Orange California Consumer Loan Agreement is a legally binding document that outlines the terms and conditions between a borrower and a lender in Orange, California. This agreement governs the lending and borrowing of funds for personal or consumer purposes within Orange County. The Orange California Consumer Loan Agreement includes crucial information such as the names and contact details of both parties involved, the loan amount, interest rate, repayment schedule, late payment penalties, and any additional fees associated with the loan. It also specifies the rights and responsibilities of both the borrower and lender. There are a few different types of Consumer Loan Agreements commonly found in Orange, California: 1. Personal Installment Loan: This type of loan agreement allows borrowers to receive a lump sum of money and repay it in equal monthly installments over a specified period. The interest rate and repayment terms are agreed upon by both parties. 2. Auto Loan Agreement: This agreement pertains specifically to loans taken out for purchasing a vehicle. The borrower and lender agree on the loan amount, interest rate, and repayment schedule, which typically spans from a few months to several years. 3. Payday Loan Agreement: A payday loan is a short-term, high-interest loan typically taken out in emergencies or when the borrower needs quick access to cash. The agreement outlines the loan amount, interest rate, repayment date (usually the borrower's next payday), and any associated fees. Payday loans are governed by strict regulations in Orange, California, to protect consumers. 4. Home Equity Loan Agreement: This type of loan agreement is secured by the borrower's home equity and allows them to access a certain amount of money for various purposes, such as home improvements or debt consolidation. The agreement specifies the loan amount, interest rate, repayment schedule, and consequences of defaulting on payments. When drafting or reviewing an Orange California Consumer Loan Agreement, it is crucial to consider the legal requirements specific to Orange County and comply with local, state, and federal regulations. It is advisable to consult with an attorney to ensure full compliance and protection of both parties' rights and obligations.

