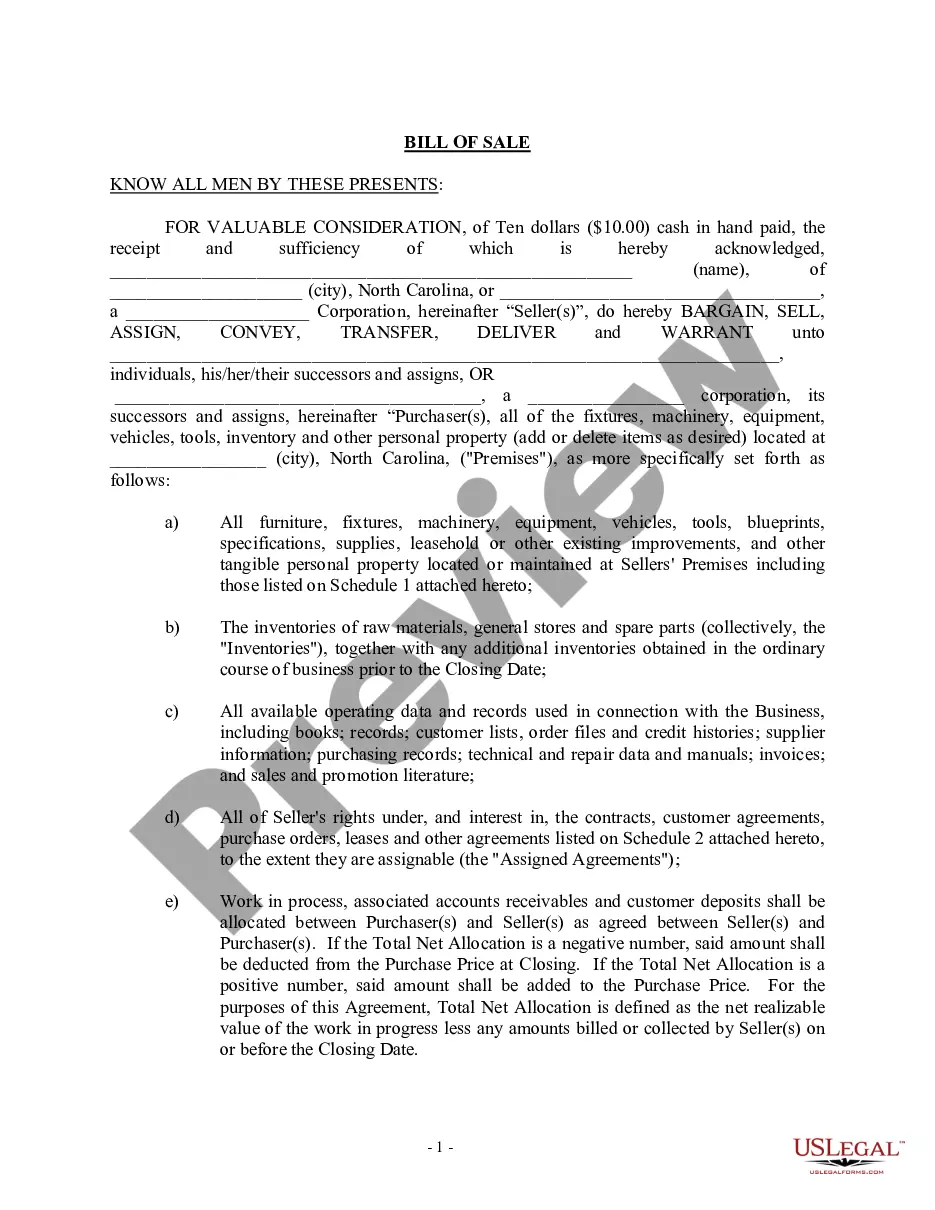

A Simple Promissory Note for Personal Loan is a legally binding document used in San Diego, California, to record a loan agreement between two individuals, where one party lends money to the other. This type of promissory note outlines essential details such as the loan amount, repayment terms, interest rate (if any), and any additional conditions agreed upon by both parties. It ensures that the borrower acknowledges their debt and guarantees their commitment to repay the loan amount in a timely manner. In San Diego, there are various types of Simple Promissory Notes for Personal Loans available, depending on specific loan requirements: 1. Fixed-Rate Promissory Note: This type of promissory note establishes a fixed interest rate, which remains unchanged throughout the loan term. It provides clarity and stability to both the lender and the borrower and allows for easy calculations to determine future repayment amounts. 2. Variable-Rate Promissory Note: Unlike the fixed-rate promissory note, a variable-rate note permits the interest rate to fluctuate, typically based on an index such as the prime rate. This allows for changes in interest rates over time, which may result in varying monthly repayment amounts. It is vital to carefully assess the risks associated with variable interest rates before choosing this option. 3. Balloon Promissory Note: This promissory note has a relatively lower periodic repayment amount during the loan term, followed by a large final payment called the "balloon payment" at the end. Balloon notes are suitable for borrowers who anticipate a significant cash inflow by the loan's maturity or plan to refinance the debt. 4. Secured Promissory Note: This type of promissory note includes a collateral provision, where the borrower pledges specific assets (such as property, vehicles, or investments) as security for the loan. In the event of default, the lender has the right to seize and sell the collateral to recover the outstanding amount. 5. Unsecured Promissory Note: Unlike a secured promissory note, an unsecured note does not require collateral. The lender relies solely on the borrower's creditworthiness and trust, making it riskier for the lender but less demanding for the borrower. It is crucial for both parties involved to thoroughly understand the terms and conditions mentioned in the promissory note. Seeking legal advice is recommended to ensure compliance with California state laws and to protect the interests of all parties involved in the loan transaction.

San Diego California Simple Promissory Note for Personal Loan

Description

How to fill out San Diego California Simple Promissory Note For Personal Loan?

If you need to find a reliable legal document supplier to get the San Diego Simple Promissory Note for Personal Loan, look no further than US Legal Forms. No matter if you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed form.

- You can search from over 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of learning materials, and dedicated support team make it simple to locate and execute different documents.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

Simply select to search or browse San Diego Simple Promissory Note for Personal Loan, either by a keyword or by the state/county the form is intended for. After locating required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to start! Simply locate the San Diego Simple Promissory Note for Personal Loan template and check the form's preview and description (if available). If you're confident about the template’s terminology, go ahead and click Buy now. Register an account and select a subscription option. The template will be instantly available for download as soon as the payment is processed. Now you can execute the form.

Taking care of your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our extensive collection of legal forms makes these tasks less costly and more reasonably priced. Create your first company, arrange your advance care planning, create a real estate agreement, or complete the San Diego Simple Promissory Note for Personal Loan - all from the convenience of your home.

Sign up for US Legal Forms now!