A Harris Texas Simple Promissory Note for Tuition Fee is a legally binding document that outlines the terms and conditions of a loan agreement between a borrower and a lender for educational expenses. This promissory note serves as evidence of the loan and provides clear guidelines regarding repayment. Keywords: Harris Texas, simple promissory note, tuition fee, loan agreement, educational expenses, borrower, lender, repayment. There are different types of Harris Texas Simple Promissory Note for Tuition Fee based on specific requirements or variations in terms. Some of these variations may include: 1. Fixed Interest Rate Promissory Note: This type of promissory note features a predetermined interest rate that remains constant throughout the loan term. Both parties agree to this rate, ensuring a consistent and predictable repayment schedule. 2. Variable Interest Rate Promissory Note: Unlike a fixed interest rate promissory note, this type allows for changes in the interest rate over time. These changes typically depend on market conditions or other predetermined factors specified in the note. 3. Installment Promissory Note: An installment promissory note breaks down the loan into equal monthly or periodic payments, including principal and interest, ensuring that the borrower repays the loan gradually over a specific period. 4. Lump Sum Promissory Note: In case a borrower wishes to repay the entire loan amount in a single payment, a lump sum promissory note can be used. This type eliminates the need for periodic installments, allowing for immediate repayment. 5. Secured Promissory Note: A secured promissory note involves collateral or an asset that serves as security for the loan. If the borrower fails to repay the debt, the lender may have the right to claim the collateral as compensation. 6. Unsecured Promissory Note: Unlike a secured note, this type does not require collateral. Instead, the borrower's creditworthiness and trustworthiness are the main factors allowing them to obtain the loan. When using a Harris Texas Simple Promissory Note for Tuition Fee, it is essential to consult with professionals to ensure compliance with local laws and ensure the terms are fair and reasonable for both the borrower and lender.

Harris Texas Simple Promissory Note for Tutition Fee

Description

How to fill out Harris Texas Simple Promissory Note For Tutition Fee?

Whether you intend to open your company, enter into an agreement, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific documentation corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business occurrence. All files are collected by state and area of use, so opting for a copy like Harris Simple Promissory Note for Tutition Fee is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you several additional steps to get the Harris Simple Promissory Note for Tutition Fee. Follow the guidelines below:

- Make sure the sample meets your personal needs and state law requirements.

