Hennepin Minnesota Partnership Agreement Involving Silent Partner A Hennepin Minnesota Partnership Agreement involving a silent partner is an important legal document that outlines the rights and responsibilities of all parties involved in a business partnership. In this arrangement, one partner, known as the silent partner, provides capital or resources to the partnership but has limited involvement in the day-to-day operations of the business. Key elements of a Hennepin Minnesota Partnership Agreement involving a silent partner include: 1. Partnership Structure: The agreement will clearly outline the partnership's structure, including the roles and responsibilities of each partner. The silent partner's limited involvement in decision-making, management, and operations will be specified. 2. Financial Contributions: The agreement will detail the silent partner's financial contribution to the partnership, which can include capital investment, assets, or other resources. The distribution of profits and losses amongst partners will also be discussed. 3. Voting Rights: The agreement will specify the voting rights of each partner, considering the silent partner's limited involvement. It may assign more decision-making power to the active partner(s) while ensuring that significant decisions are made with mutual consent. 4. Accountability and Liability: The agreement will establish the silent partner's liability in the partnership, ensuring that they are not held personally liable for business debts or obligations beyond their initial investment. The active partner(s) typically assume higher levels of liability. 5. Termination and Dissolution: The agreement will outline the process for terminating the partnership, including circumstances that may trigger dissolution, such as breach of contract or bankruptcy. It will also address procedures for the silent partner's exit, ensuring a smooth transition. Different types of Hennepin Minnesota Partnership Agreements involving a silent partner may include: 1. Limited Liability Partnership (LLP) with Silent Partner: This type of partnership agreement provides limited liability protection to all partners, including the silent partner. It offers a combination of partnership flexibility and corporate liability protection. 2. Limited Partnership (LP) with Silent Partner: In this arrangement, the silent partner assumes limited liability, while the active partner(s) retain unlimited liability. The silent partner's involvement is restricted, and they primarily act as an investor. 3. General Partnership (GP) with Silent Partner: This type of partnership agreement does not provide limited liability protection to any partner, exposing all partners to personal liability. The silent partner's involvement is minimal, and they typically have no decision-making power. In conclusion, a Hennepin Minnesota Partnership Agreement involving a silent partner is a legal document that establishes the terms and conditions for a business partnership with a limited involvement silent partner. Clarifying the roles, financial contributions, voting rights, liability, and termination procedures in such agreements is crucial for a successful partnership.

Hennepin Minnesota Partnership Agreement Involving Silent Partner

Description

How to fill out Hennepin Minnesota Partnership Agreement Involving Silent Partner?

How much time does it normally take you to create a legal document? Because every state has its laws and regulations for every life sphere, locating a Hennepin Partnership Agreement Involving Silent Partner meeting all local requirements can be tiring, and ordering it from a professional attorney is often expensive. Numerous online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. Apart from the Hennepin Partnership Agreement Involving Silent Partner, here you can get any specific document to run your business or individual affairs, complying with your regional requirements. Professionals check all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required sample, and download it. You can pick the document in your profile anytime in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you obtain your Hennepin Partnership Agreement Involving Silent Partner:

