Oakland Michigan is a county located in the southeastern part of the state. It is part of the Detroit metropolitan area and is known for its vibrant communities, beautiful landscapes, and diverse culture. Within Oakland Michigan, there are various types of Simple Promissory Notes for Family Loans available to individuals. These promissory notes serve as legal agreements between family members who wish to provide financial support to one another. One type of Simple Promissory Note for Family Loan in Oakland Michigan is the secured promissory note. This type of note includes collateral, such as a property or asset, which the borrower pledges as security for the loan. By including collateral, the lender can feel more secure in lending money, as they have the right to seize the pledged asset if the borrower fails to repay the loan. Another type of Simple Promissory Note for Family Loan in Oakland Michigan is the unsecured promissory note. Unlike the secured note, this type does not require collateral. Instead, it relies solely on the borrower's promise to repay the loan. Unsecured promissory notes typically have higher interest rates since the lender takes on a greater risk without any collateral. Furthermore, there is the demand promissory note, which allows the lender to demand full repayment of the loan at any time. This type of note provides flexibility for both parties, as the lender can request repayment when needed, and the borrower can repay the loan whenever they have the means to do so. Lastly, there is the installment promissory note. This type of note breaks the loan into smaller, regular payments called installments. Each installment includes both the principal loan amount and the interest, making it easier for the borrower to manage their repayment. Installment promissory notes typically have a fixed interest rate, ensuring that the borrower knows exactly how much they need to repay each month. In conclusion, Oakland Michigan offers various types of Simple Promissory Notes for Family Loans to accommodate the needs of borrowers and lenders alike. These include secured promissory notes, unsecured promissory notes, demand promissory notes, and installment promissory notes. When considering a family loan, it is essential to choose the most suitable type of promissory note that aligns with your financial goals and preferences.

Oakland Michigan Simple Promissory Note for Family Loan

Description

How to fill out Oakland Michigan Simple Promissory Note For Family Loan?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to draft some of them from the ground up, including Oakland Simple Promissory Note for Family Loan, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in different types varying from living wills to real estate paperwork to divorce papers. All forms are arranged based on their valid state, making the searching process less frustrating. You can also find information materials and tutorials on the website to make any tasks related to document completion straightforward.

Here's how to find and download Oakland Simple Promissory Note for Family Loan.

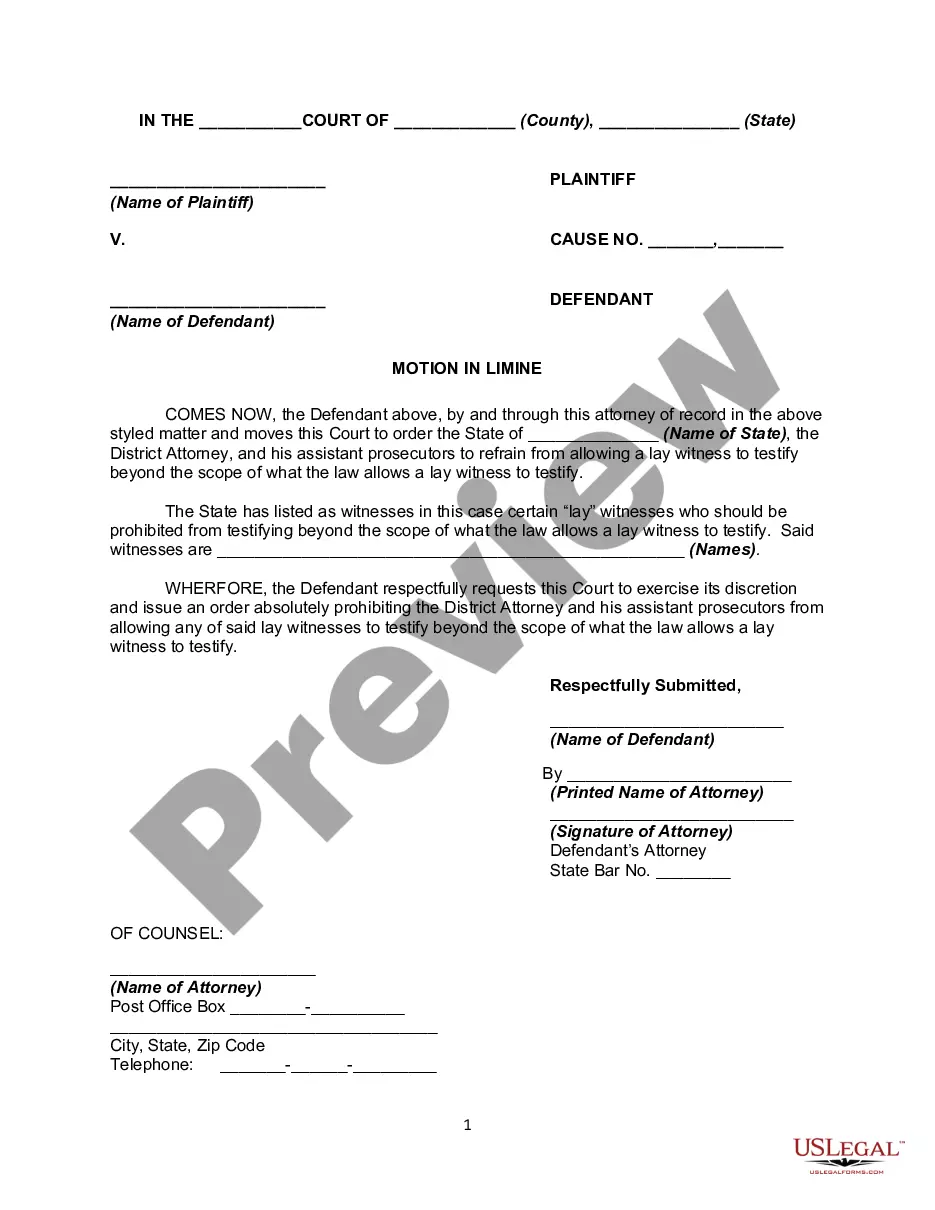

- Take a look at the document's preview and description (if provided) to get a general information on what you’ll get after getting the document.

- Ensure that the document of your choice is adapted to your state/county/area since state laws can affect the validity of some records.

- Check the similar forms or start the search over to locate the right file.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Pick the option, then a needed payment method, and purchase Oakland Simple Promissory Note for Family Loan.

- Choose to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Oakland Simple Promissory Note for Family Loan, log in to your account, and download it. Needless to say, our platform can’t take the place of an attorney completely. If you need to cope with an extremely challenging situation, we advise using the services of a lawyer to review your form before executing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of customers. Become one of them today and purchase your state-specific paperwork effortlessly!