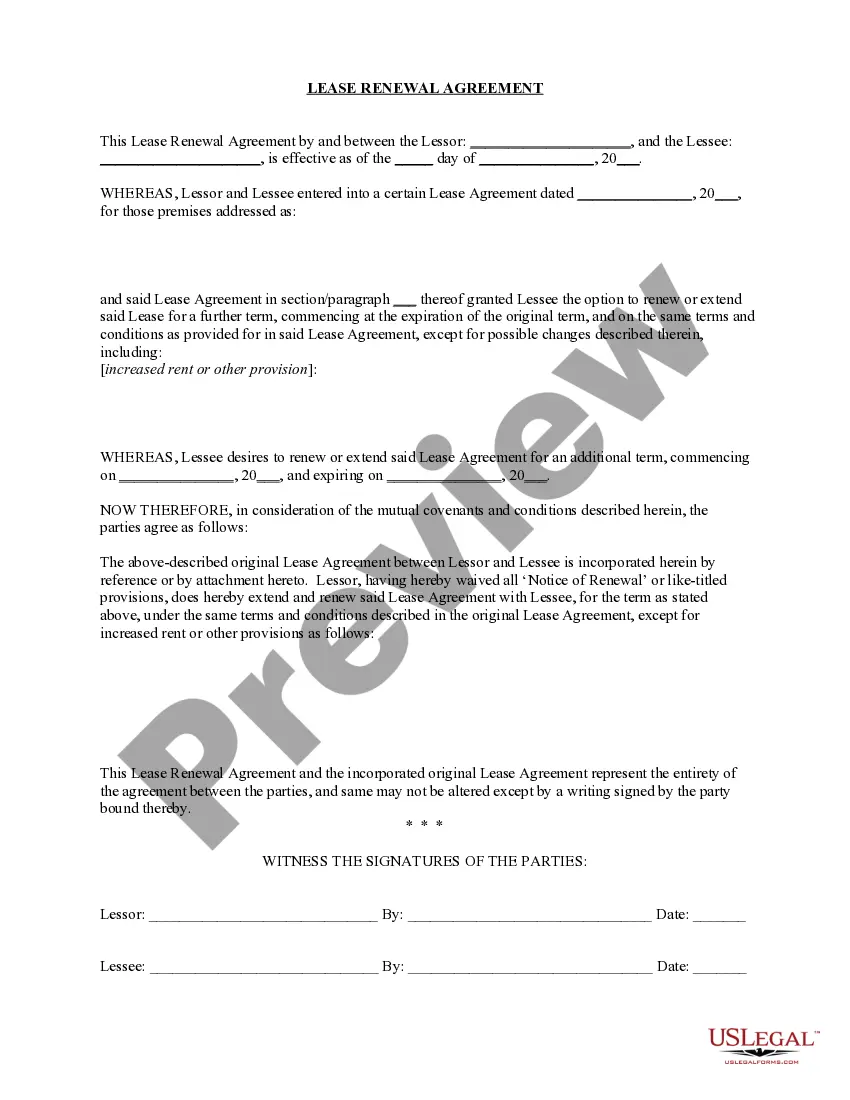

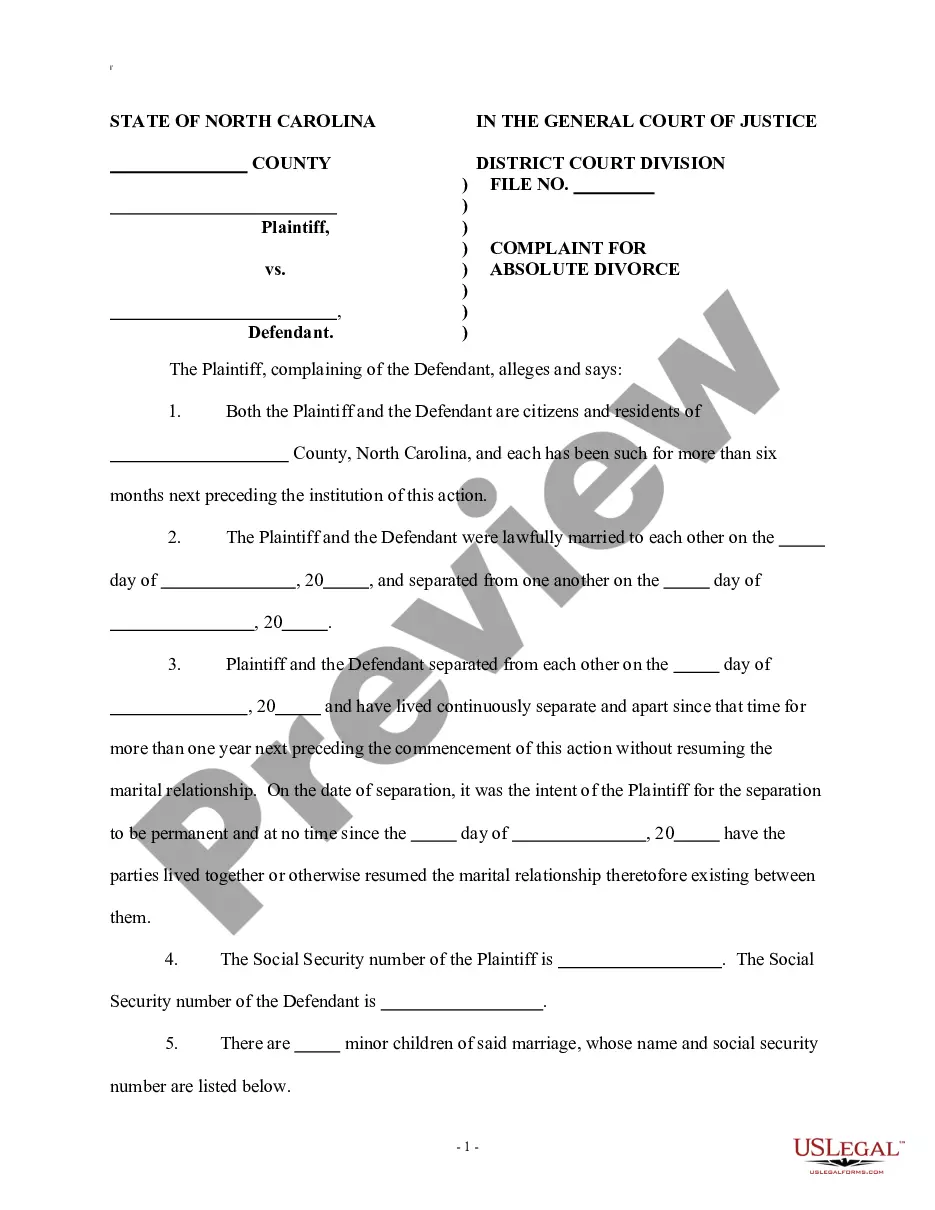

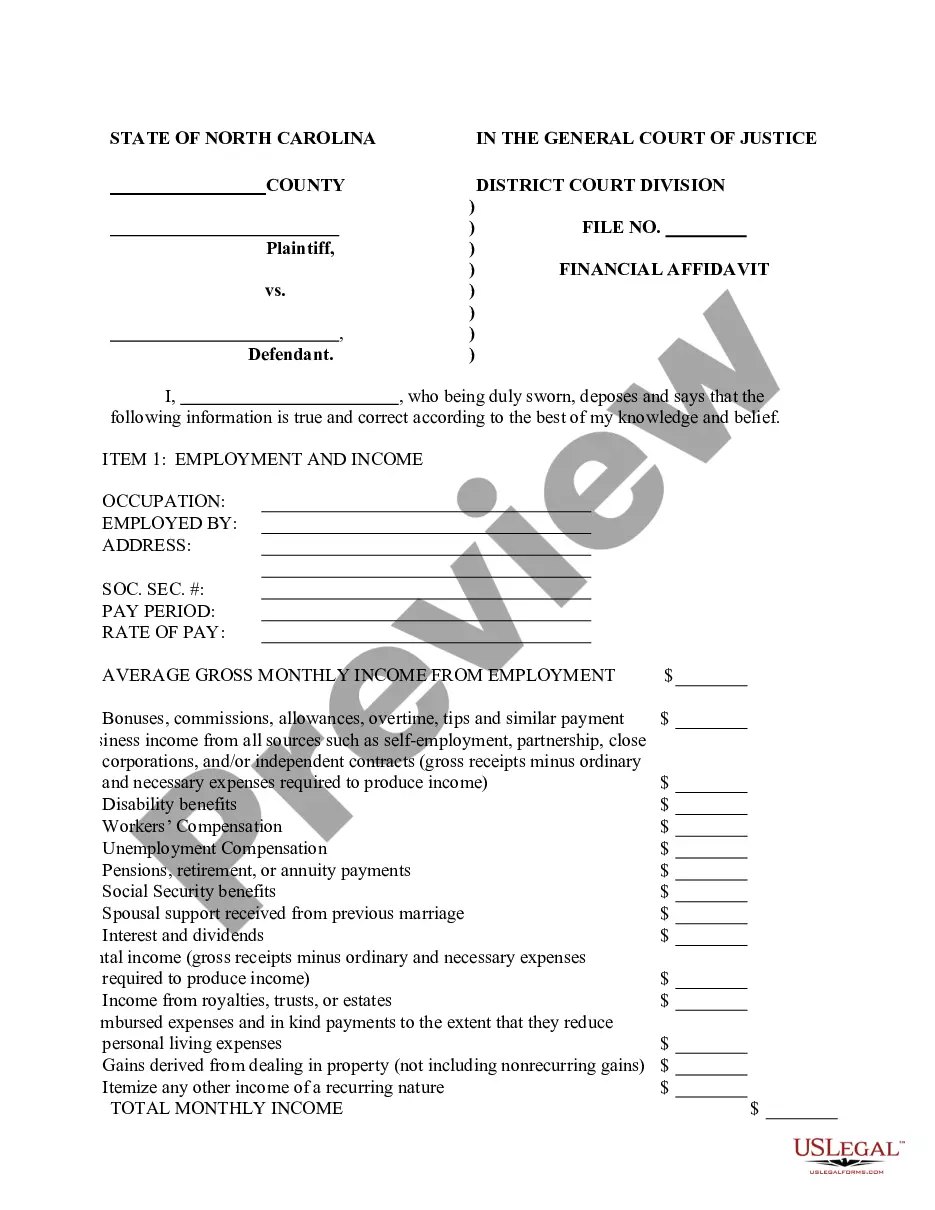

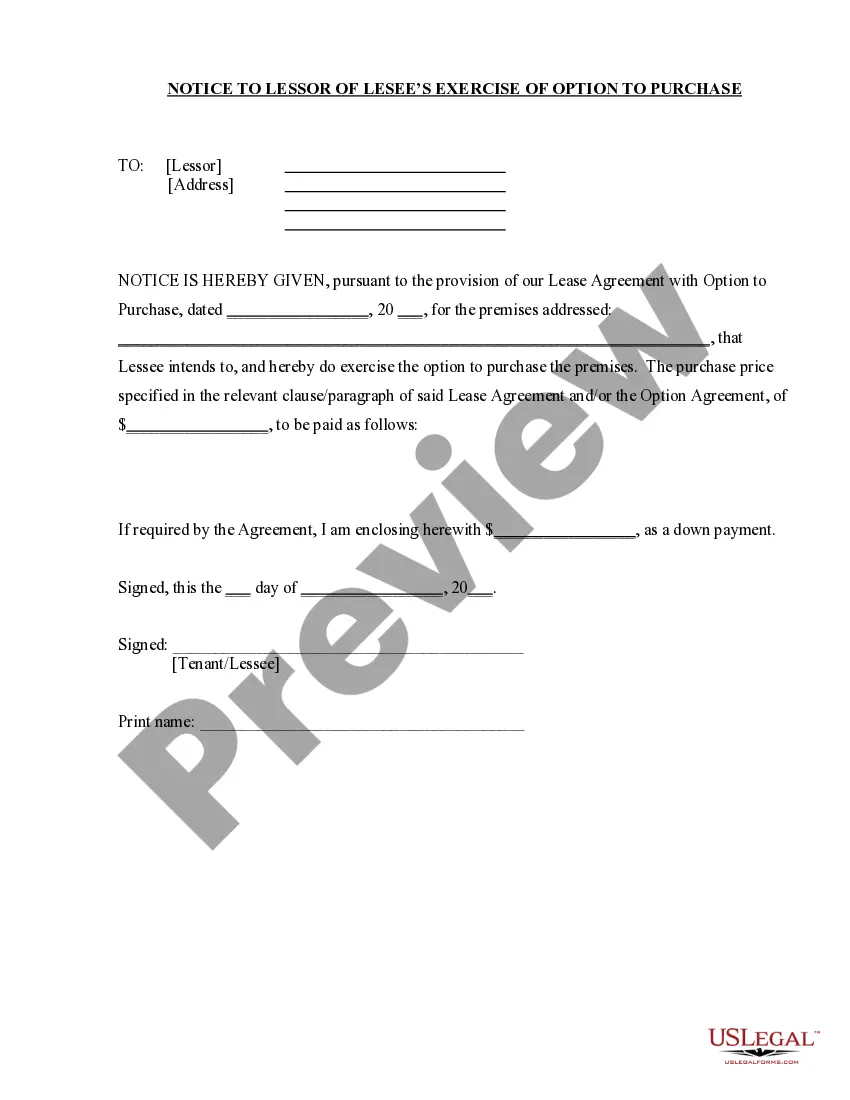

San Diego California Simple Promissory Note for Vehicle Purchase is a legal document used in the city of San Diego, California, for a straightforward financial agreement between a buyer and seller of a vehicle. The promissory note outlines the terms and conditions of the agreement, including the purchase price, payment schedule, interest rates (if applicable), and other important details. Keywords: San Diego California, Simple Promissory Note, Vehicle Purchase, legal