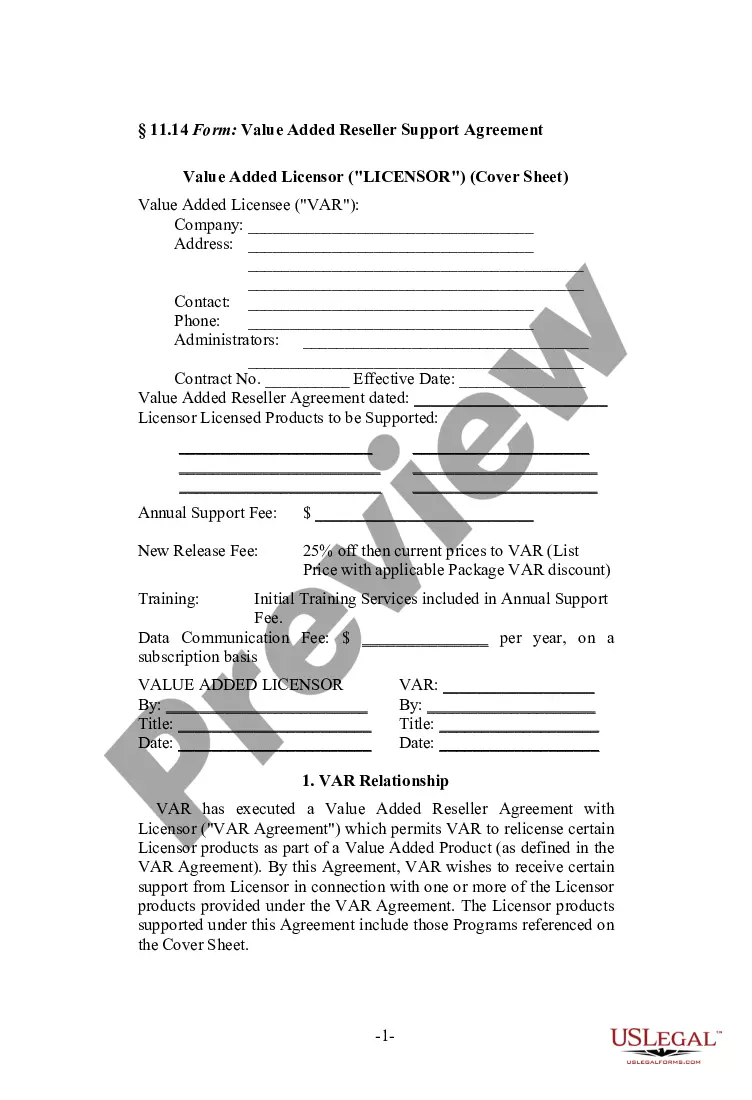

Los Angeles, California Simple Promissory Note for School A Los Angeles, California simple promissory note for school is a legally binding document that outlines an agreement between a borrower and a lender regarding the repayment of a loan for educational purposes. This note provides a detailed description of the terms and conditions involved in the loan, ensuring clarity and transparency for both parties involved. Keywords: Los Angeles, California, simple promissory note, school, borrower, lender, loan, repayment, educational purposes, terms and conditions. Types of Los Angeles, California Simple Promissory Note for School: 1. Fixed-Term Promissory Note: This type of promissory note stipulates a predetermined period within which the borrower must repay the loan. The note clearly mentions the loan amount, interest rate, repayment schedule, and any other specific terms agreed upon. 2. Interest-Free Promissory Note: In some cases, a promissory note may not require the borrower to pay any interest. This type of note is suitable for situations where the lending party is either a family member or a close friend who wishes to support the borrower's education without charging any interest on the loan. 3. Installment Promissory Note: An installment promissory note allows the borrower to repay the loan in regular, equal installments over a specified period. The note includes details regarding the loan amount, interest rate if applicable, installment amounts, and the frequency and duration of payments. 4. Balloon Promissory Note: This type of promissory note involves the borrower making smaller periodic payments over a specific term, with a larger final payment (balloon payment) due at the end of the term. Balloon notes are often utilized when the borrower expects a windfall or plans to refinance the loan before the balloon payment becomes due. 5. Secured Promissory Note: A secured promissory note requires the borrower to provide collateral as security for the loan. If the borrower fails to repay the loan according to the agreed terms, the lender has the right to seize the collateral. Collateral can be any valuable asset, such as real estate, a vehicle, or personal property. It is important for both the borrower and the lender to fully understand the terms and obligations outlined in the Los Angeles, California simple promissory note for school. Seeking legal advice or consulting with a professional before entering into such agreements is always recommended ensuring compliance with applicable laws and regulations.

Los Angeles California Simple Promissory Note for School

Description

How to fill out Los Angeles California Simple Promissory Note For School?

How much time does it typically take you to draw up a legal document? Given that every state has its laws and regulations for every life situation, finding a Los Angeles Simple Promissory Note for School suiting all regional requirements can be tiring, and ordering it from a professional attorney is often expensive. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, collected by states and areas of use. Aside from the Los Angeles Simple Promissory Note for School, here you can find any specific document to run your business or personal deeds, complying with your county requirements. Professionals check all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed form, and download it. You can retain the file in your profile at any moment later on. Otherwise, if you are new to the platform, there will be some extra steps to complete before you obtain your Los Angeles Simple Promissory Note for School:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Los Angeles Simple Promissory Note for School.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!