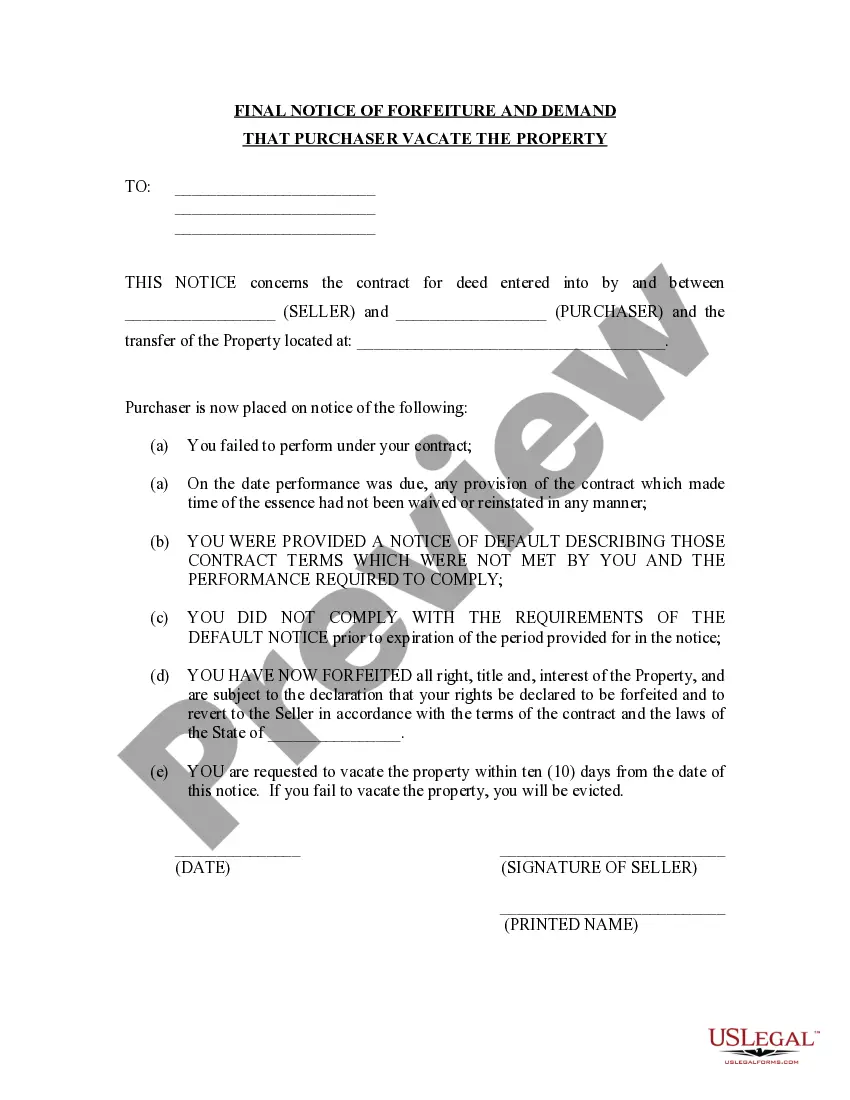

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Philadelphia, Pennsylvania is a vibrant city located in the northeastern region of the United States. Known for its rich history, diverse culture, and thriving economy, Philadelphia is home to numerous attractions, iconic landmarks, and a plethora of business opportunities. The General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a legally binding contract that outlines the terms and conditions of a business sale between a sole proprietor and a buyer. This agreement is specifically tailored for transactions taking place within Philadelphia, Pennsylvania. In essence, the General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement provides a comprehensive framework for the transfer of assets, liabilities, and other key business components from the seller to the buyer. By utilizing this agreement, both parties can protect their interests and ensure a smooth and transparent transaction. Keywords: Philadelphia, Pennsylvania, sole proprietor, asset purchase agreement, contract, business sale, terms and conditions, legally binding, transfer of assets, liabilities, business components, seller, buyer, transaction. Different types of Philadelphia Pennsylvania General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement may include: 1. Standard Asset Purchase Agreement: This is the most common type of agreement used for the sale of a business by a sole proprietor in Philadelphia, Pennsylvania. It outlines the general terms and conditions of the transaction while addressing the transfer of assets and liabilities. 2. Confidentiality Agreement: In certain cases, a sole proprietor may require a separate agreement to ensure the confidentiality of sensitive business information during the negotiation and due diligence process. A confidentiality agreement can be incorporated into the asset purchase agreement. 3. Non-Compete Agreement: If the seller intends to restrict the buyer from engaging in competitive activities within a certain geographical area and timeframe, a non-compete agreement can be incorporated into the asset purchase agreement. This protects the seller's goodwill and helps maintain the value of the business being sold. 4. Employment Agreement: In some instances, the buyer may elect to retain certain employees of the business being acquired. An employment agreement can be included within the asset purchase agreement to outline the terms and conditions of employment for these individuals. 5. Payment and Escrow Agreement: When the purchase price is to be paid in installments or through escrow, a separate agreement can be added to the asset purchase agreement. This agreement specifies the payment terms, schedules, and the role of an escrow agent, if applicable. Keywords: Philadelphia, Pennsylvania, sole proprietor, asset purchase agreement, standard agreement, confidentiality agreement, non-compete agreement, employment agreement, payment agreement, escrow agreement.Philadelphia, Pennsylvania is a vibrant city located in the northeastern region of the United States. Known for its rich history, diverse culture, and thriving economy, Philadelphia is home to numerous attractions, iconic landmarks, and a plethora of business opportunities. The General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a legally binding contract that outlines the terms and conditions of a business sale between a sole proprietor and a buyer. This agreement is specifically tailored for transactions taking place within Philadelphia, Pennsylvania. In essence, the General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement provides a comprehensive framework for the transfer of assets, liabilities, and other key business components from the seller to the buyer. By utilizing this agreement, both parties can protect their interests and ensure a smooth and transparent transaction. Keywords: Philadelphia, Pennsylvania, sole proprietor, asset purchase agreement, contract, business sale, terms and conditions, legally binding, transfer of assets, liabilities, business components, seller, buyer, transaction. Different types of Philadelphia Pennsylvania General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement may include: 1. Standard Asset Purchase Agreement: This is the most common type of agreement used for the sale of a business by a sole proprietor in Philadelphia, Pennsylvania. It outlines the general terms and conditions of the transaction while addressing the transfer of assets and liabilities. 2. Confidentiality Agreement: In certain cases, a sole proprietor may require a separate agreement to ensure the confidentiality of sensitive business information during the negotiation and due diligence process. A confidentiality agreement can be incorporated into the asset purchase agreement. 3. Non-Compete Agreement: If the seller intends to restrict the buyer from engaging in competitive activities within a certain geographical area and timeframe, a non-compete agreement can be incorporated into the asset purchase agreement. This protects the seller's goodwill and helps maintain the value of the business being sold. 4. Employment Agreement: In some instances, the buyer may elect to retain certain employees of the business being acquired. An employment agreement can be included within the asset purchase agreement to outline the terms and conditions of employment for these individuals. 5. Payment and Escrow Agreement: When the purchase price is to be paid in installments or through escrow, a separate agreement can be added to the asset purchase agreement. This agreement specifies the payment terms, schedules, and the role of an escrow agent, if applicable. Keywords: Philadelphia, Pennsylvania, sole proprietor, asset purchase agreement, standard agreement, confidentiality agreement, non-compete agreement, employment agreement, payment agreement, escrow agreement.