheny, Pennsylvania. This agreement grants a silent partner the opportunity to invest in the partnership without actively participating in the business operations or decision-making process. The silent partner may contribute capital, assets, or expertise while also sharing in the profits and losses of the partnership. This partnership agreement provides a framework for the terms and conditions of the collaboration between the active partner(s), who are responsible for managing the day-to-day operations and decision-making, and the silent partner. The agreement may specify different types of silent partners, depending on their level of involvement and contribution. These may include: 1. Capital-Only Silent Partner: In this type of partnership agreement, the silent partner solely contributes a financial investment to the partnership. They do not play an active role in the management or decision-making process but receive a portion of the profits proportional to their investment. 2. Expertise Silent Partner: This partnership involves a silent partner who contributes specialized knowledge, skills, or valuable contacts to the partnership without actively participating in the daily operations. They bring their expertise to benefit the business while also sharing in the profits according to the terms agreed upon in the agreement. 3. Asset Contributor Silent Partner: This type of partnership agreement involves a silent partner who contributes physical assets, such as equipment, property, or inventory, to the partnership. The assets are utilized by the active partner(s) in the business operations, and the silent partner receives a percentage of the profits generated by utilizing their assets. The Allegheny Pennsylvania Partnership Agreement Involving Silent Partner typically covers various aspects, including the duration of the partnership, capital contributions, profit and loss allocation, decision-making authority, dispute resolution, and procedures for withdrawal or dissolution of the partnership. It is crucial for all parties involved to carefully negotiate and draft this agreement with the assistance of legal professionals to ensure clarity, fairness, and protection of their interests. In conclusion, the Allegheny Pennsylvania Partnership Agreement Involving Silent Partner serves as a crucial document to formalize collaborative ventures while allowing silent partners to contribute financially, offer expertise, or provide assets without having an active role in the day-to-day operations.

Allegheny Pennsylvania Partnership Agreement Involving Silent Partner

Description

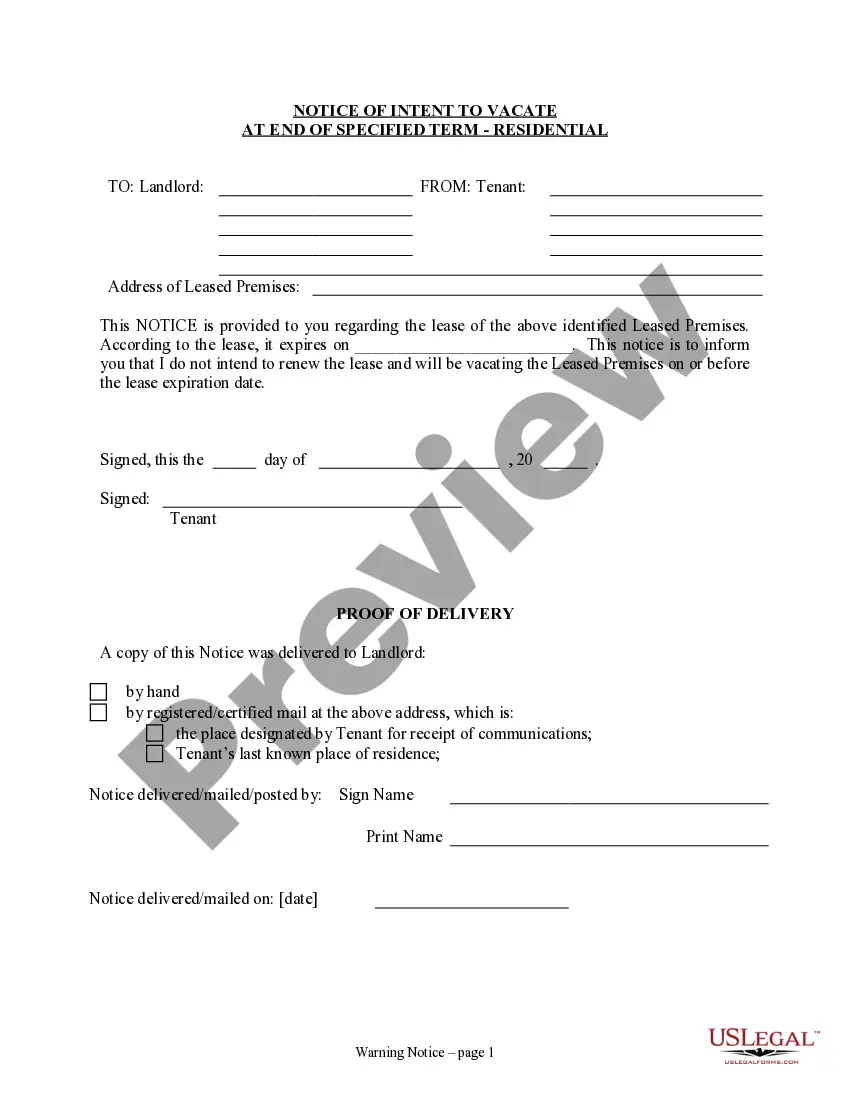

How to fill out Allegheny Pennsylvania Partnership Agreement Involving Silent Partner?

If you need to find a trustworthy legal form provider to get the Allegheny Partnership Agreement Involving Silent Partner, consider US Legal Forms. Whether you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed form.

- You can browse from over 85,000 forms arranged by state/county and situation.

- The intuitive interface, variety of supporting resources, and dedicated support team make it simple to get and complete different documents.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

You can simply select to search or browse Allegheny Partnership Agreement Involving Silent Partner, either by a keyword or by the state/county the document is created for. After finding the needed form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the Allegheny Partnership Agreement Involving Silent Partner template and take a look at the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Register an account and select a subscription option. The template will be immediately ready for download as soon as the payment is processed. Now you can complete the form.

Taking care of your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our rich variety of legal forms makes these tasks less pricey and more affordable. Set up your first business, arrange your advance care planning, create a real estate contract, or complete the Allegheny Partnership Agreement Involving Silent Partner - all from the convenience of your sofa.

Sign up for US Legal Forms now!