Orange California Consumer Loan Agreement

Description

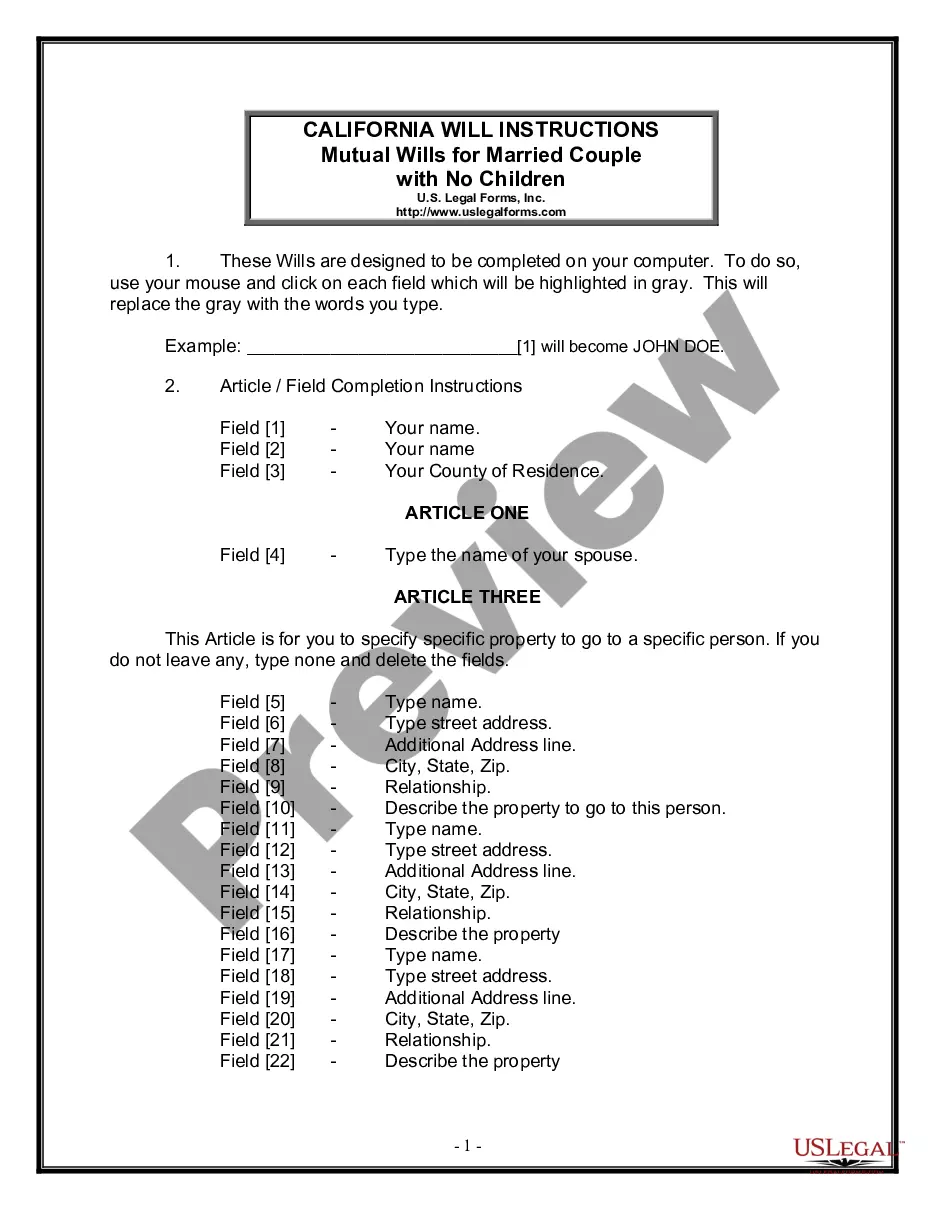

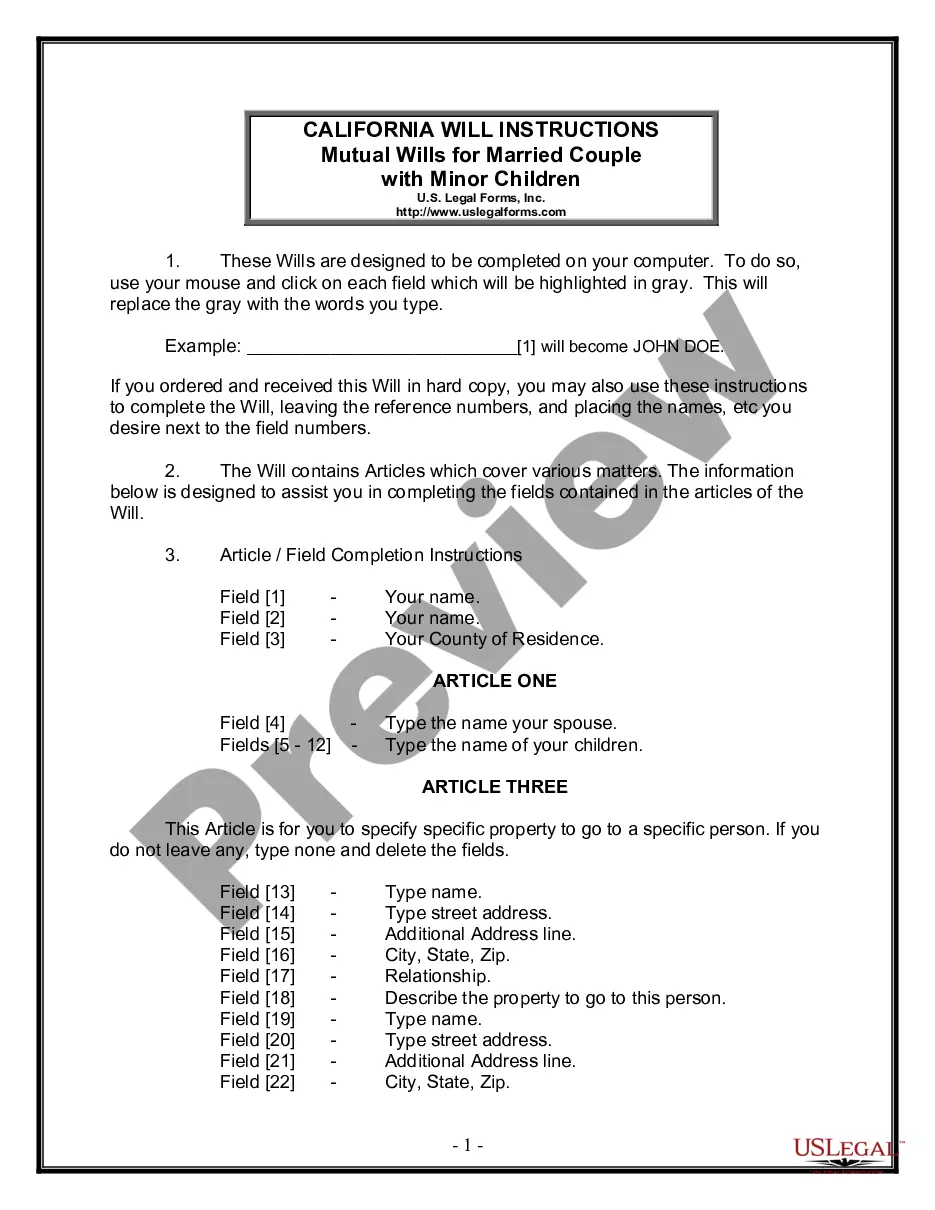

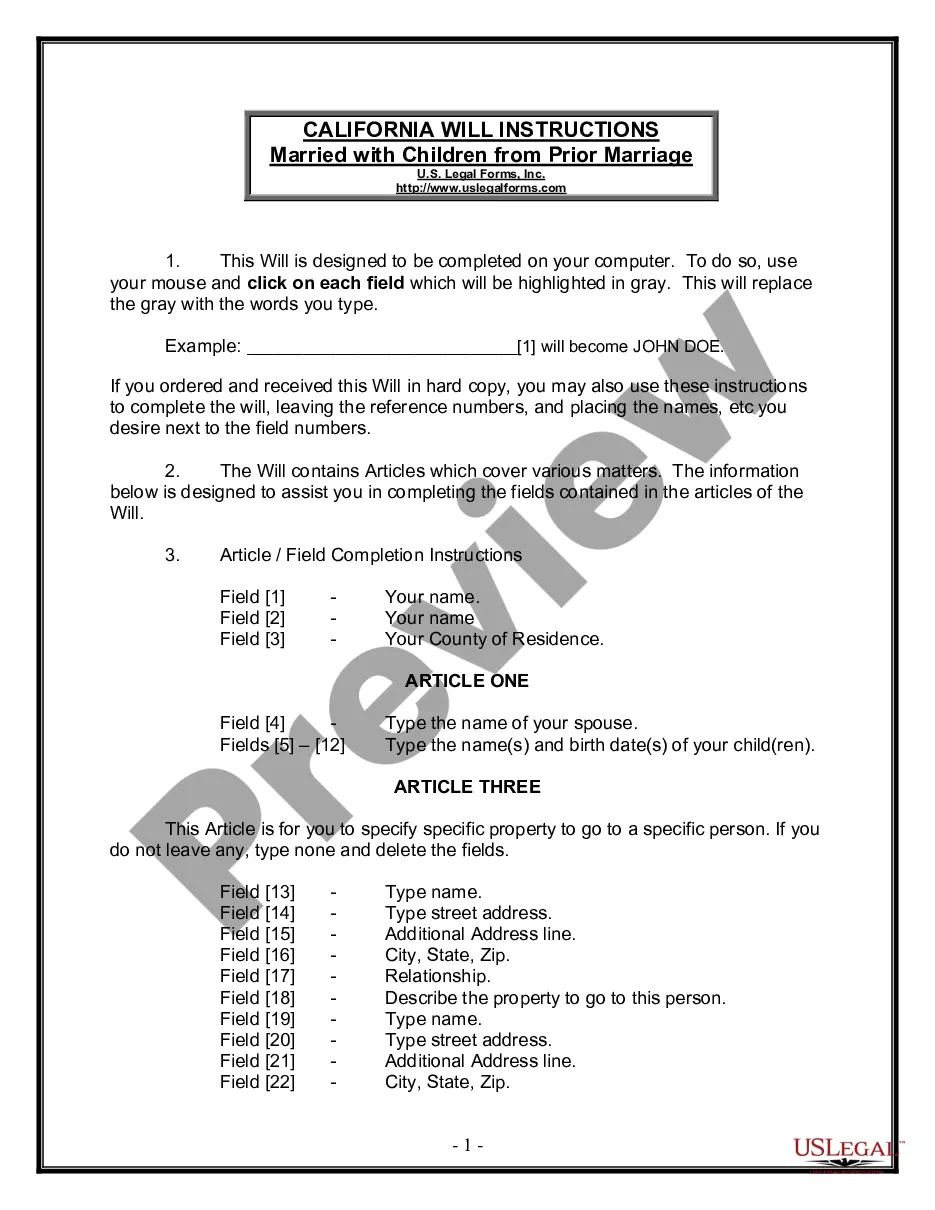

How to fill out Orange California Consumer Loan Agreement?

Draftwing forms, like Orange Consumer Loan Agreement, to manage your legal affairs is a difficult and time-consumming process. Many circumstances require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can get your legal matters into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal documents crafted for a variety of scenarios and life situations. We make sure each document is compliant with the regulations of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how effortless it is to get the Orange Consumer Loan Agreement form. Go ahead and log in to your account, download the template, and personalize it to your requirements. Have you lost your document? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is fairly simple! Here’s what you need to do before getting Orange Consumer Loan Agreement:

- Make sure that your document is compliant with your state/county since the regulations for writing legal paperwork may differ from one state another.

- Learn more about the form by previewing it or going through a brief intro. If the Orange Consumer Loan Agreement isn’t something you were hoping to find, then use the header to find another one.

- Log in or create an account to start utilizing our service and download the form.

- Everything looks great on your side? Hit the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment details.

- Your form is ready to go. You can try and download it.

It’s an easy task to locate and purchase the appropriate document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!