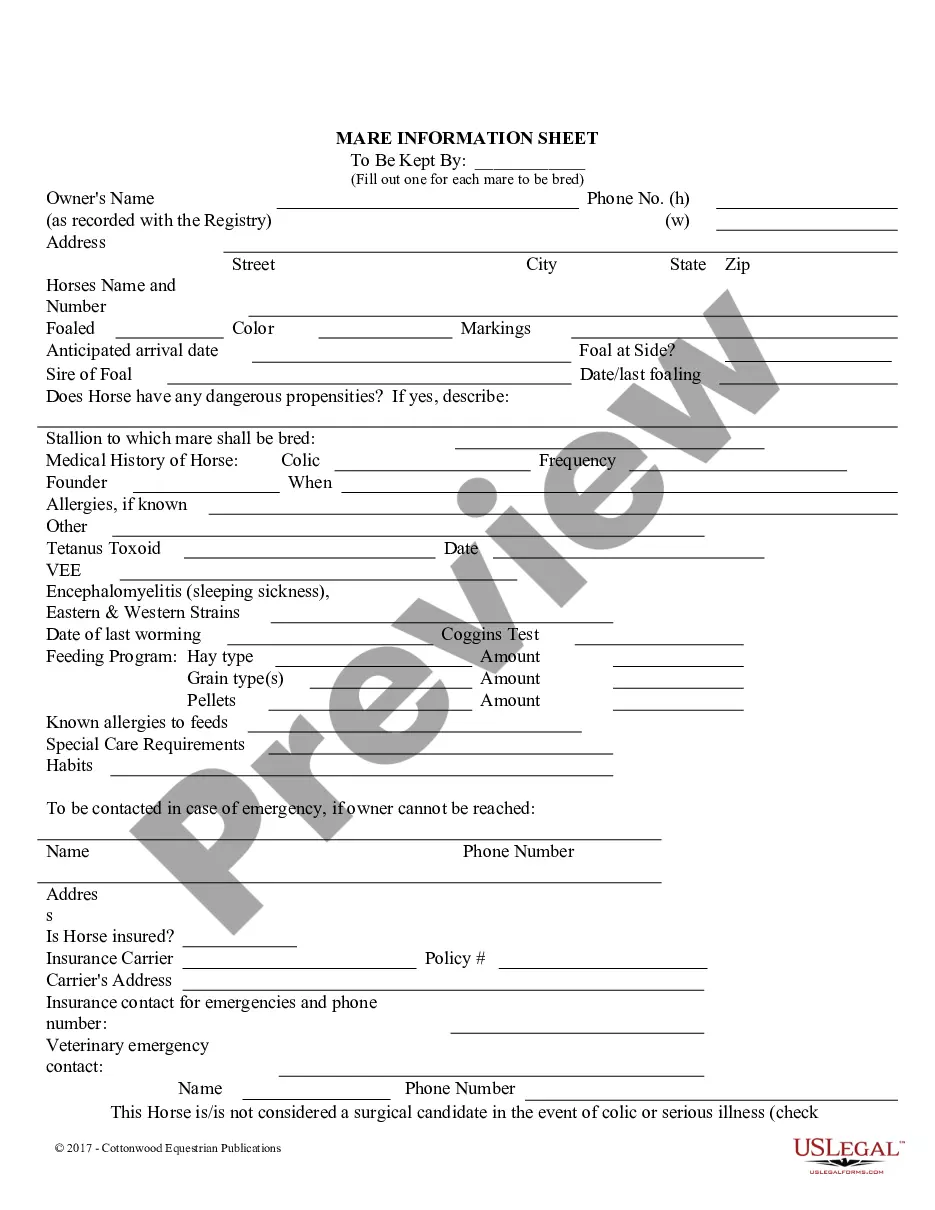

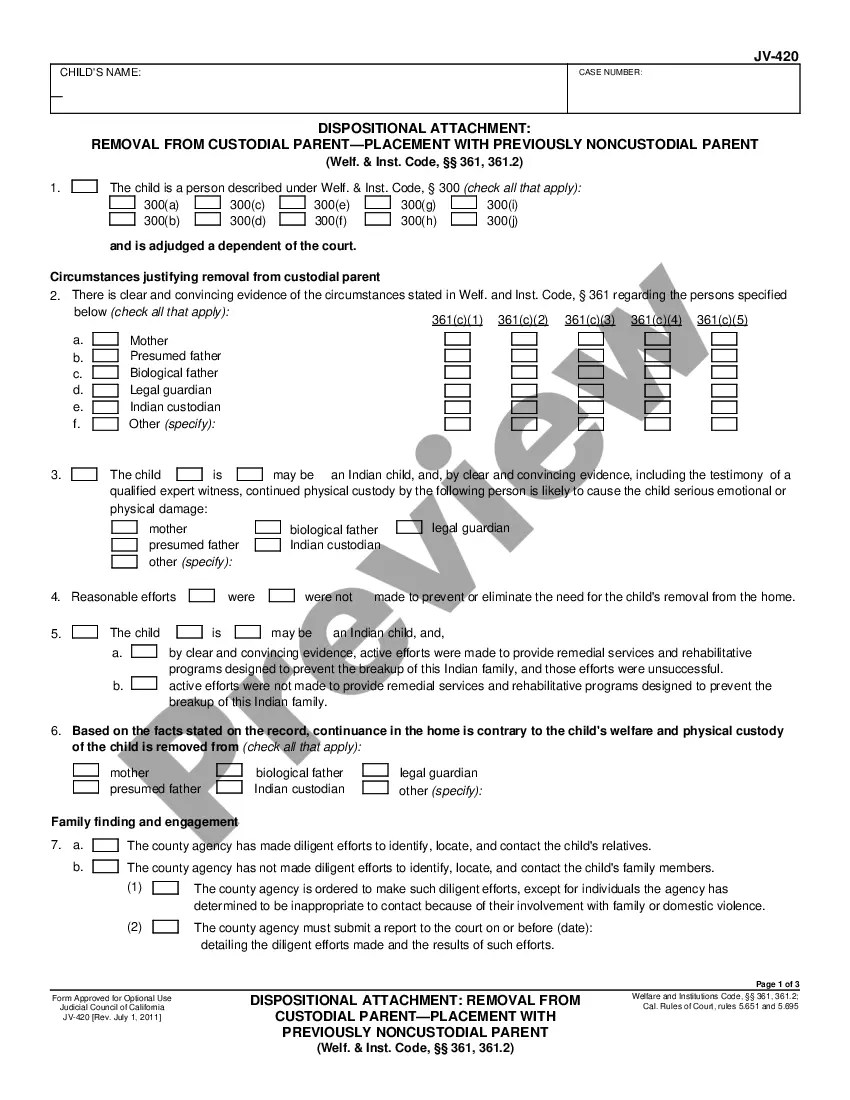

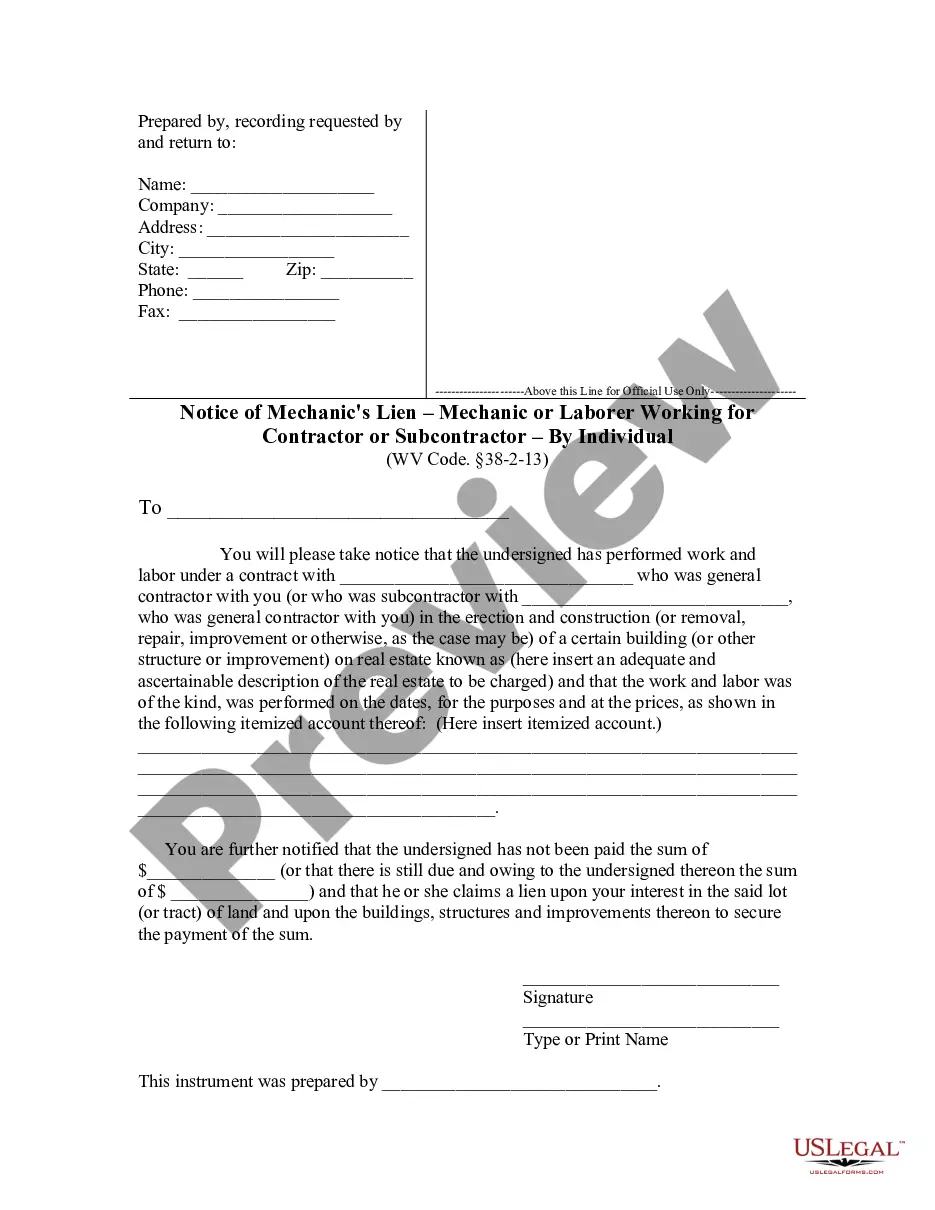

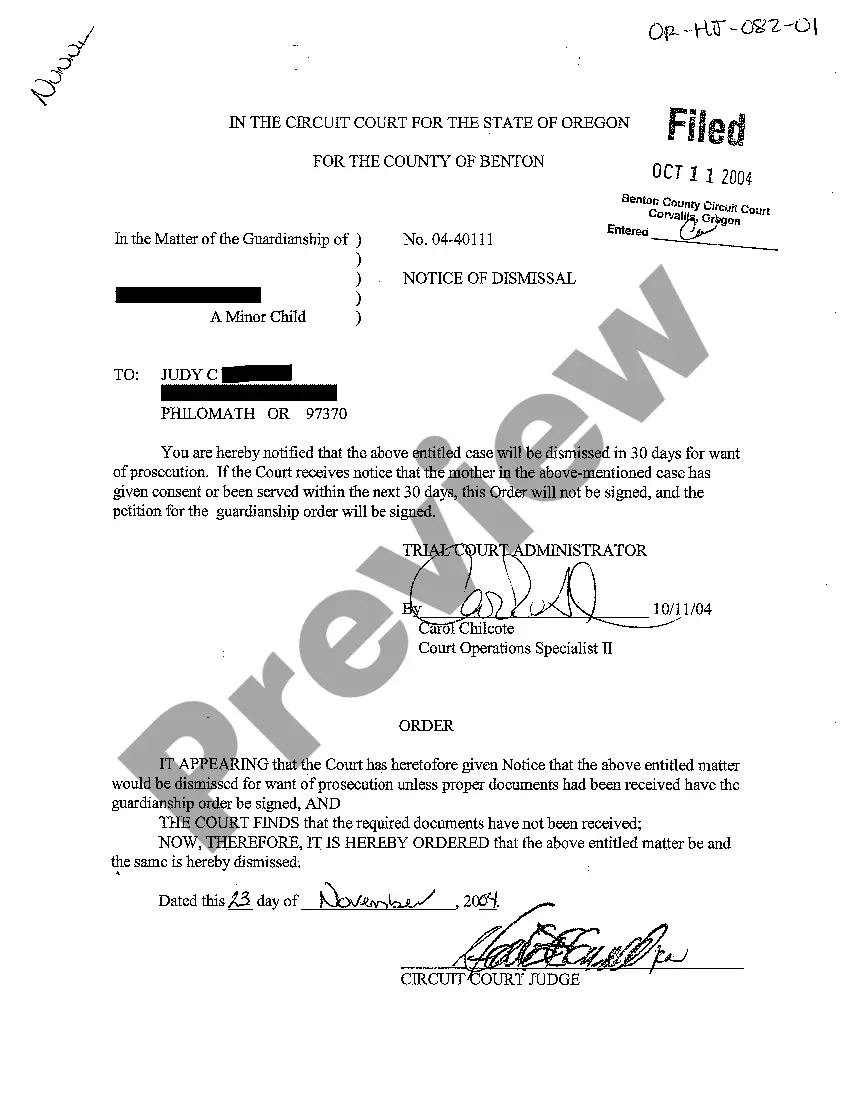

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the file when you find the proper one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Harris Simple Promissory Note for Tutition Fee in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!

Form popularity

FAQ

This is to express in writing my inability to pay on time the amount due for my tuition fees amounting to P. I promise to pay said amount on or before . Furthermore, I am fully aware that subsequent Promissory Notes shall not be accepted without settling my current due amount.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

