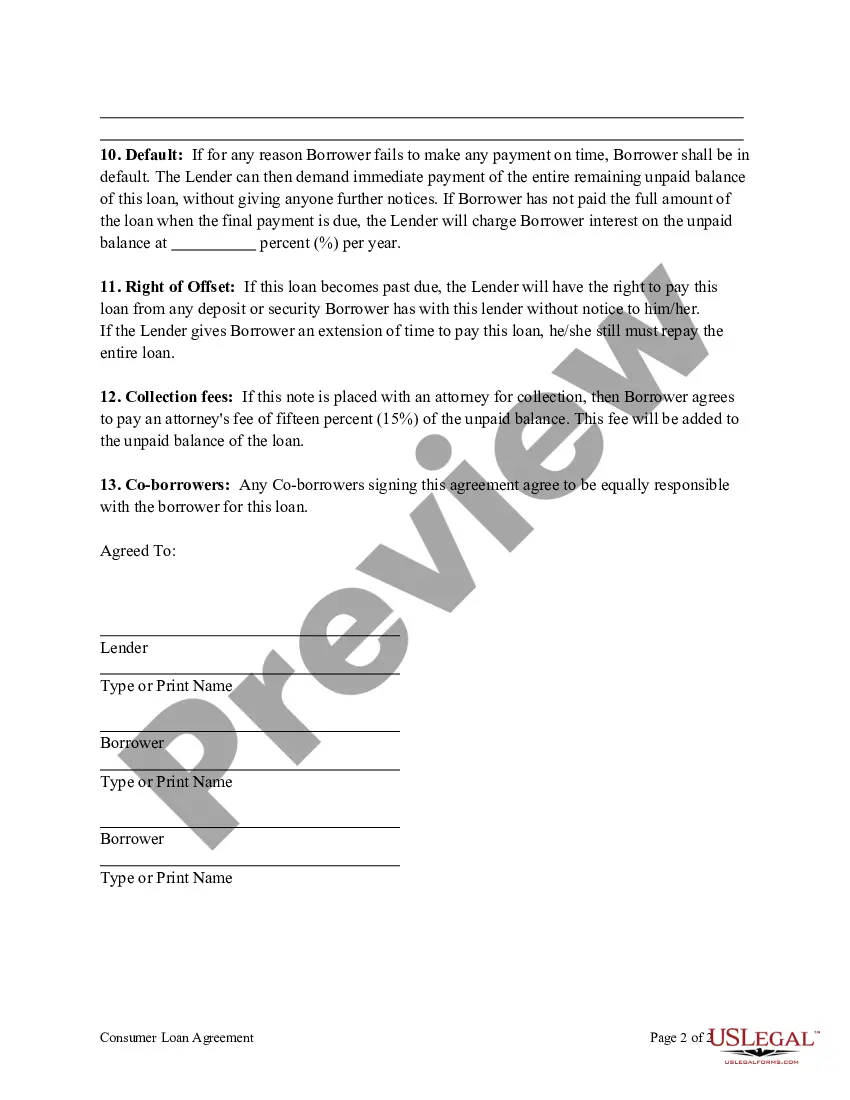

Contra Costa County, located in California, offers a variety of consumer loan agreements to meet the financial needs of its residents. These agreements serve as legally binding contracts between the borrower and the lender, outlining the terms and conditions of the loan. The Contra Costa California Consumer Loan Agreement is designed to protect the rights and interests of both parties involved in the lending process. It clarifies important aspects such as loan amount, repayment schedules, interest rates, fees, penalties, and any other relevant terms. The key aim of this agreement is to ensure transparency and fairness in consumer lending practices. By clearly delineating the terms, borrowers can understand their obligations and make informed decisions, while lenders can protect their investments. In case of any disputes or legal issues, the loan agreement serves as crucial evidence, ensuring a smooth resolution. There are various types of consumer loan agreements available in Contra Costa County, each catering to different financial needs and circumstances. Some common types include: 1. Personal Loans: Personal loans are unsecured loans that can be used for various purposes such as debt consolidation, medical expenses, or home improvement. These loans are typically based on the borrower's creditworthiness and may have higher interest rates compared to secured loans. 2. Auto Loans: Auto loans are designed specifically for purchasing vehicles. These loans can be secured, where the vehicle serves as collateral, or unsecured, relying on the borrower's creditworthiness. Interest rates and repayment terms may vary based on factors such as the borrower's credit score, down payment, and the age of the vehicle. 3. Mortgage Loans: Mortgage loans are secured loans used for financing real estate properties. The loan agreement outlines the terms of the loan, including repayment schedules, interest rates, and potential penalties. Contra Costa County offers diverse mortgage options, including fixed-rate mortgages, adjustable-rate mortgages, and government-backed loans like FHA and VA loans. 4. Payday Loans: Payday loans are short-term, high-interest loans designed to assist individuals in need of immediate cash. However, they often come with high fees and interest rates, making them a costly borrowing option. It is crucial to understand the terms and conditions of payday loans before entering into such an agreement. 5. Student Loans: Student loans are specifically tailored to finance higher education expenses. These loans can be federal or private and usually have favorable interest rates and flexible repayment options. Contra Costa County provides various resources and guidance to borrowers to help them understand the terms and manage their student loan debt effectively. In conclusion, Contra Costa County in California offers a range of consumer loan agreements, tailored to different financial needs. By entering into a loan agreement, borrowers and lenders can establish clear expectations, ensuring fair and transparent lending practices. It is essential for consumers to review and understand these agreements thoroughly before signing, considering the specific loan type and its terms.

