Are you a student looking for financial assistance to cover your tuition fees in San Diego, California? Consider a San Diego California Simple Promissory Note for Tuition Fee, a useful document that outlines the terms and conditions of a loan agreement between a borrower and a lender. This comprehensive description will elaborate on what a promissory note is, how it relates specifically to tuition fees in San Diego, and any variations you might come across. A San Diego California Simple Promissory Note for Tuition Fee is a legally binding agreement between a student (borrower) and another party, such as a family member, friend, or even an educational institution (lender). The note serves as documentation of the loan, including the borrowed amount, repayment terms, and any applicable interest rates. It provides a clear understanding for both parties involved, outlining their rights, obligations, and the consequences of non-compliance with the terms set forth in the note. When it comes to a Simple Promissory Note for Tuition Fee in San Diego, California, there may be various types available. Here are a few common variations: 1. Interest-bearing Promissory Note: This type of promissory note includes an agreed-upon interest rate, which determines the additional cost of borrowing beyond the principal amount. An interest-bearing note ensures that the lender receives compensation for loaning funds to the borrower. 2. Non-interest-bearing Promissory Note: In this case, the borrower agrees to repay only the borrowed principal amount without any interest charges. This type of note is often used when the lender is a family member or a close acquaintance, where interest may not be required. 3. Fixed-Term Promissory Note: This type specifies a specific term for repayment, stating that the borrowed amount, along with any accrued interest, will be repaid in full within a set timeframe. This provides clarity and ensures a timely repayment schedule. 4. Demand Promissory Note: A demand note allows the lender to request repayment from the borrower at any time, without specifying a fixed term. This type of note provides flexibility for both parties; however, the lender can still request repayment as per their discretion. 5. Installment Promissory Note: This variation allows the borrower to repay the loan in regular installments instead of one lump sum. The terms of repayment, including the amount and frequency of installments, are stated clearly to avoid any confusion. Remember, it is crucial to consult a legal professional or financial advisor before entering into any financial agreements. They can guide you through the process, ensuring compliance with applicable laws in San Diego, California, and protecting the interests of all parties involved.

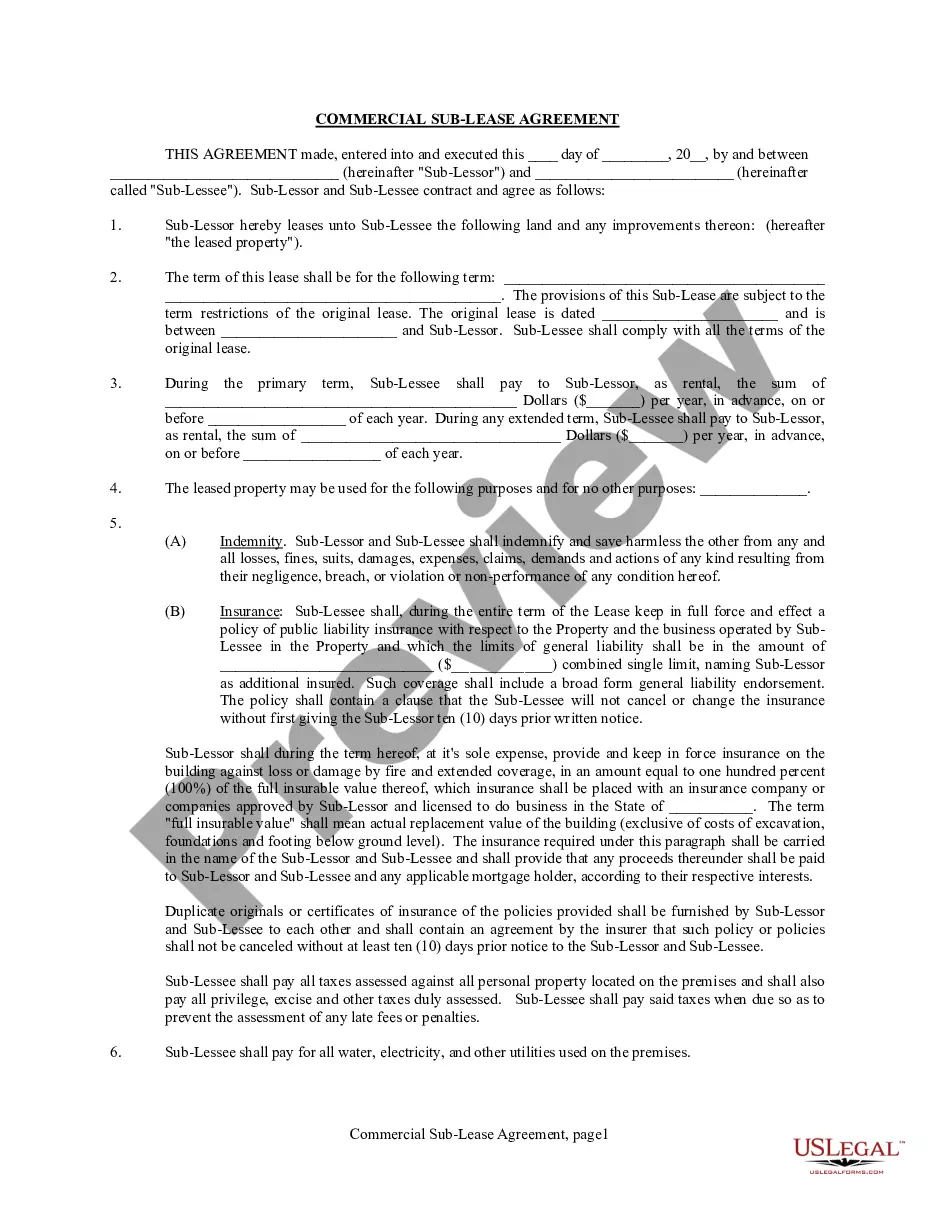

San Diego California Simple Promissory Note for Tutition Fee

Description

How to fill out San Diego California Simple Promissory Note For Tutition Fee?

Preparing legal documentation can be burdensome. Besides, if you decide to ask a legal professional to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the San Diego Simple Promissory Note for Tutition Fee, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario accumulated all in one place. Consequently, if you need the current version of the San Diego Simple Promissory Note for Tutition Fee, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the San Diego Simple Promissory Note for Tutition Fee:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the file format for your San Diego Simple Promissory Note for Tutition Fee and download it.

When done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!