document, buyer, seller, financial agreement, purchase price, payment schedule, interest rates. Different types of San Diego California Simple Promissory Note for Vehicle Purchase: 1. Fixed Interest Promissory Note: This type of promissory note specifies a fixed interest rate that will be charged on the outstanding balance until the loan is fully paid off. 2. Variable Interest Promissory Note: A variable interest rate is specified in this promissory note. The interest rate may fluctuate over time based on a predefined benchmark, such as an index, making it suitable for borrowers who are comfortable with potential interest rate changes. 3. Balloon Promissory Note: This note requires smaller periodic payments over the loan duration, with a large "balloon" payment due at the end. It allows borrowers to have lower monthly payments initially, but they need to ensure they have the means to pay off the balloon payment or refinance the loan. 4. Secured Promissory Note: This promissory note includes a collateral agreement, such as the vehicle itself, to secure the loan. If the borrower fails to repay the loan, the lender has the right to take ownership of the collateral to recover the outstanding balance. 5. Unsecured Promissory Note: Unlike a secured promissory note, an unsecured note does not have any collateral attached. It relies solely on the borrower's promise to repay the loan. Lenders typically charge higher interest rates for unsecured notes due to the increased risk involved. In conclusion, a San Diego California Simple Promissory Note for Vehicle Purchase is a legal document used to establish the terms and conditions of a financial agreement between a buyer and seller of a vehicle in San Diego, California. Different types of promissory notes, such as fixed interest, variable interest, balloon, secured, and unsecured, offer specific advantages and features depending on the borrower's needs and preferences.

