Maricopa, Arizona Simple Promissory Note for Personal Loan: A Comprehensive Guide When it comes to borrowing or lending money, it is essential to have a legally binding agreement in place to protect both parties involved. The Maricopa, Arizona area offers a simplified document called a Simple Promissory Note for Personal Loan, which outlines the terms and conditions of the loan. This article aims to provide a detailed description of what this note is and the different types available. A Maricopa, Arizona Simple Promissory Note for Personal Loan serves as a formal agreement between a lender and borrower for a personal loan. It clearly outlines the amount borrowed, the interest rate (if applicable), the repayment schedule, and any additional terms or conditions agreed upon. This note is a legally binding document that ensures both parties understand their roles and responsibilities throughout the duration of the loan. The principal components of a Maricopa, Arizona Simple Promissory Note for Personal Loan include: 1. Loan Amount: The note specifies the exact amount of money borrowed by the borrower from the lender. It is crucial to record the precise figure to avoid any confusion or disputes in the future. 2. Interest Rate: If interest is applicable to the loan, the note will outline the agreed-upon rate. This ensures that both parties are aware of the additional cost associated with borrowing the money. 3. Repayment Schedule: The note includes a detailed repayment plan, outlining the frequency and amount of payments the borrower is obligated to make. This plan will typically include due dates and the total number of installments required for full repayment. 4. Late Payment Penalties: In case the borrower fails to make payments on time, the note may specify the penalties or fees involved. This serves as an incentive for borrowers to fulfill their payment obligations promptly. 5. Collateral: If the loan is secured, meaning the borrower offers an asset as collateral in case of default, the note will clearly state the collateral provided. This ensures that the lender has legal recourse to recover their funds. Types of Maricopa, Arizona Simple Promissory Notes for Personal Loan: 1. Fixed Interest Rate Note: This type of note establishes a fixed interest rate that remains consistent throughout the loan's duration. It provides stability and predictability to borrowers as they know exactly how much interest they will pay over time. 2. Variable Interest Rate Note: In contrast to the fixed interest rate note, this type of note has an interest rate that fluctuates according to market conditions or other predetermined factors. Borrowers should carefully consider the potential risks associated with variable interest rates. 3. Lump-Sum Repayment Note: Some loans require a single repayment of the entire principal amount and interest within a specified period. This lump-sum repayment note outlines the exact terms and conditions for such an agreement. 4. Installment Repayment Note: This note is the most common type and establishes a regular installment plan for the repayment of the loan. Borrowers make equal payments over a set period until the principal amount and interest are fully repaid. By understanding the significance of a Maricopa, Arizona Simple Promissory Note for Personal Loan, borrowers and lenders can ensure a transparent and mutually beneficial transaction. It is essential to choose the right type of note that aligns with the specific requirements and preferences of both parties involved.

Maricopa Arizona Simple Promissory Note for Personal Loan

Description

How to fill out Maricopa Arizona Simple Promissory Note For Personal Loan?

Laws and regulations in every area vary from state to state. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Maricopa Simple Promissory Note for Personal Loan, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used many times: once you purchase a sample, it remains available in your profile for further use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Maricopa Simple Promissory Note for Personal Loan from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Maricopa Simple Promissory Note for Personal Loan:

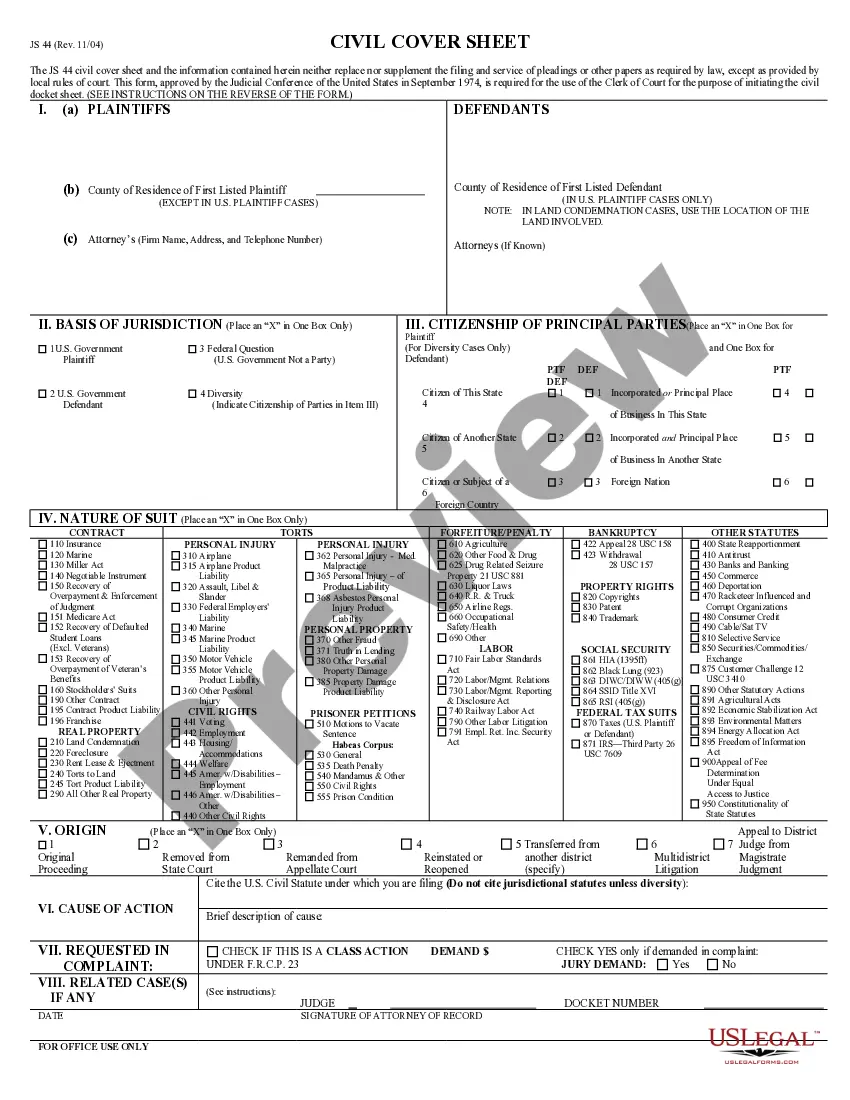

- Analyze the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the document when you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!