Collin Texas Partnership Agreement Involving Silent Partner: A Comprehensive Guide to Collaborative Ventures What is a Collin Texas Partnership Agreement Involving Silent Partner? A Collin Texas Partnership Agreement Involving Silent Partner is a legally binding contract that outlines the terms and conditions of a business partnership between two or more parties in the Collin County region of Texas. This agreement specifies the roles, responsibilities, and rights of each partner, including a silent partner who typically invests capital into the venture but does not actively participate in its day-to-day operations. Types of Collin Texas Partnership Agreements Involving Silent Partner: 1. General Partnership Involving Silent Partner: This type of partnership agreement involves two or more partners, with at least one silent partner who provides financial backing but is not actively involved in the management or decision-making processes. The agreement defines profit-sharing, liabilities, and other obligations. 2. Limited Partnership Involving Silent Partner: In this partnership agreement, there are at least one general partner and one silent partner. The general partners are responsible for the operations, while the silent partner's liability is limited to their investment. This agreement provides structure and protection for both types of partners. Key Components of a Collin Texas Partnership Agreement Involving Silent Partner: 1. Identification of Partners: The agreement clearly defines the names and roles of each partner, distinguishing between general partners who actively participate and the silent partner who only contributes capital. 2. Capital Contributions: The agreement outlines the amount and manner in which each partner contributes capital to the business, including the silent partner's financial commitment. 3. Profit and Loss Distribution: It defines how profits and losses will be allocated among the partners, including any special provisions for the silent partner. 4. Silent Partner's Rights and Obligations: This section outlines the silent partner's limited involvement, specifying that they will not participate in daily operations, decision-making, or management activities. 5. Management and Decision-Making: Details regarding decision-making authority, responsibilities, and limitations are clearly outlined to avoid conflicts between partners. 6. Dissolution or Exit Strategy: The agreement addresses the circumstances under which the partnership may dissolve, as well as procedures for the silent partner to exit the venture. 7. Confidentiality and Non-compete Clause: To protect the interests of the partners, this section ensures that all parties maintain confidentiality and refrain from engaging in any activities that may be in direct competition with the business. It is important to consult with legal professionals specializing in partnership agreements while preparing a Collin Texas Partnership Agreement Involving Silent Partner. The specific terms and conditions of the agreement may vary depending on the nature of the partnership, the desires of the partners, and the applicable laws within the Collin County region of Texas.