San Diego California Simple Promissory Note for Vehicle Purchase

Description

How to fill out San Diego California Simple Promissory Note For Vehicle Purchase?

Preparing documents for the business or individual needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to draft San Diego Simple Promissory Note for Vehicle Purchase without expert assistance.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid San Diego Simple Promissory Note for Vehicle Purchase by yourself, using the US Legal Forms online library. It is the largest online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed form.

In case you still don't have a subscription, adhere to the step-by-step guideline below to obtain the San Diego Simple Promissory Note for Vehicle Purchase:

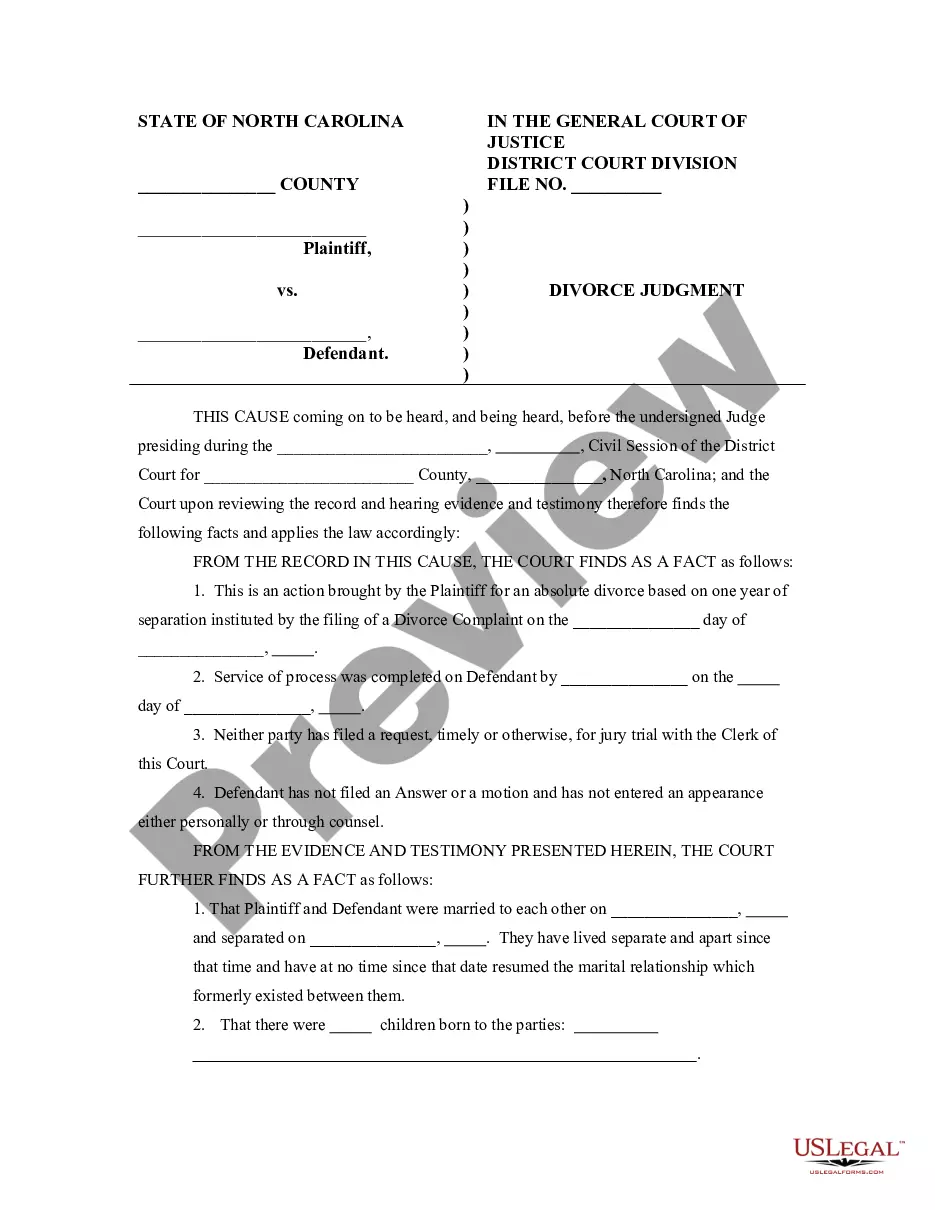

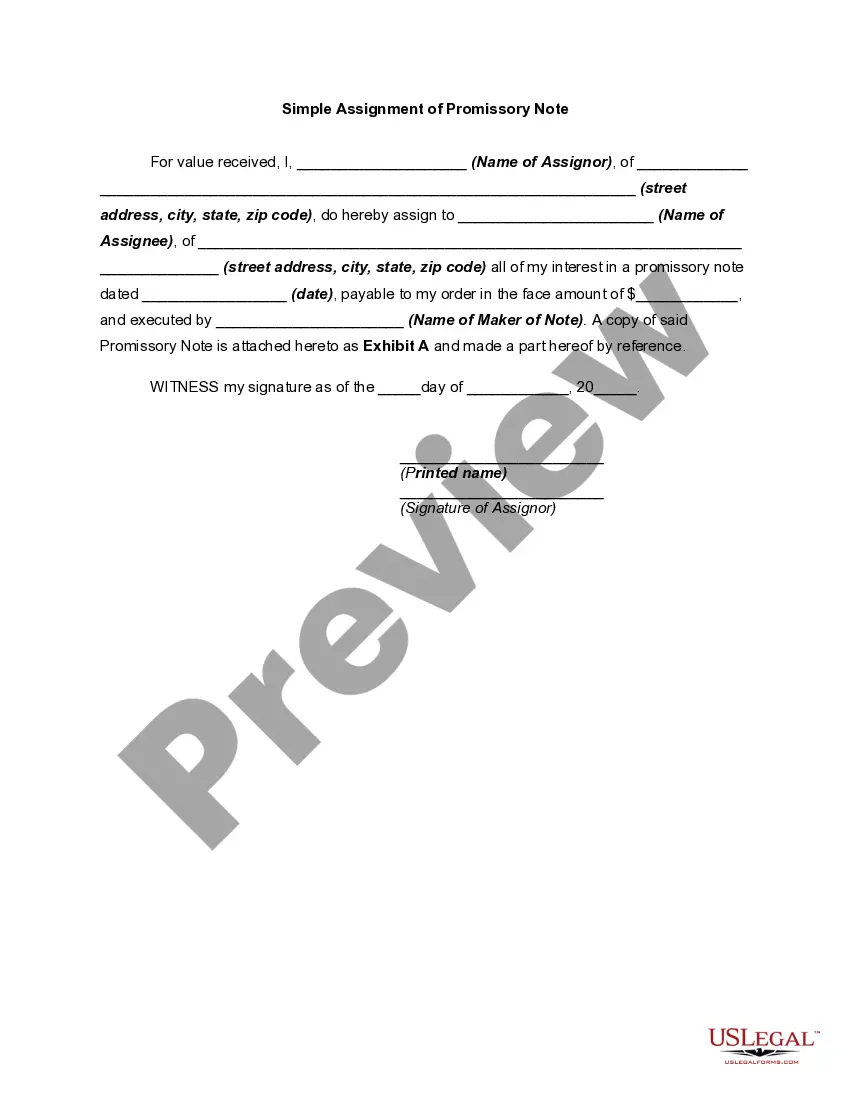

- Examine the page you've opened and check if it has the document you need.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that satisfies your needs, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal forms for any scenario with just a few clicks!