Dallas, Texas Simple Promissory Note for Car Loan: A Comprehensive Overview If you are considering obtaining a car loan in Dallas, Texas, it is essential to familiarize yourself with the concept of a Simple Promissory Note. Essentially, a Simple Promissory Note is a legally binding document that outlines the terms and conditions of a loan agreement between a borrower and a lender. In the context of car loans, a Simple Promissory Note serves as evidence of the loan and establishes the repayment obligations for the borrower. Commonly referred to as a "car loan agreement," a Simple Promissory Note for a car loan in Dallas, Texas specifically defines the financial agreement that enables individuals to secure funding for purchasing a vehicle. These notes come in various types, tailored to meet different borrower needs, and each carries its own characteristics and advantages. 1. Fixed-Rate Promissory Note for Car Loan: This type of promissory note has a fixed interest rate throughout the loan term, ensuring stable and predictable monthly payments for the borrower. Fixed-rate promissory notes are suitable for individuals who prefer a consistent repayment plan with no surprises. 2. Adjustable-Rate Promissory Note for Car Loan: Unlike a fixed-rate promissory note, an adjustable-rate note features an interest rate that may vary periodically based on market conditions or other predetermined factors. Adjustable-rate promissory notes are ideal for borrowers who expect fluctuations in interest rates during the loan term. 3. Balloon Promissory Note for Car Loan: A balloon promissory note involves regular monthly payments for a specific period, followed by a larger "balloon" payment due at the end. This type of note is suitable for borrowers who anticipate having a lump sum of money available at the conclusion of the loan term. 4. Secured Promissory Note for Car Loan: A secured promissory note includes collateral, usually the vehicle being financed, which serves as security for the loan. In the event of non-payment, the lender has the right to take possession of the collateral. Secured promissory notes often offer lower interest rates compared to unsecured loans. 5. Unsecured Promissory Note for Car Loan: An unsecured promissory note does not require collateral, making it less restrictive for borrowers who might not have valuable assets to leverage. However, unsecured loans usually come with higher interest rates due to the increased risk for lenders. When acquiring a Dallas, Texas Simple Promissory Note for a car loan, it is crucial for both lenders and borrowers to carefully review the terms and conditions outlined in the agreement. This helps ensure everyone involved understands their rights, obligations, repayment schedules, interest rates, and any potential penalties or fees associated with the loan. Whether you are a borrower seeking financing or a lender facilitating a car loan, obtaining legal advice or consulting with financial professionals in Dallas, Texas is always recommended ensuring compliance with local regulations and maximize the benefits of your Simple Promissory Note for Car Loan.

Dallas Texas Simple Promissory Note for Car Loan

Description

How to fill out Dallas Texas Simple Promissory Note For Car Loan?

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask a lawyer to draft a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Dallas Simple Promissory Note for Car Loan, it may cost you a lot of money. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case collected all in one place. Therefore, if you need the latest version of the Dallas Simple Promissory Note for Car Loan, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Dallas Simple Promissory Note for Car Loan:

- Look through the page and verify there is a sample for your area.

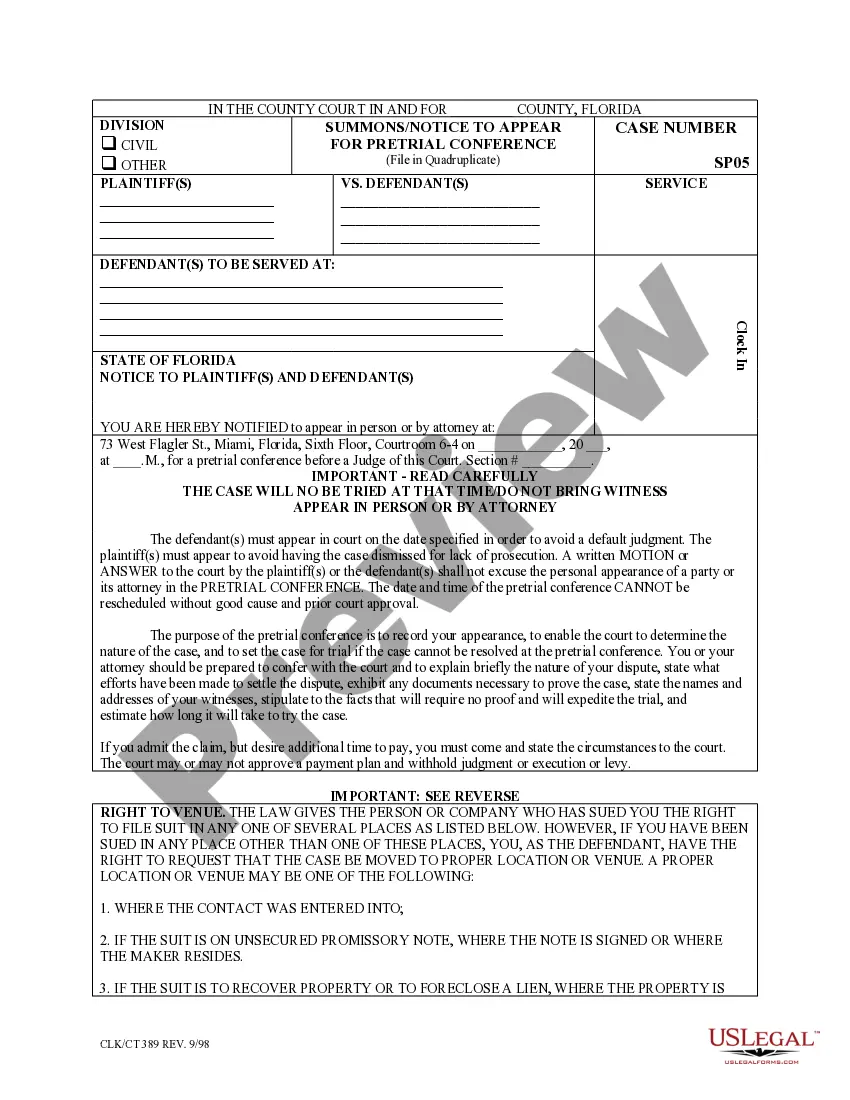

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now when you find the required sample and pick the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the document format for your Dallas Simple Promissory Note for Car Loan and download it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!