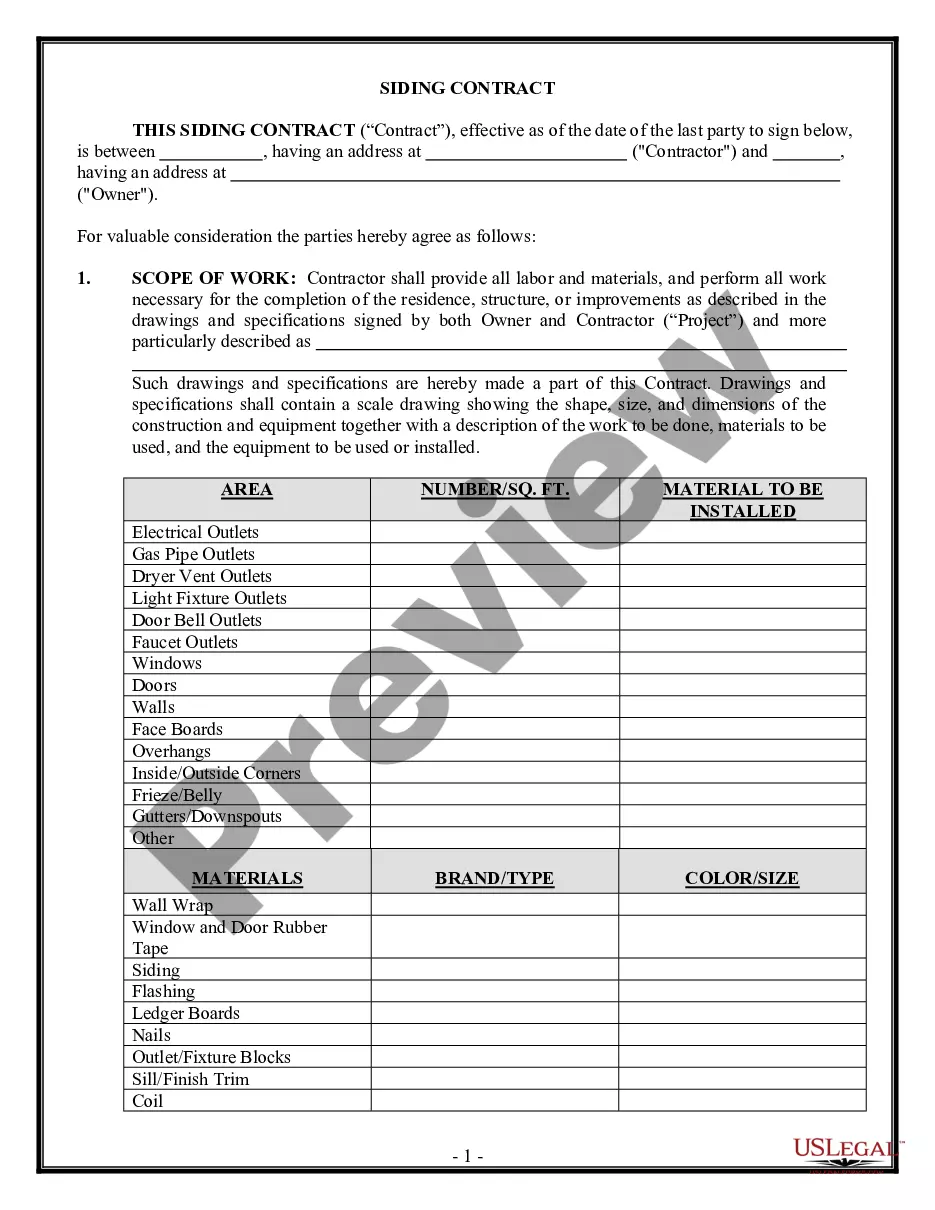

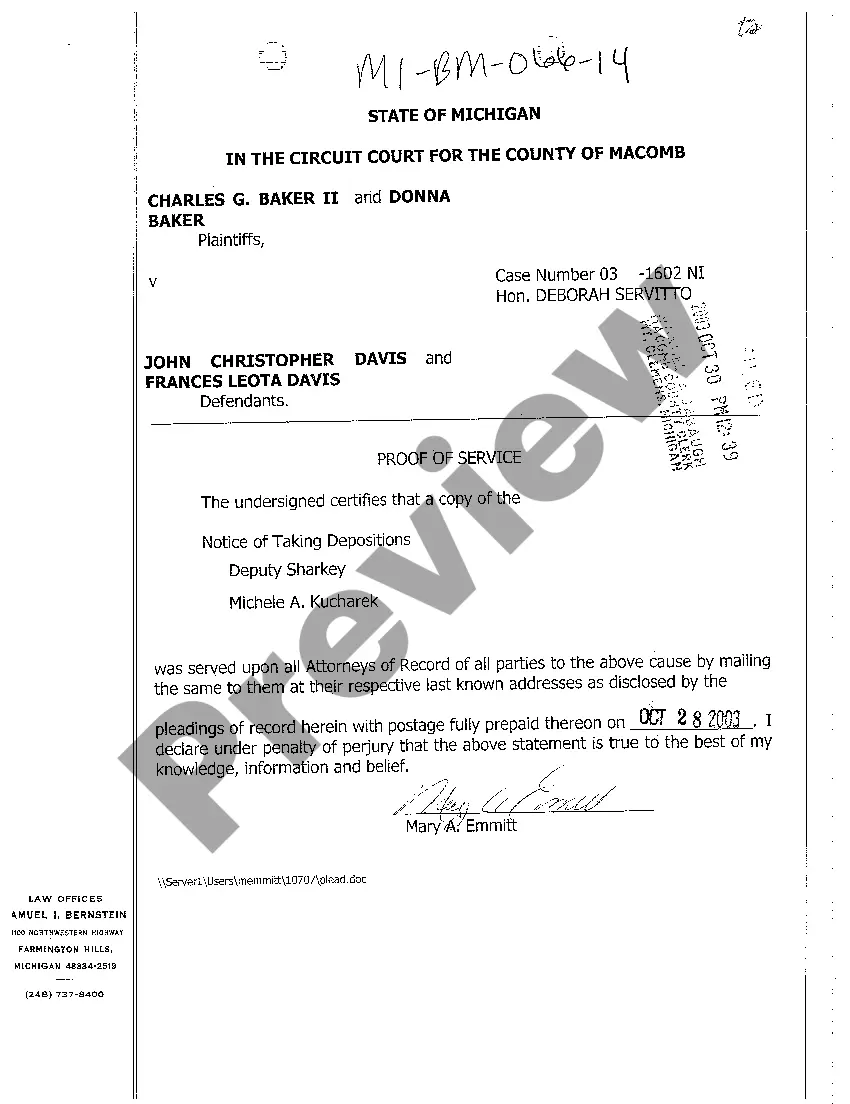

A Nassau New York Simple Promissory Note for Tuition Fee is a legally binding document that outlines the terms and conditions of a loan agreement between a borrower and a lender in Nassau County, New York, specifically designed for the purpose of financing educational expenses. It serves as an agreement between the two parties, stating that the borrower promises to repay the borrowed amount along with any applicable interest within a specified timeframe. The note contains essential information such as the names and contact information of both parties, the amount borrowed, the interest rate (if any), repayment terms, and other relevant clauses. It acts as a written evidence of the loan, ensuring transparency and preventing any potential disputes in the future. This note is an effective way for educational institutions, lenders, or individuals to secure student loans smoothly and legally. Different types of Nassau New York Simple Promissory Notes for Tuition Fee may include variations based on loan duration, interest rates, and other specific terms established by the parties involved. Some common types of promissory notes may include variable interest rates, fixed interest rates, and graduated payment plans. Variable interest rate promissory notes allow for fluctuation in the interest rate over time, usually tied to an external index such as the prime rate or LIBOR. Fixed interest rate promissory notes, on the other hand, have a predetermined interest rate that remains constant throughout the repayment period. Graduated payment plans structure the repayment schedule in a way where the initial payments are smaller and gradually increase over time, accommodating borrowers' capacity to repay as their income increases. In summary, a Nassau New York Simple Promissory Note for Tuition Fee is a legal document serving as an agreement between a borrower and a lender for financing educational expenses. It outlines the terms and conditions of the loan, repayment schedule, and any other relevant details. Different types of promissory notes may be available, depending on specific loan terms established by the parties involved.

