Kings New York is a reputable financial institution that provides reliable and efficient car loan services in the state of New York. One of the options they offer is the Kings New York Simple Promissory Note for Car Loan. This type of promissory note acts as a legally-binding agreement between the borrower and the lender, clearly outlining the terms and conditions of the car loan. The Kings New York Simple Promissory Note for Car Loan is designed to provide a straightforward and hassle-free borrowing experience. It includes all the essential details required for a car loan, ensuring transparency and clarity throughout the loan process. Some key elements that are typically included in the Kings New York Simple Promissory Note for Car Loan are: 1. Loan Amount: The principal amount borrowed by the borrower to finance the purchase of the vehicle. 2. Interest Rate: The annual interest rate charged on the loan, which determines the cost of borrowing. 3. Repayment Schedule: The agreed-upon timeline for loan repayment, specifying the number of installments and their due dates. 4. Late Payment Penalties: The consequences and fees imposed if the borrower fails to make payments on time. 5. Loan Security: Details regarding any collateral or asset that secures the car loan, providing the lender with recourse in case of default. 6. Borrower and Lender Information: Comprehensive identification details of both parties involved in the car loan agreement. 7. Signatures: Signatures of the borrower and lender to indicate their consent and agreement to the terms stated in the promissory note. Kings New York may also offer variations of the Simple Promissory Note for Car Loan, catering to diverse borrower requirements. These variations could include: 1. Secured Promissory Note: Specifically designed for borrowers who offer collateral, such as the car being financed, as security against the loan. 2. Unsecured Promissory Note: Suited for borrowers who do not possess collateral, as it does not require any asset as security. 3. Balloon Payment Promissory Note: In this type of note, the borrower makes lower monthly payments throughout the loan period, with a larger final payment (balloon payment) due at the end of the term. Kings New York understands the unique financing needs of its customers and strives to provide tailored solutions through its range of Simple Promissory Notes for Car Loans. With their extensive knowledge in the financial industry, they make applying for a car loan a seamless process, ensuring customer satisfaction every step of the way.

Kings New York Simple Promissory Note for Car Loan

Description

How to fill out Kings New York Simple Promissory Note For Car Loan?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to seek professional help to create some of them from scratch, including Kings Simple Promissory Note for Car Loan, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in different types varying from living wills to real estate paperwork to divorce documents. All forms are arranged based on their valid state, making the searching process less challenging. You can also find information resources and tutorials on the website to make any tasks associated with paperwork execution straightforward.

Here's how to purchase and download Kings Simple Promissory Note for Car Loan.

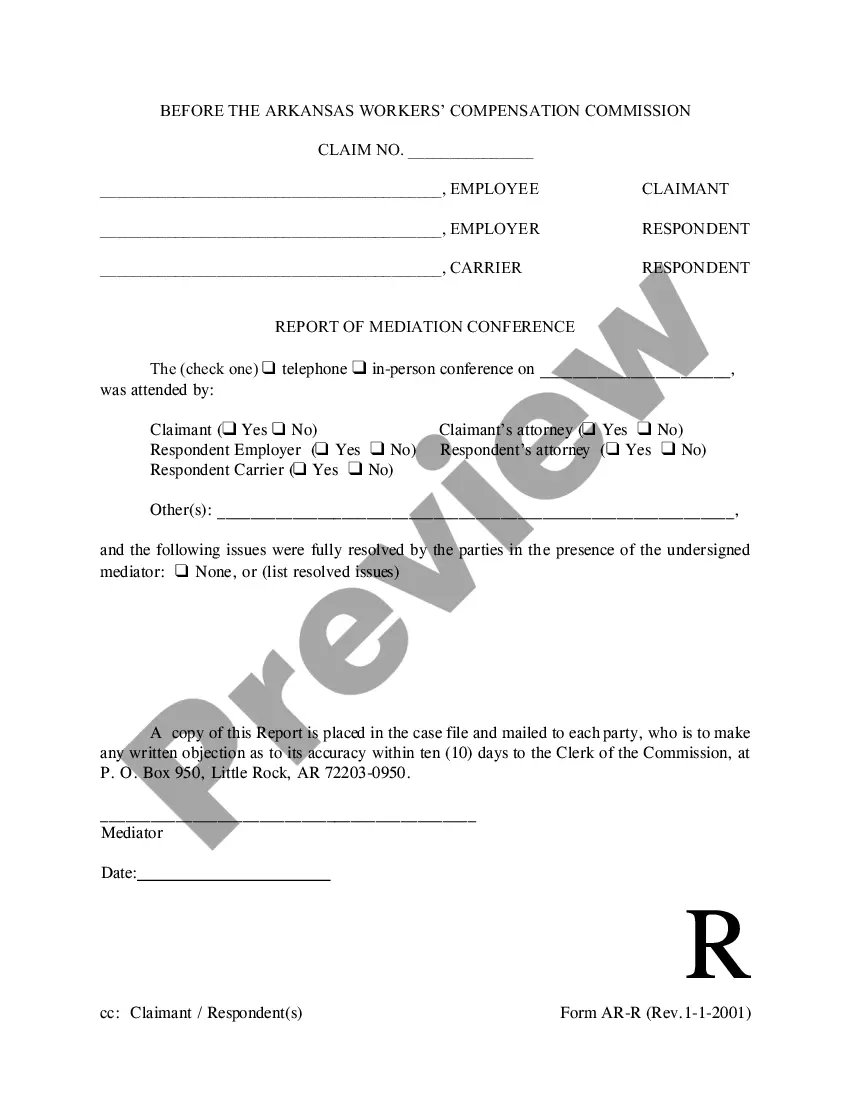

- Take a look at the document's preview and outline (if provided) to get a general information on what you’ll get after downloading the form.

- Ensure that the template of your choosing is specific to your state/county/area since state regulations can affect the validity of some documents.

- Check the similar forms or start the search over to locate the correct document.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Pick the option, then a suitable payment method, and buy Kings Simple Promissory Note for Car Loan.

- Select to save the form template in any offered format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Kings Simple Promissory Note for Car Loan, log in to your account, and download it. Of course, our website can’t replace a lawyer entirely. If you have to cope with an exceptionally challenging situation, we recommend getting a lawyer to review your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of customers. Become one of them today and get your state-specific paperwork with ease!