Oakland, Michigan Simple Promissory Note for Car Loan: A Comprehensive Guide In Oakland, Michigan, a simple promissory note for a car loan is an important legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender. This note serves as evidence of a personal loan given to finance the purchase of a vehicle. It is important for both parties to fully understand the details included in the promissory note before signing it. The key components of a simple promissory note for a car loan typically include: 1. Parties Involved: The note should clearly state the names, addresses, and contact information of the borrower (the individual receiving the loan) and the lender (the individual or financial institution providing the loan). 2. Loan Amount and Interest Rate: The principal loan amount and the agreed-upon interest rate should be clearly mentioned within the promissory note. It is essential for both parties to agree on these terms before finalizing the loan agreement. 3. Repayment Terms: The note should outline the terms of the loan repayment, including the frequency and amount of the payments. It should also specify if there are any penalties or late fees, as well as the consequences of defaulting on the loan. 4. Security Agreement: If the car being purchased with the loan funds is being used as collateral, the promissory note should include a detailed security agreement. This agreement provides the lender with the right to repossess the vehicle in the event of default. 5. Signatures and Notarization: Both parties must sign and date the promissory note to make it legally binding. Depending on the jurisdiction, notarization may also be required as an additional layer of authentication. Different types of Simple Promissory Notes for Car Loans in Oakland, Michigan: 1. Fixed Interest Rate Promissory Note: This type of promissory note has a pre-determined interest rate, which remains constant throughout the loan term. Borrowers who prefer reliable and predictable monthly payments often opt for this type of loan agreement. 2. Variable Interest Rate Promissory Note: In contrast to a fixed interest rate promissory note, this type of agreement features an interest rate that fluctuates based on market conditions. Borrowers who have a risk appetite or expect interest rates to decrease may choose this type of loan agreement. 3. Balloon Payment Promissory Note: This note option permits the borrower to make smaller monthly payments over the loan term, with a substantial lump sum due at the end. This arrangement might be suitable for individuals with higher income expectations in the future. 4. Installment Promissory Note: With an installment promissory note, the borrower repays the loan in equal monthly installments spread over the loan term. This type of promissory note ensures consistent repayment amounts, making it easier for borrowers to manage their finances. Remember, when considering a promissory note for a car loan, it is vital to consult with legal professionals or financial advisors to ensure its compliance with local laws and regulations.

Oakland Michigan Simple Promissory Note for Car Loan

Description

How to fill out Oakland Michigan Simple Promissory Note For Car Loan?

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask a lawyer to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Oakland Simple Promissory Note for Car Loan, it may cost you a fortune. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario accumulated all in one place. Therefore, if you need the latest version of the Oakland Simple Promissory Note for Car Loan, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Oakland Simple Promissory Note for Car Loan:

- Glance through the page and verify there is a sample for your area.

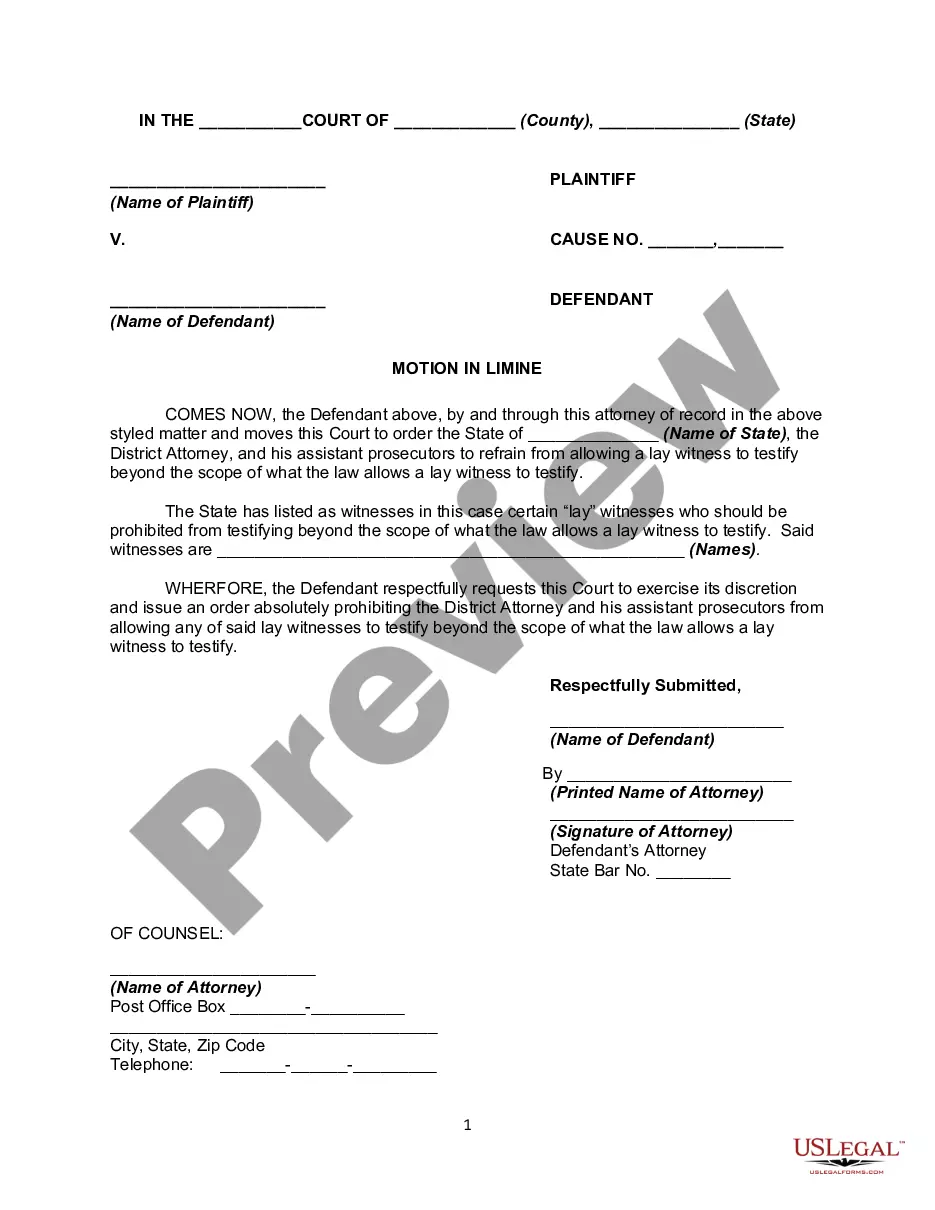

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the document format for your Oakland Simple Promissory Note for Car Loan and download it.

When done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!