Nassau New York Simple Promissory Note for Tutition Fee

Description

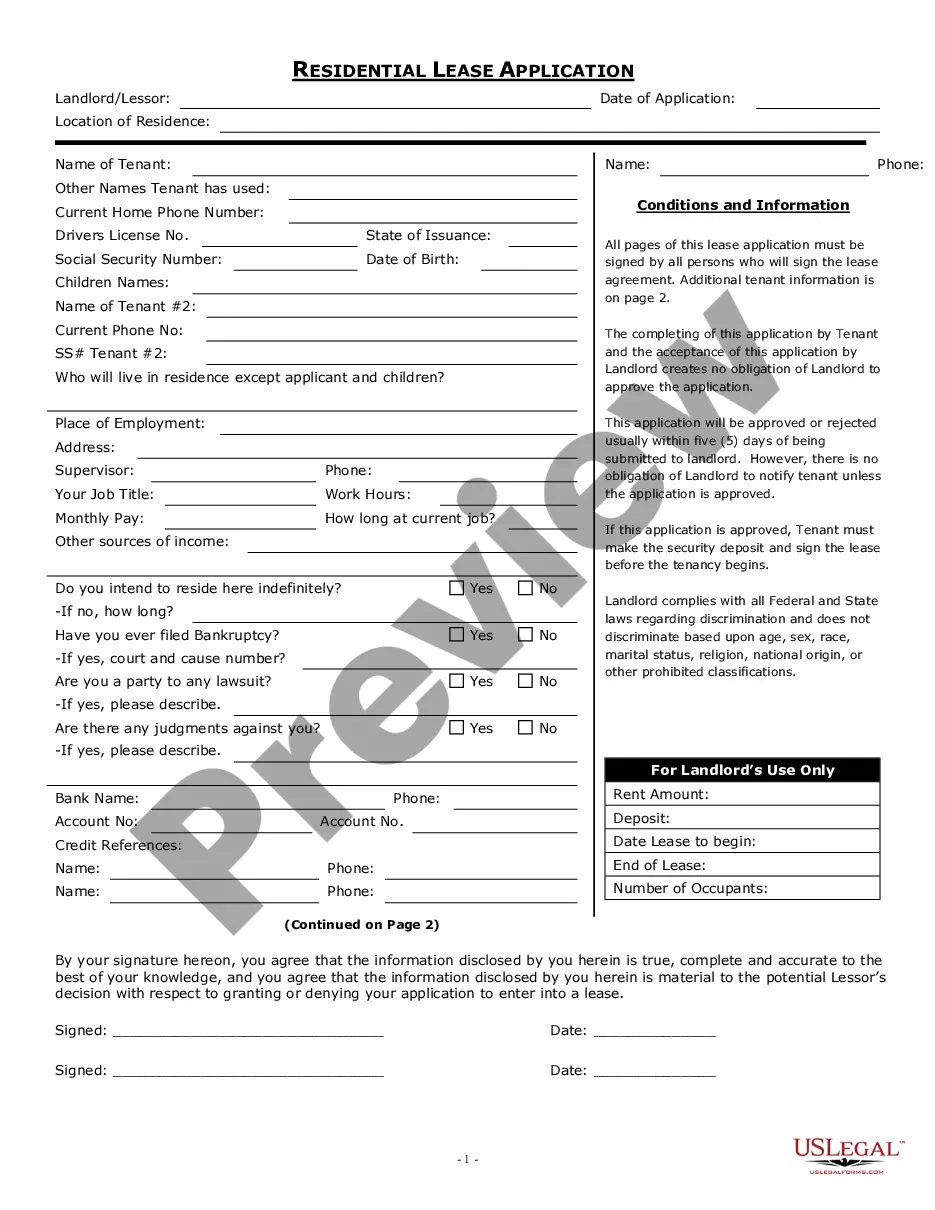

How to fill out Nassau New York Simple Promissory Note For Tutition Fee?

Are you looking to quickly draft a legally-binding Nassau Simple Promissory Note for Tutition Fee or probably any other form to manage your own or business affairs? You can select one of the two options: contact a professional to draft a legal paper for you or draft it completely on your own. Luckily, there's a third solution - US Legal Forms. It will help you get professionally written legal documents without paying unreasonable fees for legal services.

US Legal Forms provides a huge collection of over 85,000 state-compliant form templates, including Nassau Simple Promissory Note for Tutition Fee and form packages. We provide documents for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been out there for more than 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and obtain the needed document without extra hassles.

