A Maricopa Arizona Simple Promissory Note for Tuition Fee is a legally binding document that outlines an agreement between a borrower and a lender regarding the repayment of borrowed funds used for tuition fees in the Maricopa area of Arizona. This note ensures that both parties are aware of their responsibilities and protects the lender's interest in obtaining the promised payment on time. The Maricopa Arizona Simple Promissory Note for Tuition Fee typically includes essential information such as the names and contact details of the borrower and lender, the date the agreement was made, the amount borrowed, the interest rate (if applicable), the repayment terms, and any other agreed-upon conditions. By providing these details, the promissory note ensures clarity and helps avoid any potential misunderstandings between the parties involved. There might be variations of the Maricopa Arizona Simple Promissory Note for Tuition Fee based on different factors, such as the presence or absence of collateral, interest rates, repayment schedules, or specific clauses. Some common types of promissory notes regarding tuition fees in Maricopa, Arizona, might include: 1. Unsecured Promissory Note: This type of note does not require the borrower to provide collateral to secure the loan. The lender relies solely on the borrower's promise to repay the borrowed tuition funds. 2. Secured Promissory Note: This note includes collateral, such as assets or property, which the lender can claim in case the borrower fails to repay the borrowed funds as agreed. Securing the note with collateral provides additional protection for the lender. 3. Fixed Interest Promissory Note: This type of promissory note specifies a predetermined interest rate that remains constant throughout the loan term. Fixed interest rates offer stability and predictability in terms of repayments for both parties. 4. Variable Interest Promissory Note: In contrast to fixed interest, this note incorporates an interest rate that fluctuates based on an agreed-upon reference point, such as the current prime rate or a financial index. Variable interest rates can lead to varying repayment amounts, depending on market conditions. 5. Graduated Payment Promissory Note: This type of note includes a repayment schedule that starts with lower monthly installments and gradually increases over time. It is beneficial for borrowers who anticipate an increase in income or expect to repay a larger sum in the future. By tailoring the Maricopa Arizona Simple Promissory Note for Tuition Fee to the specific circumstances and needs of the borrower and lender, all parties involved can establish a transparent and fair agreement that protects the lender's investment while ensuring the borrower's financial obligations are met.

Maricopa Arizona Simple Promissory Note for Tutition Fee

Description

How to fill out Maricopa Arizona Simple Promissory Note For Tutition Fee?

Laws and regulations in every sphere differ from state to state. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Maricopa Simple Promissory Note for Tutition Fee, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for different life and business situations. All the documents can be used multiple times: once you pick a sample, it remains accessible in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Maricopa Simple Promissory Note for Tutition Fee from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Maricopa Simple Promissory Note for Tutition Fee:

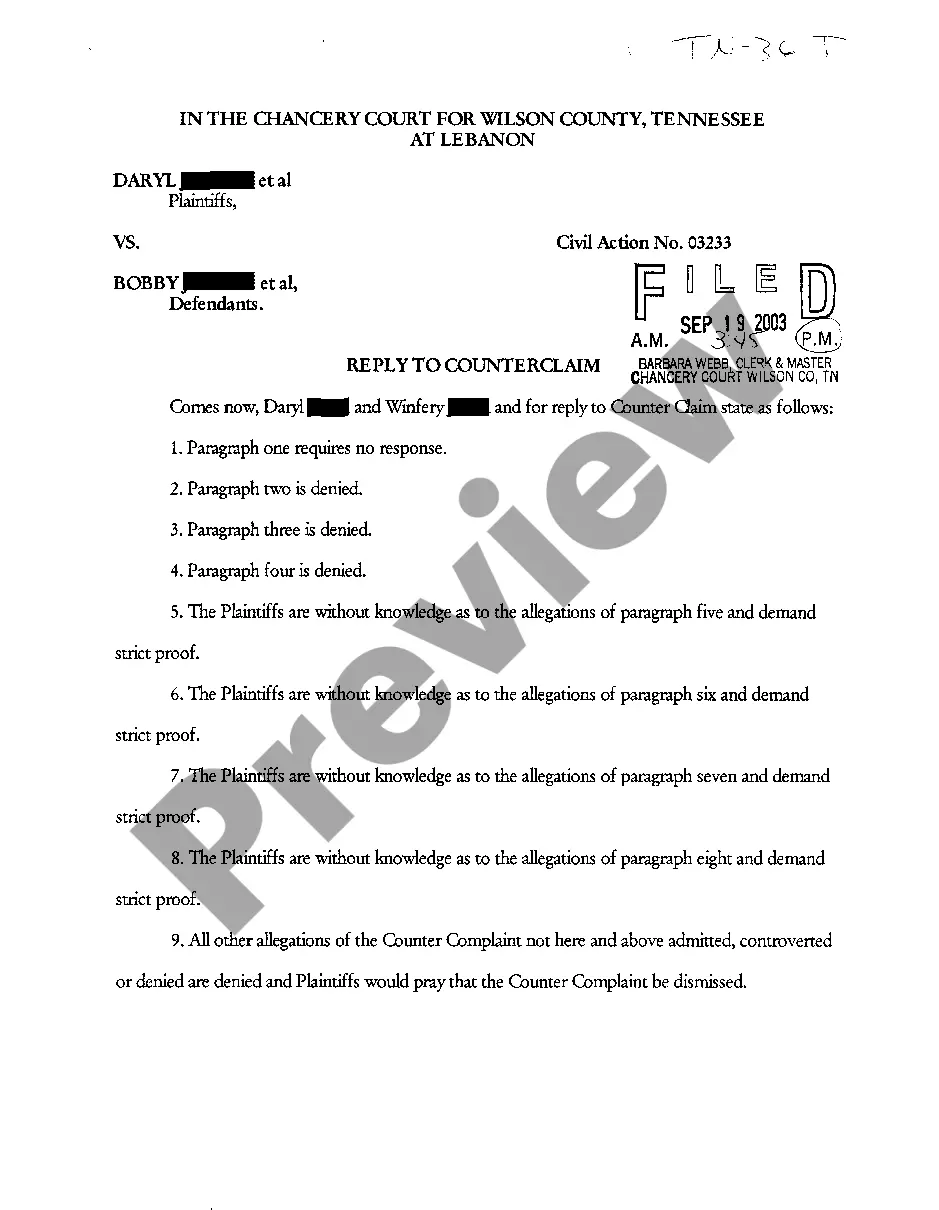

- Examine the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the template when you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!