A Philadelphia Pennsylvania Corporate Asset Purchase Agreement is a legal contract that outlines the terms and conditions for the sale and purchase of assets by one corporation from another corporation within the jurisdiction of Philadelphia, Pennsylvania. This agreement governs the transfer of various assets such as equipment, machinery, intellectual property, licenses, real estate, contracts, inventory, goodwill, and other tangible and intangible properties. The purpose of a Corporate Asset Purchase Agreement is to establish a clear understanding between the buyer and the seller regarding the assets being sold, the purchase price, payment terms, representations and warranties, conditions precedent, covenants, indemnification provisions, and other relevant terms and conditions. One type of Philadelphia Pennsylvania Corporate Asset Purchase Agreement is a "Stock Purchase Agreement." In this type of agreement, the buyer acquires the stock or shares of the selling corporation, which includes all of its assets, liabilities, and obligations. It is essential to differentiate between Corporate Asset Purchase Agreements and Stock Purchase Agreements, as they entail different legal considerations and implications. Another type is a "Bulk Sale Agreement." This agreement is commonly used when a corporation intends to sell a significant portion of its assets as a whole rather than individual assets. It simplifies the transaction by bundling the assets together, saving time and avoiding the need for separate transfers. Additionally, a "Simple Asset Purchase Agreement" can be used when there are only a few assets being purchased, making it a more straightforward and concise agreement compared to others that involve more extensive asset transfers. Philadelphia Pennsylvania Corporate Asset Purchase Agreements must comply with the applicable state laws, including the Pennsylvania Business Corporation Law and any specific regulations within the city of Philadelphia. These agreements may require the involvement of legal professionals, such as corporate lawyers and accountants, to ensure compliance with all relevant laws and to protect the interests of both parties.

Philadelphia Pennsylvania Corporate Asset Purchase Agreement

Description

How to fill out Philadelphia Pennsylvania Corporate Asset Purchase Agreement?

Preparing legal documentation can be burdensome. Besides, if you decide to ask a legal professional to draft a commercial contract, papers for ownership transfer, pre-marital agreement, divorce papers, or the Philadelphia Corporate Asset Purchase Agreement, it may cost you a lot of money. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario collected all in one place. Consequently, if you need the latest version of the Philadelphia Corporate Asset Purchase Agreement, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Philadelphia Corporate Asset Purchase Agreement:

- Glance through the page and verify there is a sample for your area.

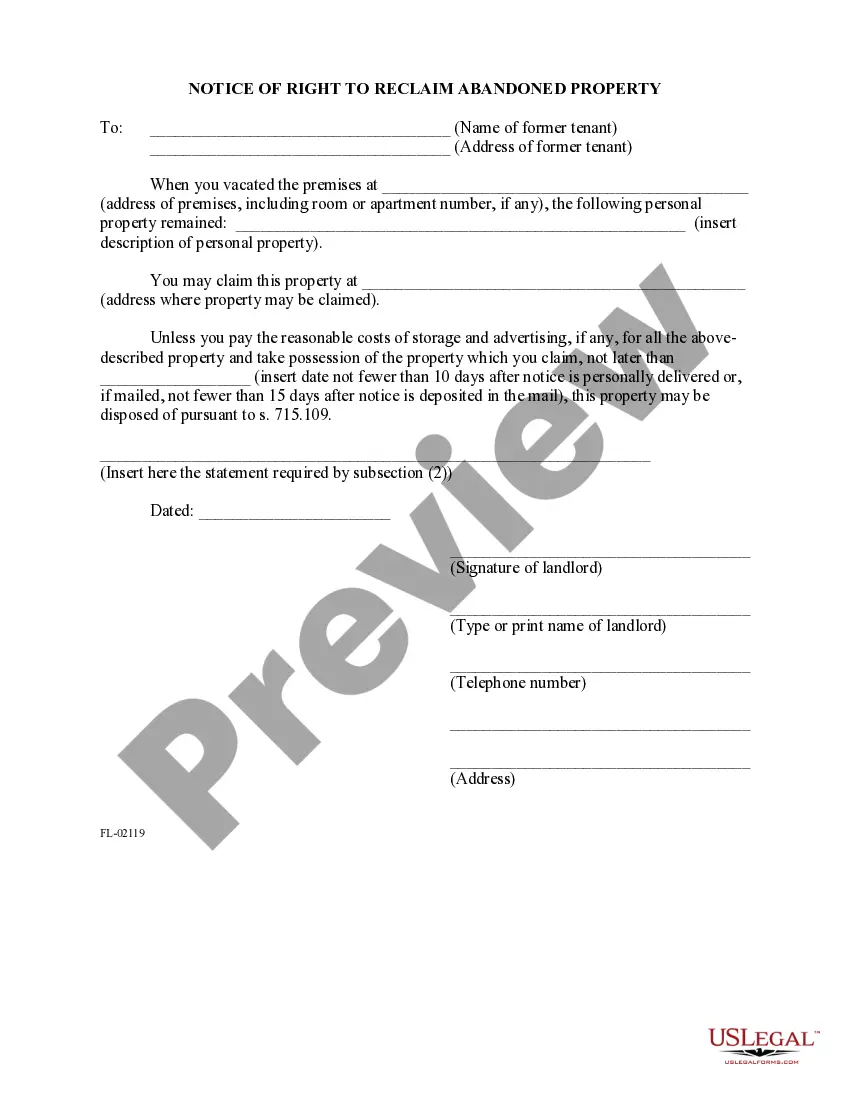

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the document format for your Philadelphia Corporate Asset Purchase Agreement and save it.

When finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!