A Contra Costa California Simple Promissory Note for Tuition Fee is a legally binding document that outlines the terms and conditions under which a borrower agrees to repay a loan for educational expenses. It serves as a written agreement between the borrower and the lender, ensuring that both parties are aware of their responsibilities and rights. This type of promissory note is commonly used by students or their parents when seeking financial assistance to cover the costs of tuition, fees, books, and other educational expenses. By signing the promissory note, the borrower acknowledges their obligation to repay the loan according to the agreed-upon terms. The Contra Costa California Simple Promissory Note for Tuition Fee typically includes important details such as the names and contact information of both parties, the amount borrowed, the interest rate (if applicable), the repayment schedule, and any penalties or late fees for missed payments. Different types of Contra Costa California Simple Promissory Notes for Tuition Fee may vary in terms of interest rates, repayment periods, and lender requirements. Some common variations include fixed-rate promissory notes, variable-rate promissory notes, and deferred repayment promissory notes. In a fixed-rate promissory note, the interest rate remains constant throughout the repayment period, providing stability for the borrower. On the other hand, a variable-rate promissory note allows the interest rate to fluctuate based on an agreed-upon benchmark, which can result in changing monthly payments for the borrower. Deferred repayment promissory notes are an option for borrowers who need more time before they can start repaying the loan. With this type of note, the borrower can delay making monthly payments until a specific future date or until they complete their education. It is essential to carefully review and understand the terms and conditions outlined in the Contra Costa California Simple Promissory Note for Tuition Fee before signing the document. If any doubts or questions arise, seeking legal advice or guidance from a financial aid office is highly recommended ensuring complete comprehension and to protect the interests of both parties involved.

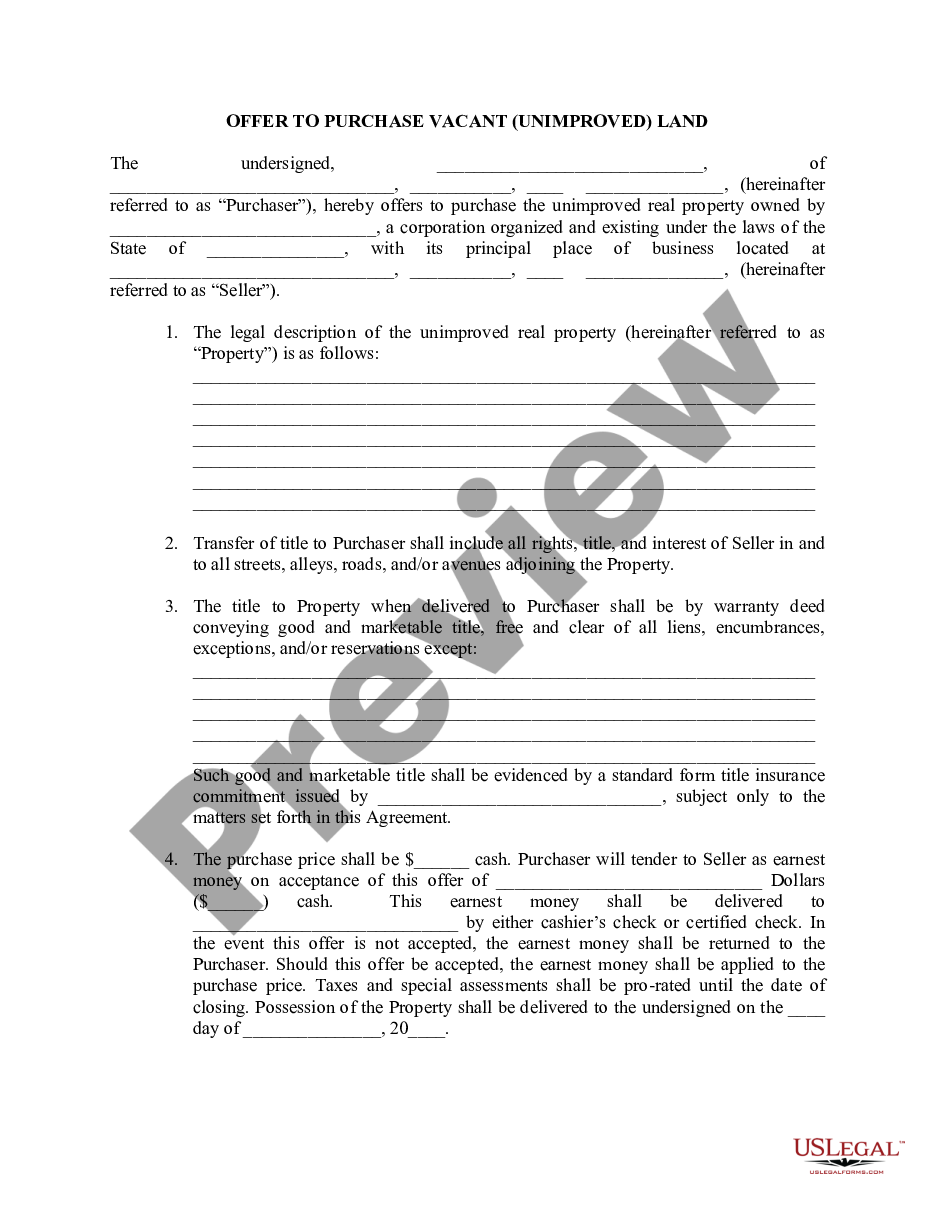

Contra Costa California Simple Promissory Note for Tutition Fee

Description

How to fill out Contra Costa California Simple Promissory Note For Tutition Fee?

Creating paperwork, like Contra Costa Simple Promissory Note for Tutition Fee, to manage your legal affairs is a difficult and time-consumming task. Many situations require an attorney’s involvement, which also makes this task expensive. However, you can take your legal matters into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal forms intended for a variety of scenarios and life situations. We ensure each document is compliant with the laws of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already aware of our services and have a subscription with US, you know how effortless it is to get the Contra Costa Simple Promissory Note for Tutition Fee template. Simply log in to your account, download the template, and personalize it to your requirements. Have you lost your document? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is fairly straightforward! Here’s what you need to do before downloading Contra Costa Simple Promissory Note for Tutition Fee:

- Ensure that your document is specific to your state/county since the regulations for creating legal paperwork may vary from one state another.

- Find out more about the form by previewing it or reading a brief intro. If the Contra Costa Simple Promissory Note for Tutition Fee isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to begin using our website and get the document.

- Everything looks great on your side? Click the Buy now button and choose the subscription plan.

- Select the payment gateway and type in your payment details.

- Your form is good to go. You can go ahead and download it.

It’s easy to locate and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!