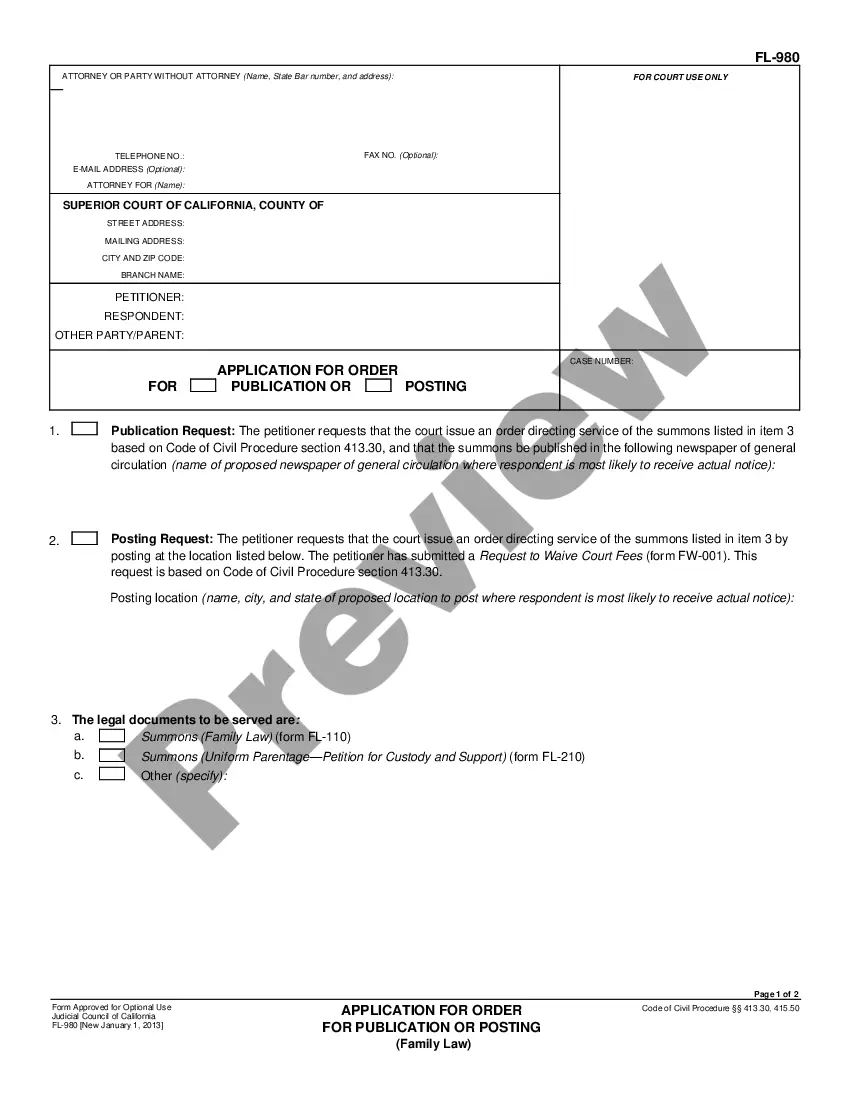

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Cuyahoga County, Ohio is located in the northeastern part of the state and is home to the city of Cleveland. It is a vibrant county with a diverse economy and a range of industries, including manufacturing, healthcare, tourism, and technology. Cuyahoga County offers a dynamic business environment for entrepreneurs and investors looking to buy or sell a business. The General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a legal document used in Cuyahoga County, Ohio, when a sole proprietor wishes to sell their business assets to a buyer. This agreement outlines the terms and conditions of the sale and transfer of assets, including but not limited to physical assets, intellectual property, contracts, and goodwill. This Cuyahoga Ohio General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a comprehensive document that covers various aspects of the transaction. It typically includes sections such as: 1. Parties: Identifies the seller (sole proprietor) and the buyer involved in the transaction. 2. Purchase Price: Specifies the agreed-upon price for the assets being sold, including any adjustments or conditions. 3. Assets Included: Lists all the assets included in the sale, such as inventory, equipment, real estate, licenses, and customer lists. 4. Liabilities Excluded: Clarifies any liabilities or debts that will not be assumed by the buyer and will remain the responsibility of the seller. 5. Due Diligence: Allows the buyer a specified period to conduct a thorough review of the seller's financial statements, contracts, and other relevant documents. 6. Representations and Warranties: Contains statements made by the seller regarding the accuracy of the business's financials, compliance with laws, and any pending legal disputes. 7. Closing Conditions: Outlines the conditions that must be met before the sale can be finalized, such as obtaining necessary permits or approvals. 8. Confidentiality: Protects the confidentiality of any sensitive business information disclosed during the negotiation and sale process. 9. Non-Compete Clause: May include restrictions on the seller's ability to compete with the buyer's business within a specified geographic area and time frame. 10. Governing Law: Determines which state's laws will govern the interpretation and enforcement of the agreement. While there may not be different types of Cuyahoga Ohio General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement, specific terms and conditions may vary depending on the nature of the business being sold and the negotiations between the buyer and seller.Cuyahoga County, Ohio is located in the northeastern part of the state and is home to the city of Cleveland. It is a vibrant county with a diverse economy and a range of industries, including manufacturing, healthcare, tourism, and technology. Cuyahoga County offers a dynamic business environment for entrepreneurs and investors looking to buy or sell a business. The General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a legal document used in Cuyahoga County, Ohio, when a sole proprietor wishes to sell their business assets to a buyer. This agreement outlines the terms and conditions of the sale and transfer of assets, including but not limited to physical assets, intellectual property, contracts, and goodwill. This Cuyahoga Ohio General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a comprehensive document that covers various aspects of the transaction. It typically includes sections such as: 1. Parties: Identifies the seller (sole proprietor) and the buyer involved in the transaction. 2. Purchase Price: Specifies the agreed-upon price for the assets being sold, including any adjustments or conditions. 3. Assets Included: Lists all the assets included in the sale, such as inventory, equipment, real estate, licenses, and customer lists. 4. Liabilities Excluded: Clarifies any liabilities or debts that will not be assumed by the buyer and will remain the responsibility of the seller. 5. Due Diligence: Allows the buyer a specified period to conduct a thorough review of the seller's financial statements, contracts, and other relevant documents. 6. Representations and Warranties: Contains statements made by the seller regarding the accuracy of the business's financials, compliance with laws, and any pending legal disputes. 7. Closing Conditions: Outlines the conditions that must be met before the sale can be finalized, such as obtaining necessary permits or approvals. 8. Confidentiality: Protects the confidentiality of any sensitive business information disclosed during the negotiation and sale process. 9. Non-Compete Clause: May include restrictions on the seller's ability to compete with the buyer's business within a specified geographic area and time frame. 10. Governing Law: Determines which state's laws will govern the interpretation and enforcement of the agreement. While there may not be different types of Cuyahoga Ohio General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement, specific terms and conditions may vary depending on the nature of the business being sold and the negotiations between the buyer and seller.