Contra Costa California Consumer Loan Agreement

Description

How to fill out Contra Costa California Consumer Loan Agreement?

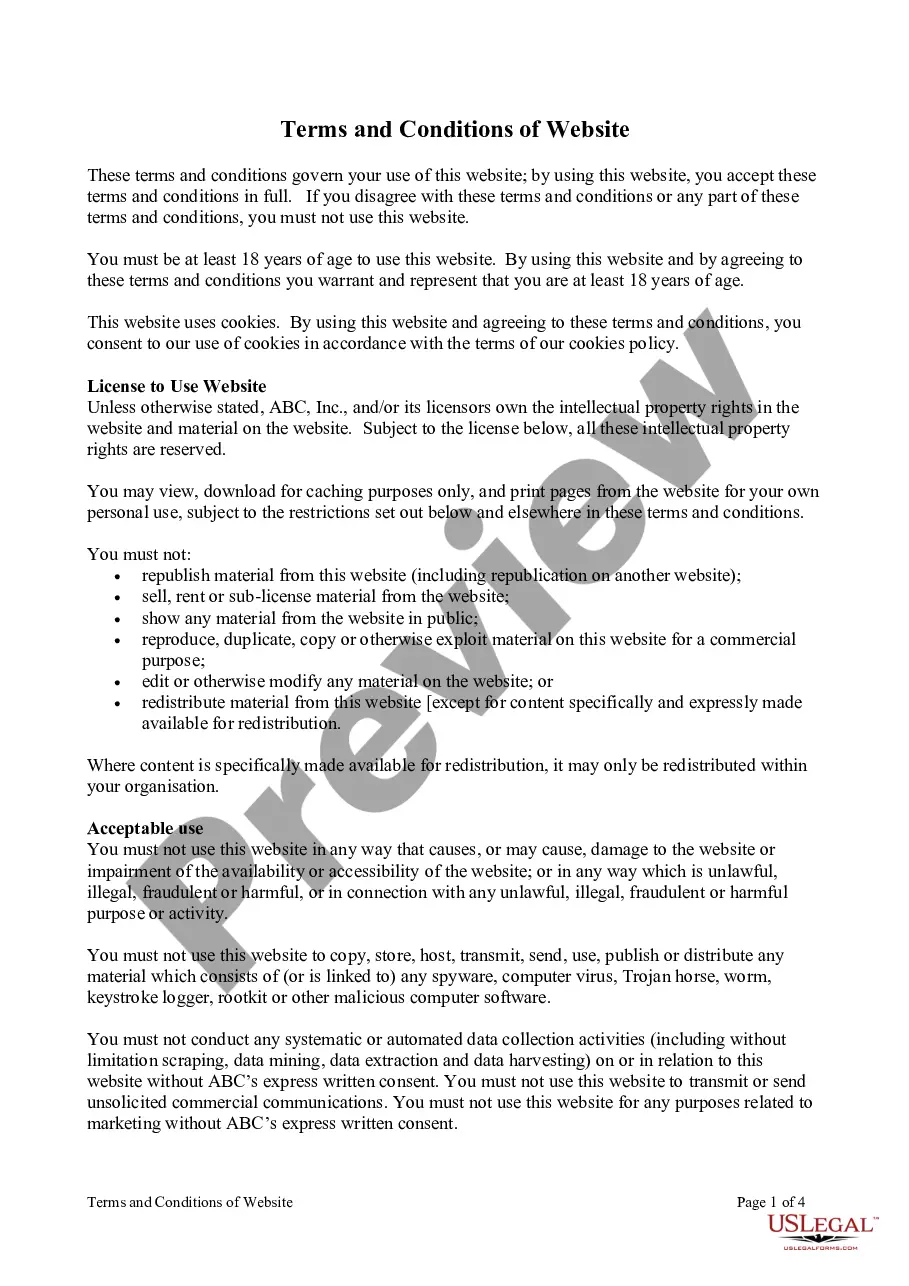

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and many other life scenarios require you prepare official documentation that varies throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. Here, you can easily locate and download a document for any individual or business objective utilized in your region, including the Contra Costa Consumer Loan Agreement.

Locating templates on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Contra Costa Consumer Loan Agreement will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guideline to get the Contra Costa Consumer Loan Agreement:

- Ensure you have opened the correct page with your local form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form corresponds to your needs.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Contra Costa Consumer Loan Agreement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!