- First and foremost, carefully verify if the Nassau Simple Promissory Note for Tutition Fee is adapted to your state's or county's regulations.

- In case the form has a desciption, make sure to verify what it's intended for.

- Start the searching process again if the template isn’t what you were seeking by utilizing the search box in the header.

- Select the plan that best suits your needs and proceed to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Nassau Simple Promissory Note for Tutition Fee template, and download it. To re-download the form, just head to the My Forms tab.

It's easy to find and download legal forms if you use our services. Moreover, the paperwork we provide are updated by law professionals, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

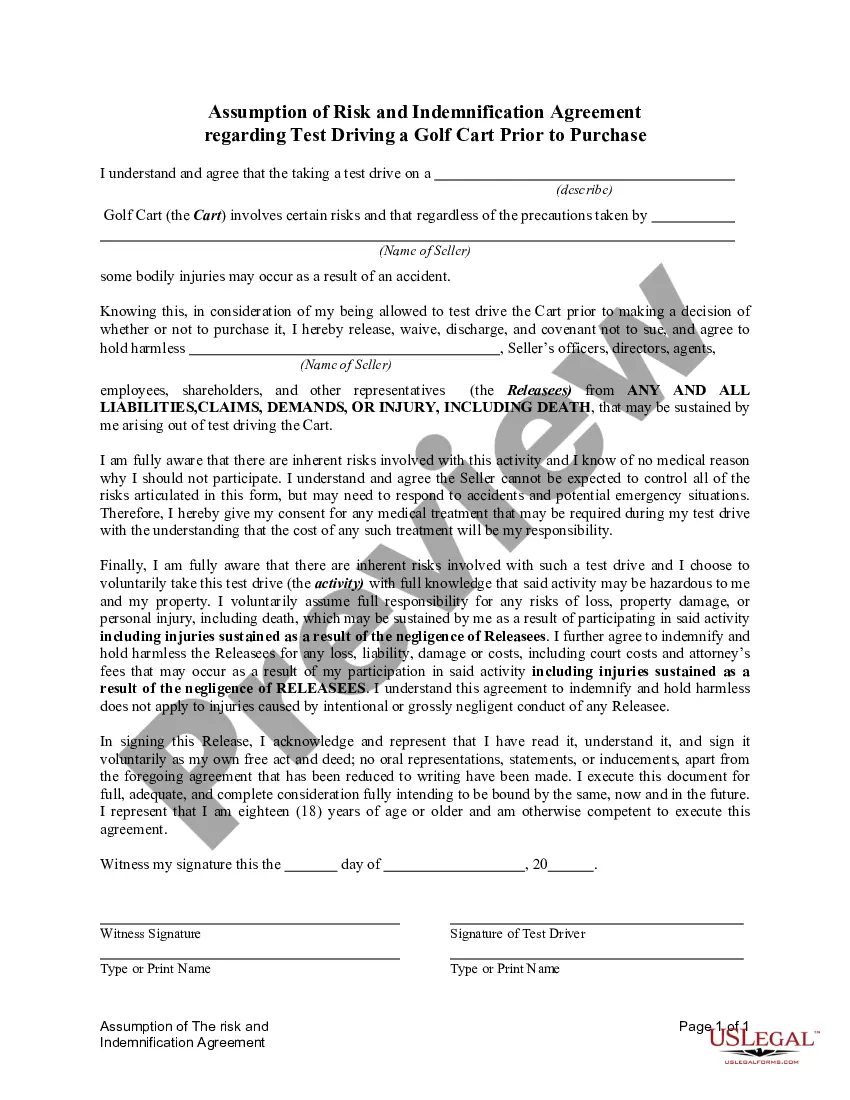

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

Additionally, the Bahamas has grown to become an internationally recognized country for its higher education system. Students not only have access to the aforementioned reasons but can study in internationally accredited universities in a country that is worth much more than a single Cruise stop!