Collin Texas Partnership Agreement Involving Silent Partner

Description

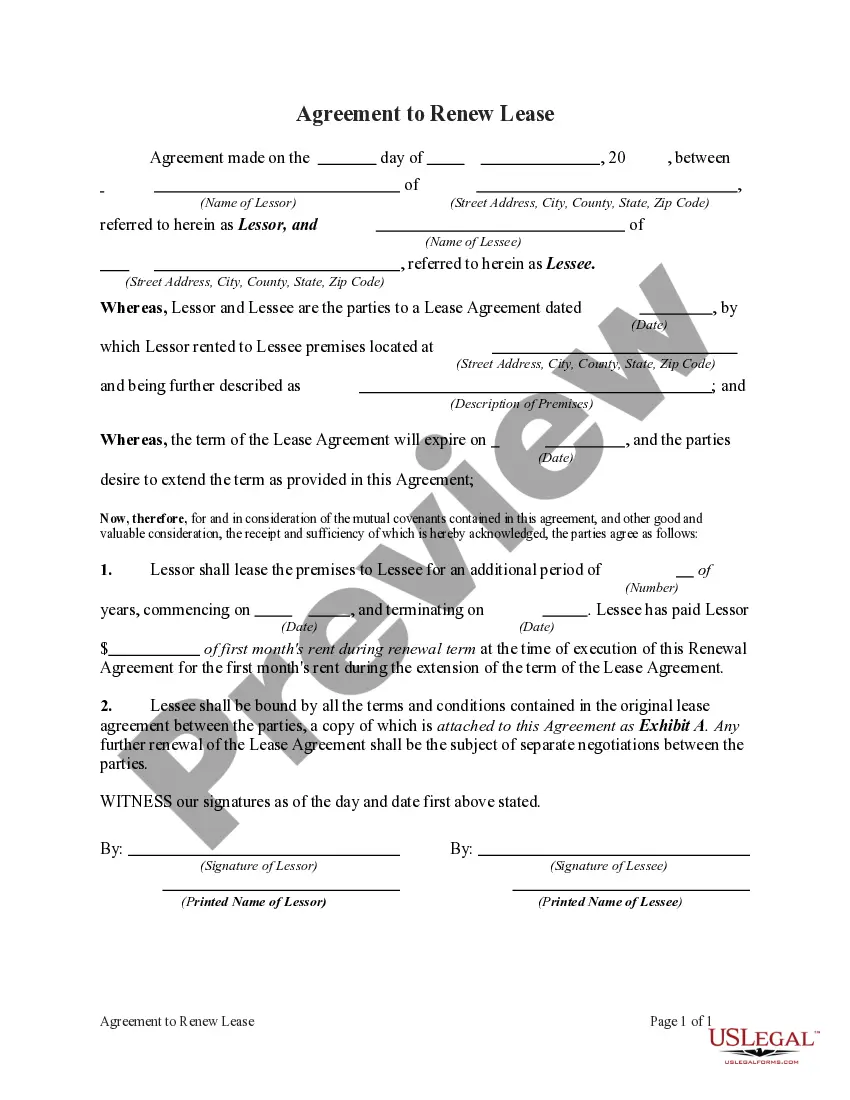

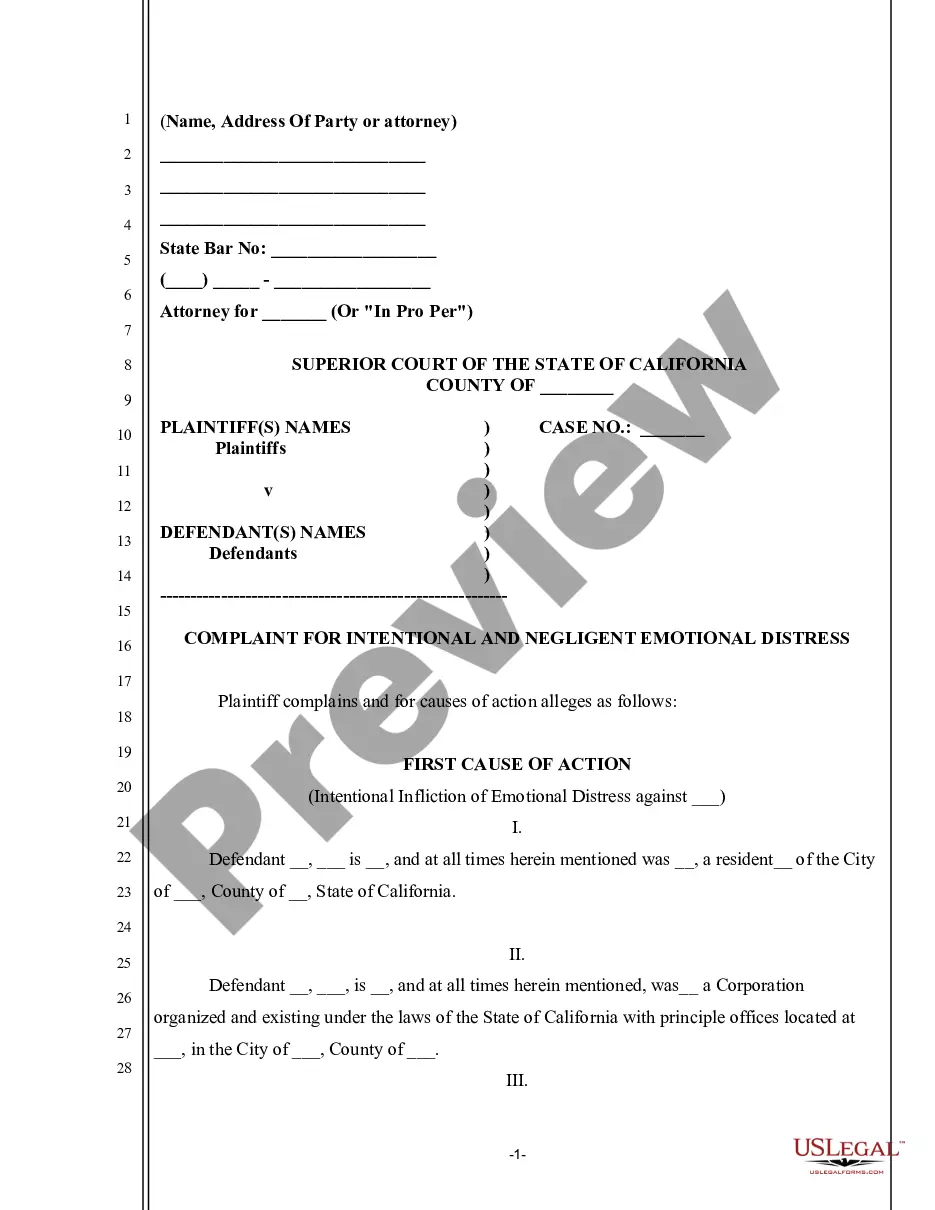

How to fill out Collin Texas Partnership Agreement Involving Silent Partner?

Preparing legal paperwork can be difficult. Besides, if you decide to ask a legal professional to draft a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Collin Partnership Agreement Involving Silent Partner, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case accumulated all in one place. Therefore, if you need the recent version of the Collin Partnership Agreement Involving Silent Partner, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Collin Partnership Agreement Involving Silent Partner:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the file format for your Collin Partnership Agreement Involving Silent Partner and save it.

When finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!