Collin Texas Simple Promissory Note for Family Loan is a legally-binding agreement used in Collin County, Texas for loans made within the family. This note outlines the terms and conditions of the loan, ensuring that both the lender and borrower are on the same page regarding repayment. The Collin Texas Simple Promissory Note for Family Loan serves as a formal document that clearly specifies the loan amount, interest rate (if applicable), repayment schedule, and any other relevant terms agreed upon by the parties involved. This note helps maintain transparency and accountability, making it an essential tool for family loans in Collin County. Different types of Collin Texas Simple Promissory Notes for Family Loan may exist depending on the specific loan arrangements. Some common variations are: 1. Straightforward Promissory Note: This is the most basic form of the note, where the borrower promises to repay the principal loan amount without any interest. This type of note is often used for interest-free loans among family members. 2. Interest-Bearing Promissory Note: In cases where the lender intends to charge interest on the loan, this type of note outlines the interest rate, usually defined as an annual percentage rate (APR). The note clearly explains how interest will be calculated and repaid by the borrower. 3. Installment Promissory Note: When the borrower needs more time to repay the loan, an installment promissory note is used. It lays out a structured repayment plan, typically involving regular monthly payments of principal and interest over an agreed-upon term. Regardless of the type, Collin Texas Simple Promissory Notes for Family Loans are designed to protect both parties and ensure that the loan agreement remains legally enforceable. It is strongly recommended consulting with a legal professional to draft or review the note to guarantee its compliance with applicable laws and regulations.

Collin Texas Simple Promissory Note for Family Loan

Description

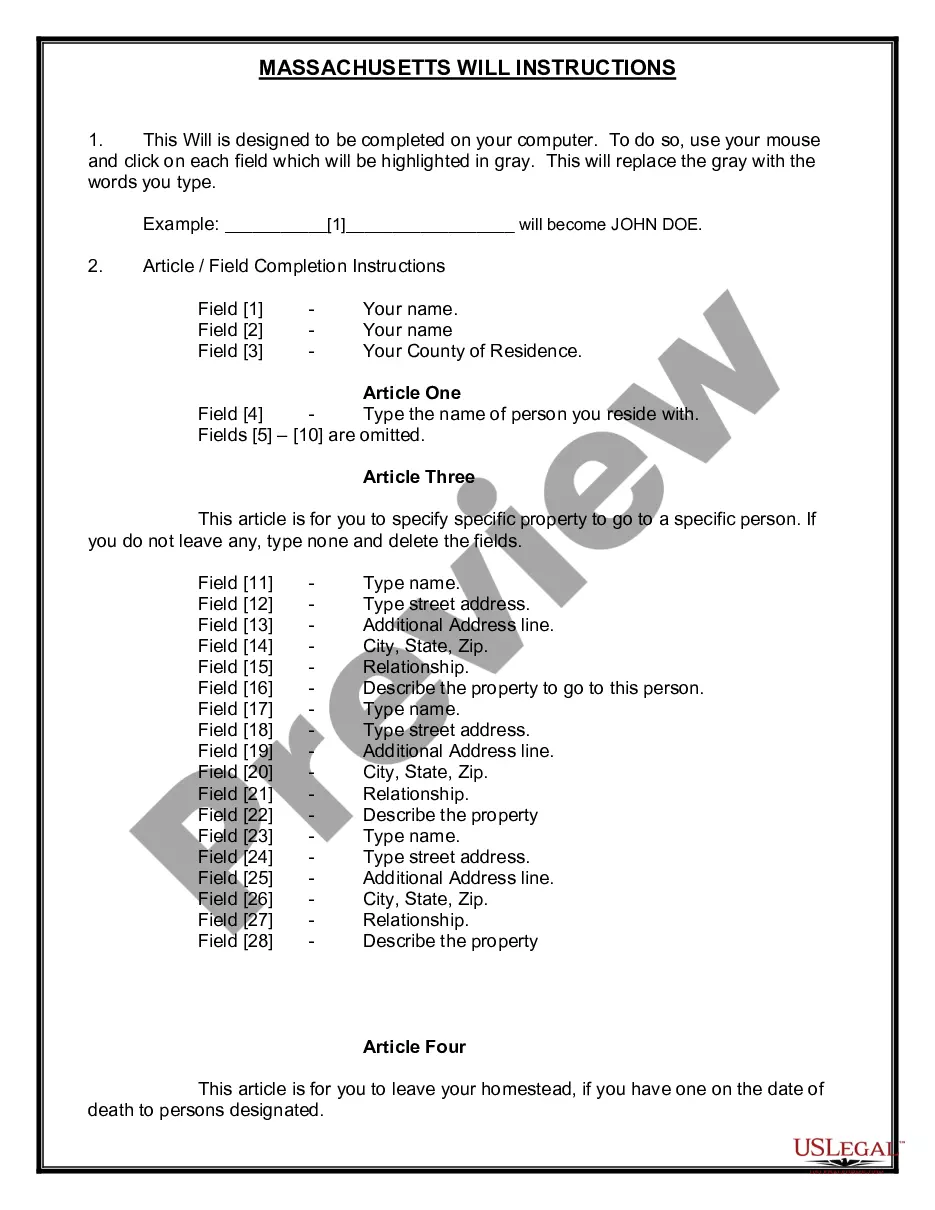

How to fill out Collin Texas Simple Promissory Note For Family Loan?

How much time does it normally take you to draft a legal document? Since every state has its laws and regulations for every life situation, finding a Collin Simple Promissory Note for Family Loan meeting all regional requirements can be stressful, and ordering it from a professional attorney is often costly. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web collection of templates, gathered by states and areas of use. Apart from the Collin Simple Promissory Note for Family Loan, here you can get any specific form to run your business or personal deeds, complying with your regional requirements. Experts verify all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required sample, and download it. You can pick the document in your profile anytime later on. Otherwise, if you are new to the platform, there will be a few more actions to complete before you obtain your Collin Simple Promissory Note for Family Loan:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now once you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Collin Simple Promissory Note for Family Loan.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!