Maricopa, Arizona is a bustling city in Pinal County known for its rich southwestern history and vibrant community. For individuals seeking financial assistance to purchase a vehicle, Maricopa Arizona offers various types of Simple Promissory Notes for Car Loans. A Maricopa Arizona Simple Promissory Note for Car Loan is a legally binding document that outlines the terms and conditions agreed upon by the lender and borrower for the car loan. It serves as a written record of the loan agreement and protects the rights of both parties involved. The Simple Promissory Note for Car Loan in Maricopa, Arizona includes essential information such as the names and contact details of the lender and borrower, the loan amount, interest rate, repayment schedule, and any additional fees or penalties. It outlines the rights and responsibilities of both parties and ensures transparency throughout the loan process. There are several types of Simple Promissory Notes for Car Loans available in Maricopa, Arizona, catering to different needs and preferences. These may include: 1. Fixed Interest Rate Promissory Note: This type of Promissory Note ensures a consistent interest rate throughout the loan term. Borrowers who prefer stability in their loan repayments may opt for this option. 2. Adjustable Interest Rate Promissory Note: For borrowers who are open to fluctuations in interest rates, this type of Promissory Note is suitable. The interest rate may vary based on market conditions, allowing borrowers to potentially benefit from lowering rates. 3. Secured Promissory Note: A Secured Promissory Note requires borrowers to pledge collateral, such as the purchased vehicle, as security for the loan. This type of note provides lenders with an added layer of financial security. 4. Unsecured Promissory Note: In contrast to a Secured Promissory Note, an Unsecured Promissory Note does not require collateral. However, lenders may adjust interest rates and terms to mitigate the potential risks associated with the absence of collateral. Regardless of the type of Maricopa Arizona Simple Promissory Note for Car Loan, it is essential for borrowers to carefully review and understand the terms before signing the agreement. Seeking legal advice or consulting a financial professional can provide borrowers with valuable insights and ensure they make informed decisions best suited to their circumstances. In conclusion, Maricopa, Arizona offers a range of Simple Promissory Note options for individuals seeking car loans. It is crucial for borrowers to thoroughly assess their requirements and review the terms and conditions of different types of Promissory Notes before making a commitment. By doing so, borrowers can navigate the car loan process with confidence and secure a suitable financing option for their vehicle purchase in Maricopa, Arizona.

Maricopa Arizona Simple Promissory Note for Car Loan

Description

How to fill out Maricopa Arizona Simple Promissory Note For Car Loan?

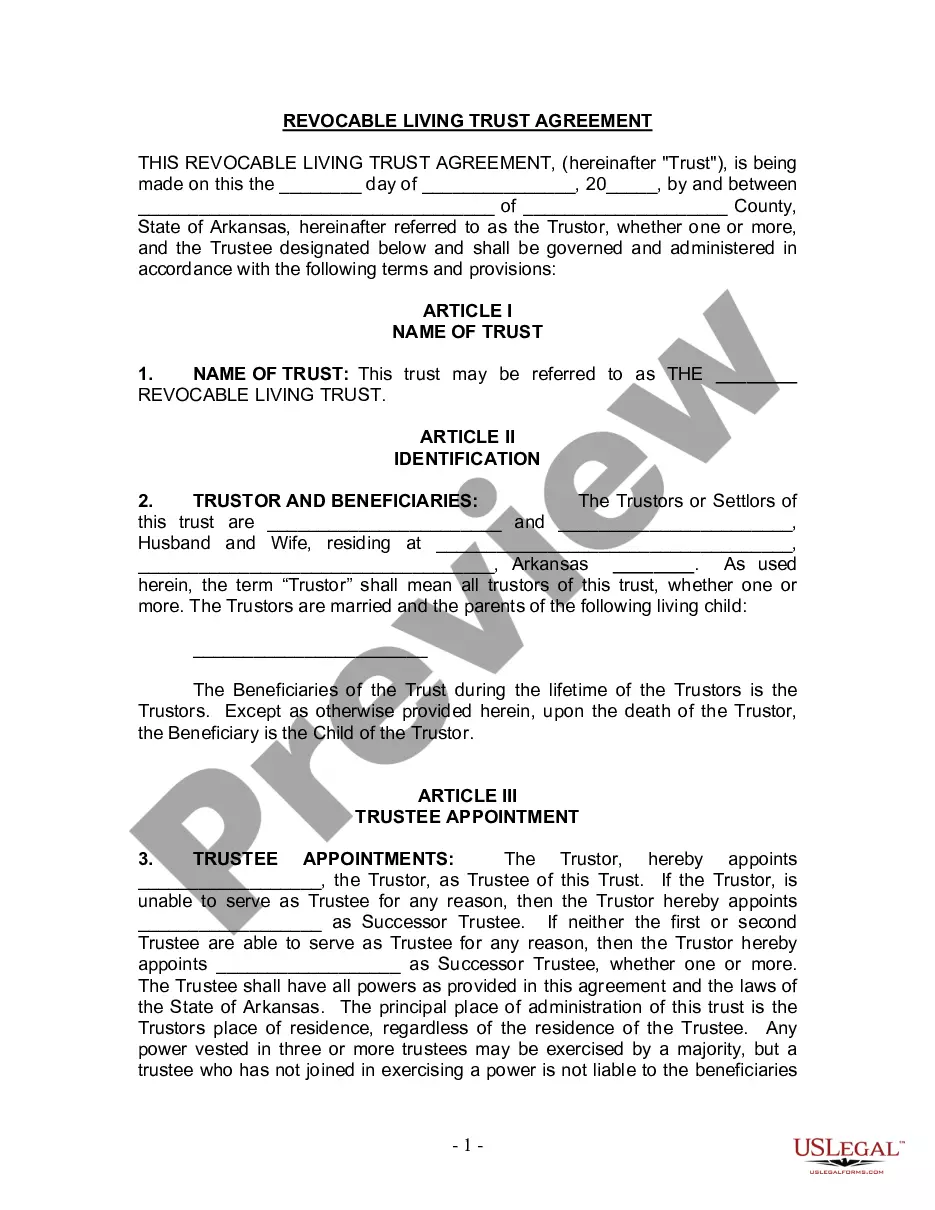

If you need to get a reliable legal paperwork supplier to obtain the Maricopa Simple Promissory Note for Car Loan, consider US Legal Forms. Whether you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate template.

- You can select from more than 85,000 forms categorized by state/county and situation.

- The intuitive interface, variety of learning materials, and dedicated support make it easy to locate and complete different papers.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

You can simply type to look for or browse Maricopa Simple Promissory Note for Car Loan, either by a keyword or by the state/county the form is created for. After locating needed template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the Maricopa Simple Promissory Note for Car Loan template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Create an account and select a subscription plan. The template will be instantly available for download once the payment is processed. Now you can complete the form.

Handling your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes this experience less pricey and more affordable. Set up your first business, organize your advance care planning, create a real estate contract, or complete the Maricopa Simple Promissory Note for Car Loan - all from the convenience of your home.

Sign up for US Legal Forms now!