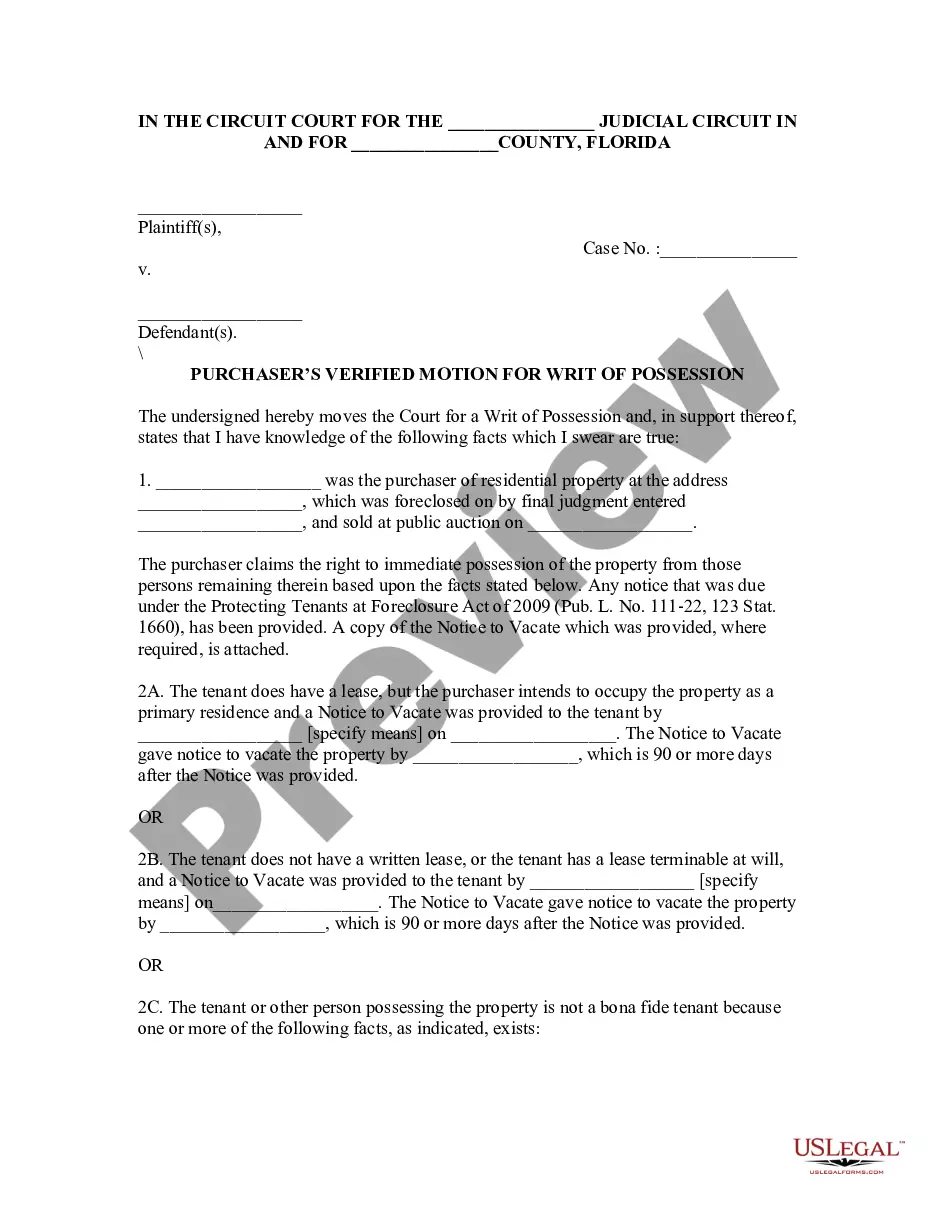

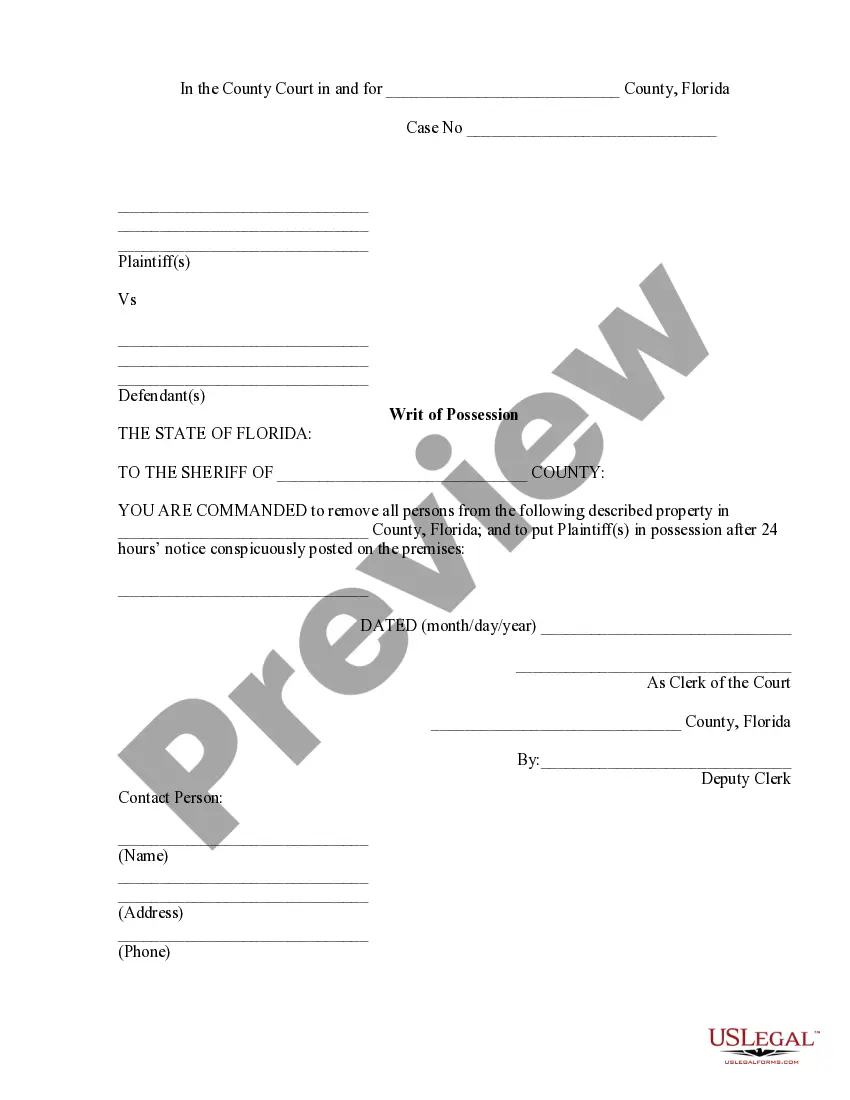

Philadelphia, Pennsylvania is a vibrant city located in the northeastern United States. Known for its rich history and bustling urban atmosphere, Philadelphia offers a diverse range of attractions, educational institutions, and cultural experiences. From iconic landmarks such as Independence Hall and the Liberty Bell to world-class museums like the Philadelphia Museum of Art and the Franklin Institute, there is no shortage of things to see and do in this captivating city. One of the significant factors that make Philadelphia a sought-after destination is its exceptional educational opportunities. The city is home to numerous prestigious universities and colleges, offering a wide array of academic programs. However, pursuing higher education can be financially demanding, leading many students to seek financial assistance through various means, including promissory notes for tuition fees. A simple promissory note for tuition fees is a legal document that outlines the terms and conditions between a borrower (usually a student) and a lender (such as a university or financial institution). It serves as a binding agreement to repay the borrowed funds within a specified period, including any agreed-upon interest. Within Philadelphia, there might be different types of simple promissory notes for tuition fees, depending on the educational institution or lender. Here are a few common variations: 1. Philadelphia University/Thomas Jefferson University Promissory Note: This particular promissory note is unique to Philadelphia University, which has since merged with Thomas Jefferson University. It outlines the terms of repayment for tuition fees borrowed by students attending these institutions. 2. Drexel University Tuition Fee Promissory Note: At Drexel University, students may enter into a promissory note to cover their tuition expenses. The note details the repayment schedule and any interest incurred on the borrowed amount. 