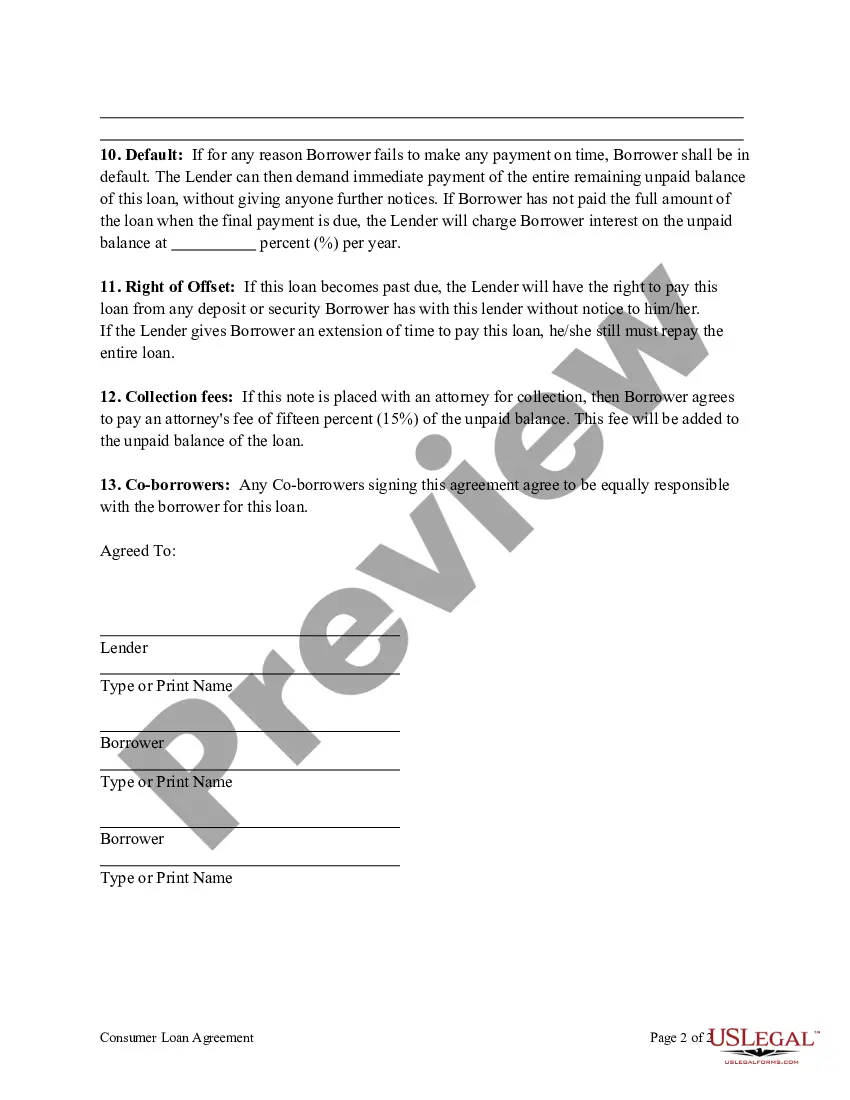

Mecklenburg County, located in North Carolina, offers various types of consumer loan agreements to cater to the financial needs of its residents. A Mecklenburg North Carolina Consumer Loan Agreement is a legally binding contract between a lender (typically a financial institution) and a borrower. This agreement outlines the terms and conditions under which a borrower can borrow a specific amount of money and establish a repayment plan. One type of consumer loan agreement offered in Mecklenburg County is the personal loan. Personal loans are generally unsecured loans that can be used for any purpose, such as debt consolidation, medical expenses, home improvement, or unexpected emergencies. The borrower agrees to repay the loan amount along with interest, often in fixed monthly installments, over a predetermined period. Another type of consumer loan agreement is the auto loan. Mecklenburg County residents can obtain an auto loan to finance the purchase of a vehicle, whether new or used. The terms and conditions for auto loans may vary based on factors such as the borrower's credit history, down payment amount, and the vehicle's value. Repayment terms are typically spread over a fixed number of months, with interest applied to the outstanding balance. Home equity loans and home equity lines of credit (Helots) are also offered as consumer loan agreements in Mecklenburg County. These loans allow homeowners to borrow against the equity they have built in their homes. Home equity loans offer a lump sum amount, while Helots provide borrowers with a flexible credit line that can be drawn upon when needed. These loans are secured by the value of the home and often have longer repayment terms compared to personal loans or auto loans. Additionally, Mecklenburg County consumer loan agreements may include payday loans or installment loans, which are short-term loans aimed at individuals facing immediate financial needs. However, it's important to note that payday loans often carry higher interest rates and fees compared to other loan types, making them a less desirable option for many borrowers. In summary, Mecklenburg North Carolina Consumer Loan Agreements encompass various loan types ranging from personal loans, auto loans, home equity loans, Helots, payday loans, and installment loans. Each loan type serves specific financial purposes and comes with its own set of terms and conditions for borrowers to consider. It is crucial for borrowers to fully understand the terms of any loan agreement they enter into, ensuring they can meet the repayment obligations without placing themselves in financial strain.

Mecklenburg North Carolina Consumer Loan Agreement

Description

How to fill out Mecklenburg North Carolina Consumer Loan Agreement?

Laws and regulations in every sphere vary throughout the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Mecklenburg Consumer Loan Agreement, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for various life and business situations. All the forms can be used multiple times: once you pick a sample, it remains available in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Mecklenburg Consumer Loan Agreement from the My Forms tab.

For new users, it's necessary to make some more steps to get the Mecklenburg Consumer Loan Agreement:

- Analyze the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the template once you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!