Sample UB Attendance Budget Sample UB Attendance Budget Based on 15 Credit Hours per Fall & Spring Semester (Local taxes, subsistence and housing costs not included):Estimated Annual CostEstimated Total CostBooks and supplies$1,500.00 per year$7,000.00Total$7,100.00 per year$31,800.002 more rows

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

University of The Bahamas The Assemblies of God Bible College, Nassau, NP, Bahamas

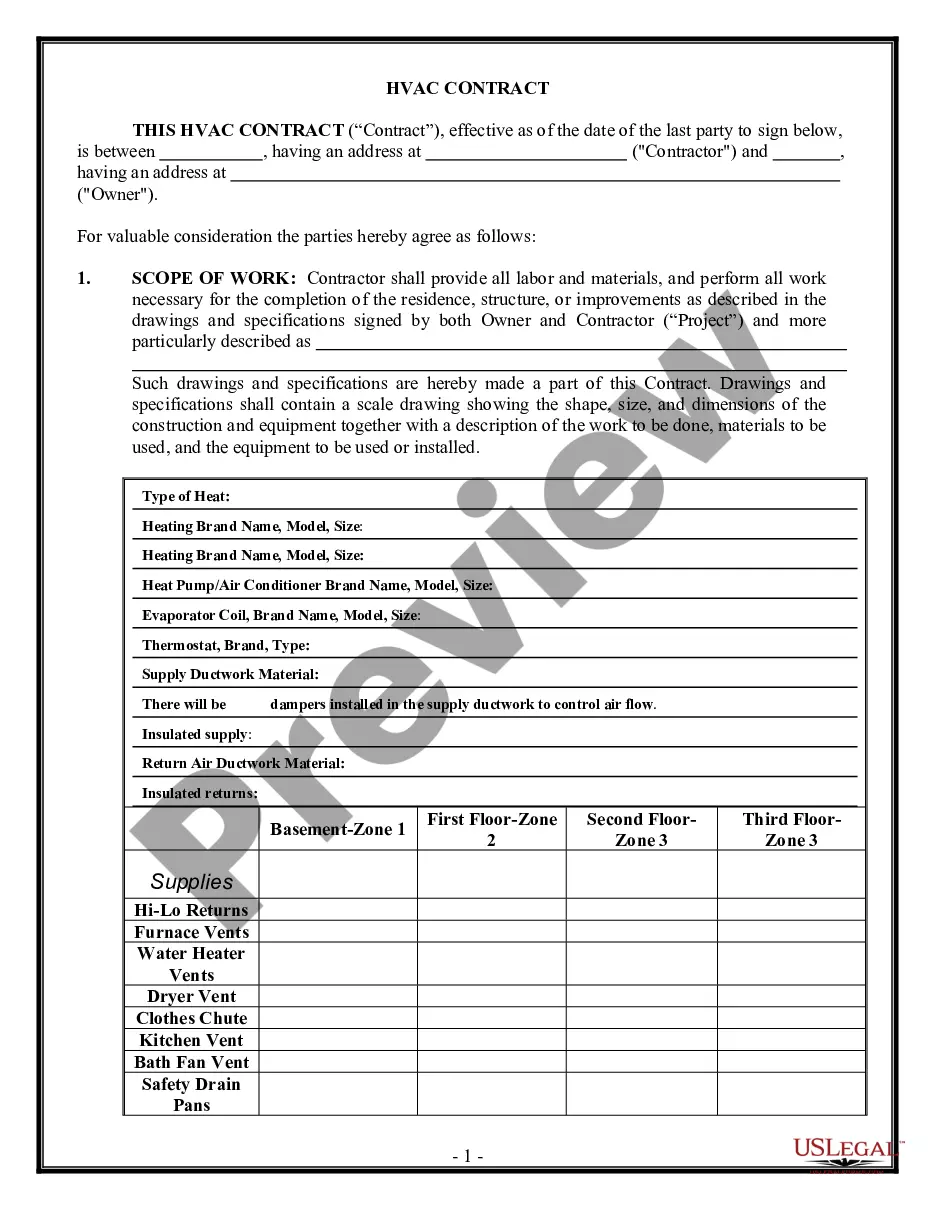

This is to express in writing my inability to pay on time the amount due for my tuition fees amounting to P. I promise to pay said amount on or before . Furthermore, I am fully aware that subsequent Promissory Notes shall not be accepted without settling my current due amount.

NASSAU, BAHAMAS Enrollment at The University of The Bahamas has increased by 57 percent since the government introduced its free tuition program at the university, according Prime Minister Dr. Hubert Minnis.

This is to express in writing my inability to pay on time the amount due for my tuition fees amounting to P. I promise to pay said amount on or before . Furthermore, I am fully aware that subsequent Promissory Notes shall not be accepted without settling my current due amount.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.