A Harris Texas Simple Promissory Note for Vehicle Purchase is an important legal document used when buying or selling a vehicle in Harris County, Texas. This promissory note outlines the terms and conditions of the transaction, providing clarity and protection for both the buyer and the seller. Keywords: Harris Texas, simple promissory note, vehicle purchase, Harris County, legal document, terms and conditions, buyer, seller. The purpose of a Harris Texas Simple Promissory Note for Vehicle Purchase is to establish a written agreement between the buyer and the seller, ensuring that both parties understand their rights and responsibilities in the transaction. It serves as evidence of the loan or credit extended by the seller to the buyer for purchasing the vehicle. This document includes various essential details, such as the names and contact information of the buyer and the seller, a detailed description of the vehicle being purchased (make, model, year, VIN number, etc.), the agreed-upon purchase price, terms of payment, and any additional conditions specific to the transaction. A Harris Texas Simple Promissory Note for Vehicle Purchase is customizable to meet the needs of both parties involved. It may include provisions for interest, late payment penalties, and default consequences. However, it remains important to comply with applicable state and federal laws to ensure the legality and enforceability of the document. It is worth mentioning that there may be different types or variations of Harris Texas Simple Promissory Notes for Vehicle Purchase, depending on the specific circumstances or preferences of the parties involved. Some examples include: 1. Installment Promissory Note: This type of promissory note outlines a payment plan where the buyer agrees to pay for the vehicle in regular installments over a specified period, including any agreed-upon interest. 2. Balloon Promissory Note: In this case, the buyer makes regular payments over a defined period but with a larger final payment, often referred to as the balloon payment, to fully satisfy the remaining balance of the loan. 3. Secured Promissory Note: This type of promissory note includes collateral to secure the loan, typically in the form of the vehicle being purchased. If the buyer defaults on payment, the seller can seize the vehicle as per the agreement. These variations allow parties to tailor the promissory note to their unique requirements, providing flexibility in terms of payment arrangements and mitigating risks associated with non-payment or default. In conclusion, a Harris Texas Simple Promissory Note for Vehicle Purchase is a crucial legal document that protects the buyer and the seller by clearly defining the terms and conditions of the vehicle sale. Whether it's an installment, balloon, or secured note, having a written agreement ensures a smooth and transparent transaction while offering legal recourse in the event of a dispute.

Harris Texas Simple Promissory Note for Vehicle Purchase

Description

How to fill out Harris Texas Simple Promissory Note For Vehicle Purchase?

How much time does it usually take you to draft a legal document? Because every state has its laws and regulations for every life sphere, finding a Harris Simple Promissory Note for Vehicle Purchase meeting all local requirements can be exhausting, and ordering it from a professional lawyer is often pricey. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online catalog of templates, grouped by states and areas of use. In addition to the Harris Simple Promissory Note for Vehicle Purchase, here you can find any specific document to run your business or personal deeds, complying with your county requirements. Specialists verify all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed form, and download it. You can get the file in your profile at any moment later on. Otherwise, if you are new to the platform, there will be some extra steps to complete before you get your Harris Simple Promissory Note for Vehicle Purchase:

- Examine the content of the page you’re on.

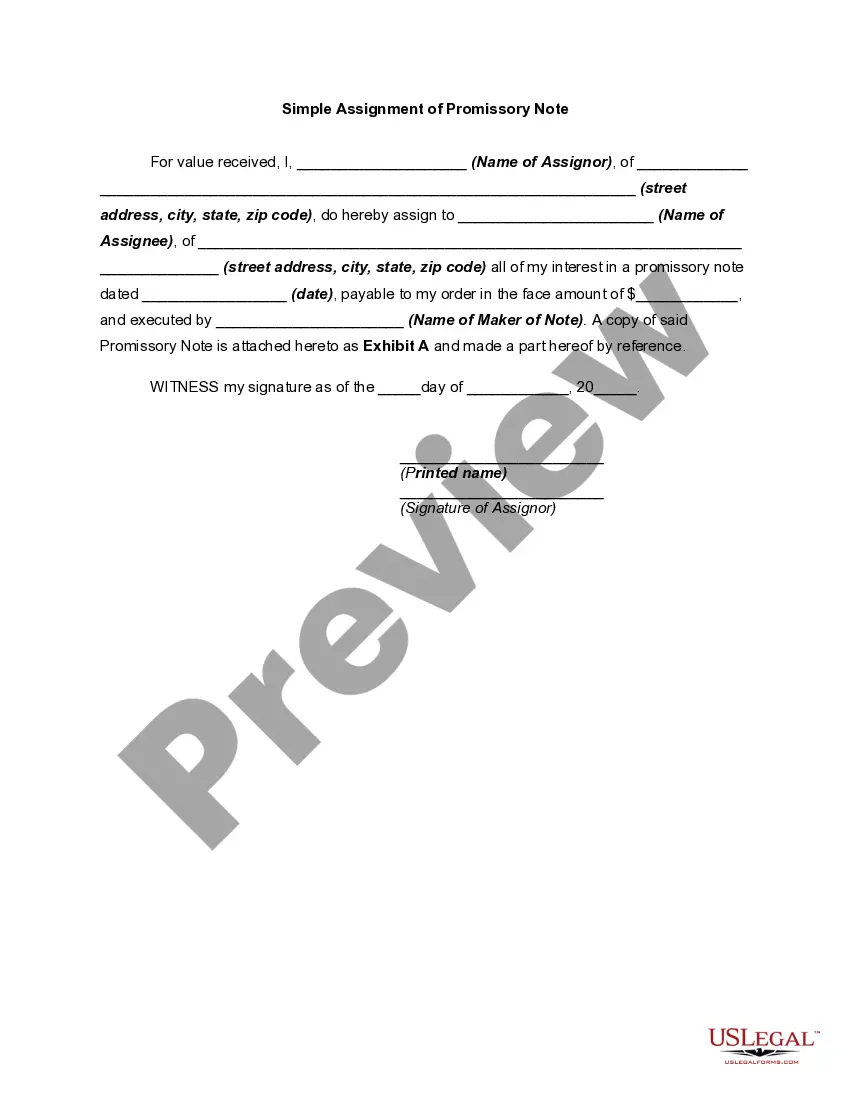

- Read the description of the template or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Harris Simple Promissory Note for Vehicle Purchase.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!