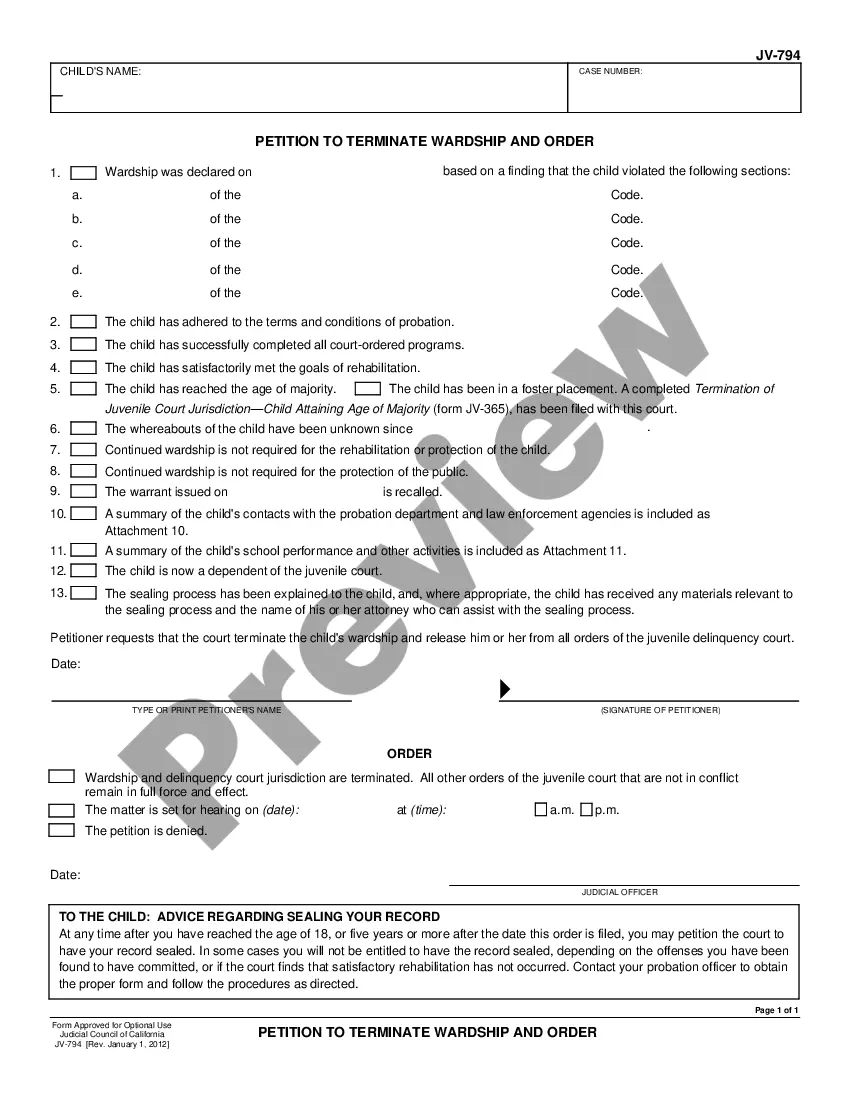

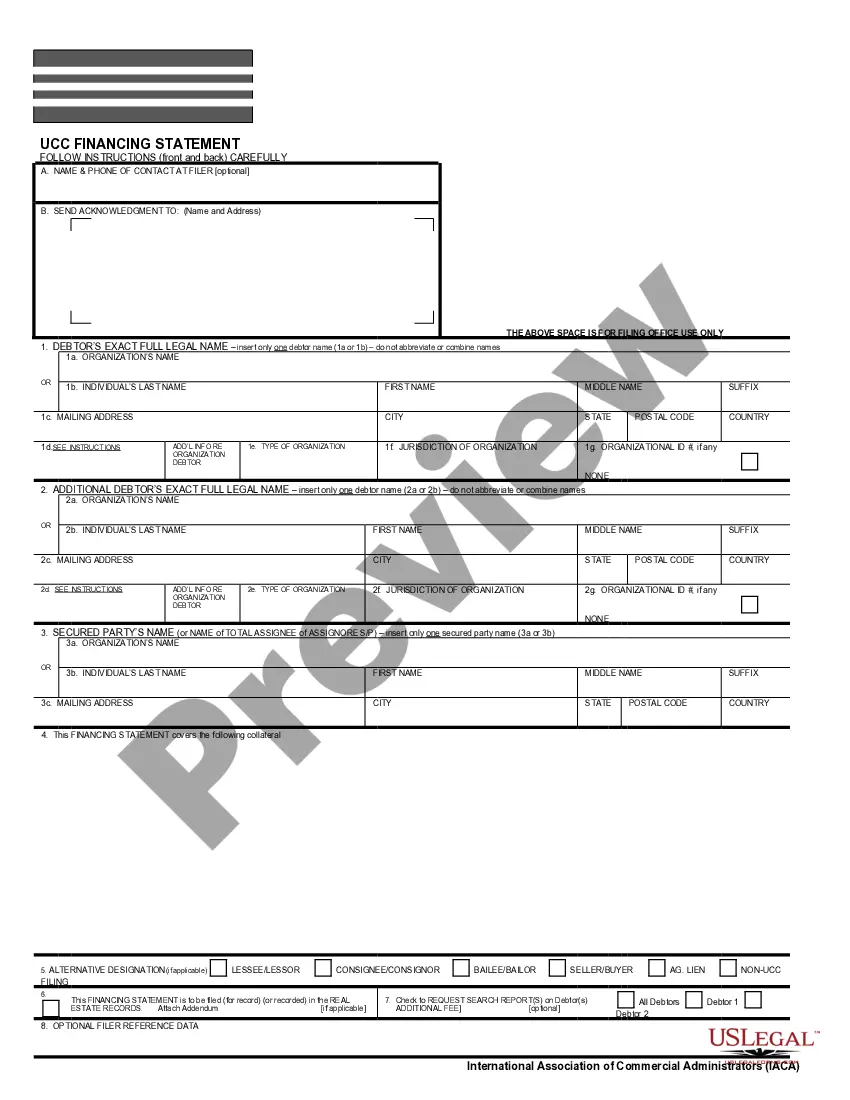

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Hennepin Partnership Agreement Involving Silent Partner.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!