3. Temple University Simple Promissory Note: Temple University offers a straightforward promissory note for students seeking financial assistance for their tuition fees. It stipulates the borrower's obligation to repay the borrowed funds, including any agreed-upon interest, within the specified timeframe. 4. University of Pennsylvania Tuition Fee Promissory Note: The University of Pennsylvania, one of the Ivy League schools located in Philadelphia, may have its own version of a promissory note for tuition fees. This document would outline the terms and conditions for repayment tailored to the university's policies. In summary, Philadelphia, Pennsylvania, is a city rich in history and culture, offering exceptional educational opportunities and experiences. For students seeking financial assistance to pay their tuition fees, simple promissory notes are commonly used. These binding agreements outline the terms and conditions of repayment and may vary depending on the educational institution or lender involved. It is crucial for borrowers to carefully review and understand the terms outlined in the promissory note before signing to ensure clear communication and a successful repayment process.

Philadelphia Pennsylvania Simple Promissory Note for Tutition Fee

Description

How to fill out Philadelphia Pennsylvania Simple Promissory Note For Tutition Fee?

Preparing papers for the business or personal needs is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the particular region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to generate Philadelphia Simple Promissory Note for Tutition Fee without expert help.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Philadelphia Simple Promissory Note for Tutition Fee on your own, using the US Legal Forms web library. It is the greatest online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required form.

In case you still don't have a subscription, follow the step-by-step instruction below to obtain the Philadelphia Simple Promissory Note for Tutition Fee:

- Look through the page you've opened and check if it has the document you need.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that fits your requirements, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal forms for any use case with just a few clicks!