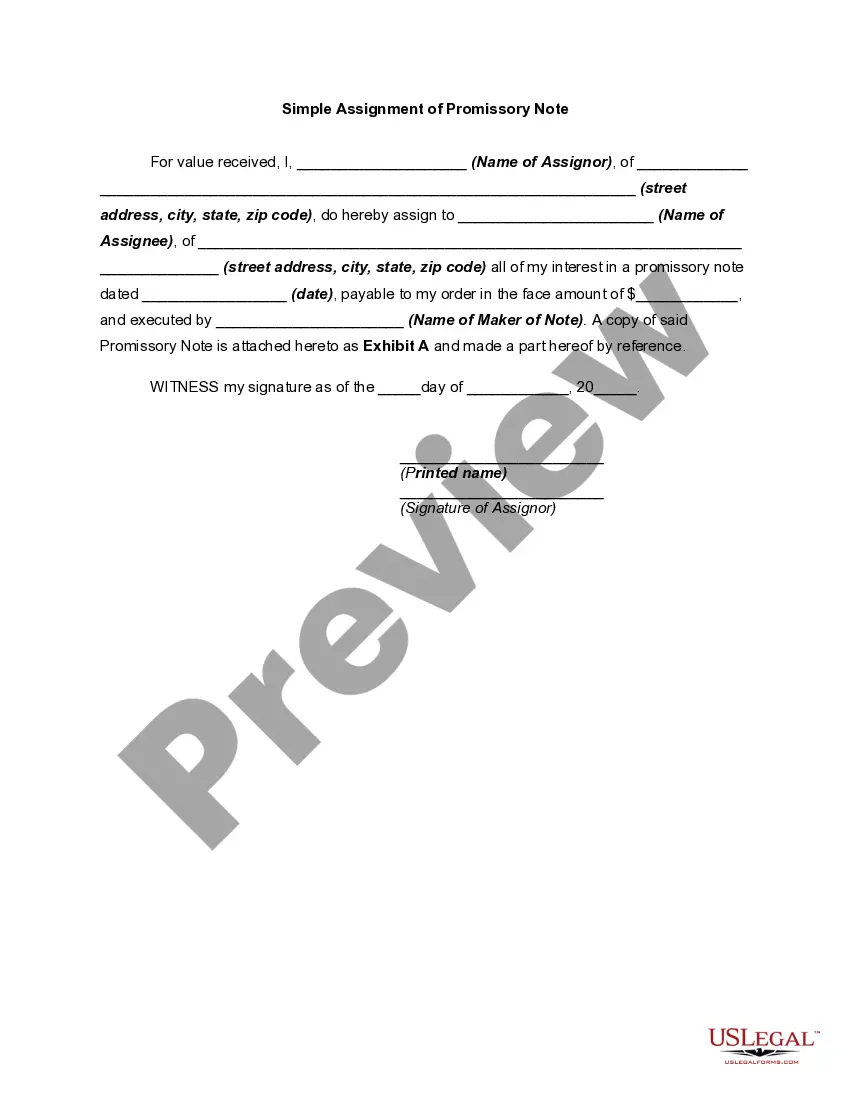

Travis Texas Simple Promissory Note for Vehicle Purchase is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower for the purchase of a vehicle. This promissory note serves as evidence of the borrower's promise to repay the loan amount in a specified manner. A Travis Texas Simple Promissory Note for Vehicle Purchase typically includes important information such as the names and contact details of both parties involved, the loan amount, the interest rate (if applicable), the repayment schedule, and any other terms and conditions agreed upon by the parties. By signing this promissory note, the borrower acknowledges their obligation to repay the loaned amount within the agreed timeframe and in accordance with the specified terms. Failure to adhere to the terms outlined in the note may result in legal consequences. It is important to note that there may be various types of Travis Texas Simple Promissory Notes for Vehicle Purchase, each catering to specific circumstances and requirements. For instance: 1. Fixed Interest Rate Promissory Note: This type of promissory note establishes a fixed interest rate that remains constant throughout the loan term. Both the lender and the borrower agree upon an interest rate that is unaffected by market fluctuations. 2. Variable Interest Rate Promissory Note: In contrast to a fixed interest rate note, a variable interest rate promissory note allows for periodic adjustments of the interest rate based on a specific index or benchmark. The interest rate may fluctuate according to market conditions, resulting in changes to the borrower's repayment amount. 3. Secured Promissory Note: This type of promissory note includes an additional layer of security for the lender. It specifies that the vehicle being purchased with the loan amount will serve as collateral. In the event of default, the lender has the right to repossess the vehicle to recoup the outstanding debt. 4. Unsecured Promissory Note: Unlike a secured note, an unsecured promissory note does not require collateral. This type of note relies solely on the borrower's creditworthiness and personal guarantee, making it suitable for borrowers who may not have assets to offer as collateral. Before entering into any promissory note agreement, it is crucial for both parties to carefully review and understand the terms and conditions included. Seeking legal advice is always recommended ensuring compliance with Travis Texas laws and to protect the interests of both the lender and the borrower.

Travis Texas Simple Promissory Note for Vehicle Purchase

Description

How to fill out Travis Texas Simple Promissory Note For Vehicle Purchase?

If you need to get a trustworthy legal paperwork supplier to obtain the Travis Simple Promissory Note for Vehicle Purchase, consider US Legal Forms. Whether you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate template.

- You can browse from more than 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, number of supporting materials, and dedicated support make it simple to find and execute various documents.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

You can simply select to search or browse Travis Simple Promissory Note for Vehicle Purchase, either by a keyword or by the state/county the form is created for. After locating needed template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the Travis Simple Promissory Note for Vehicle Purchase template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Register an account and select a subscription option. The template will be instantly ready for download once the payment is processed. Now you can execute the form.

Handling your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes these tasks less expensive and more reasonably priced. Create your first company, arrange your advance care planning, create a real estate contract, or execute the Travis Simple Promissory Note for Vehicle Purchase - all from the convenience of your sofa.

Join US Legal Forms now!