Search the county recorder's records. Promissory notes are typically recorded as public documents and accessible shortly after the closing. The trustee maintains the original deed until the loan is satisfied.

During registration you will have the opportunity to pay your fees in three equal instalments. If you wish to pay in instalments you just pay one third of your fees online with the remaining tuition fees being payable in instalments by Direct Debit.

How To Write a Promissory Note Step 1 Full names of parties (borrower and lender)Step 2 Repayment amount (principal and interest)Step 3 Payment plan.Step 4 Consequences of non-payment (default and collection)Step 5 Notarization (if necessary)Step 6 Other common details.

You can create a Promissory Note as a lender or borrower by following these steps: Select the location. Our Promissory Note template will customize your document specifically for the laws of your location.Provide party details.Establish the terms of the loan.Include final details.Sign the document.

You can get a copy of your Master Promissory Notes by going to studentloans.gov and entering your FSA ID. Click on Completed Master Promissory Notes under the menu bar heading that says My Loan Documents. The completed Master Promissory Notes will appear, and you can download them directly.

Simple Promissory Note Sample Include the date you are writing or the date you plan to send the note at the top. Write the total amount due in both numeric and long-form. Add a detailed description of the loan or note terms. For example, you'll need to include what the loan or payment is for, who will pay it and how.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.