Cook County, located in the state of Illinois, employs various financial mechanisms to manage its debt, one of which is Cook Illinois Assignment of Debt. This method involves transferring debt obligations from one entity to another, providing the county with a means to effectively manage its liabilities. Through this assignment, Cook County can lighten its debt burden, ensuring financial stability and economic growth. The Cook Illinois Assignment of Debt process is executed through legal agreements, where the county assigns its outstanding debts to external entities, typically banks or financial institutions. These institutions agree to take on the debt obligations of the county, assuming responsibility for the repayment and interest obligations associated with the assigned debt. In turn, the county benefits by reducing its outstanding debts and diversifying its financial portfolio. Cook Illinois Assignment of Debt is crucial in managing the county's debt load, allowing it to optimize its financial resources and improve its credit rating. By outsourcing the repayment of debts, Cook County frees up funds that can be directed towards crucial public services and infrastructure development. This, in turn, fosters economic growth and enhances the overall well-being of the county's residents. It is important to note that the term "Cook Illinois Assignment of Debt" may encompass various types of assignments based on the specific nature of the debt being transferred. These types can include: 1. Municipal Bond Assignments: Cook County may assign its outstanding debt relating to municipal bonds to external financial entities. Municipal bonds are issued by local governments, such as cities or counties, to raise funds for public projects and services. By assigning these debts, Cook County ensures efficient debt management and capitalizes on opportunities for favorable interest rates. 2. Loan Assignments: Cook County may assign its outstanding loans to financial institutions through Cook Illinois Assignment of Debt. These loans may include those acquired for infrastructure development, public services, or other initiatives that require funding. By transferring these debts, the county can reduce its liabilities and benefit from potential restructuring options or improved interest rates. 3. Vendor and Service Provider Debt Assignments: Cook County may also assign its debts owed to vendors or service providers. These debts may arise from contracts, agreements, or outstanding payments due to suppliers or contractors. Through Cook Illinois Assignment of Debt, these obligations are transferred to external entities, allowing the county to streamline its payment processes and manage its financial obligations more effectively. In summary, Cook Illinois Assignment of Debt is a financial strategy adopted by Cook County, Illinois, to transfer debt obligations to external entities. By doing so, the county can effectively manage its debts, lighten its financial burden, and allocate resources to public services and infrastructure development. The types of assignments may vary, including municipal bond assignments, loan assignments, and vendor/service provider debt assignments. These mechanisms ensure effective debt management, financial stability, and overall economic growth for Cook County.

Cook Illinois Assignment of Debt

Description

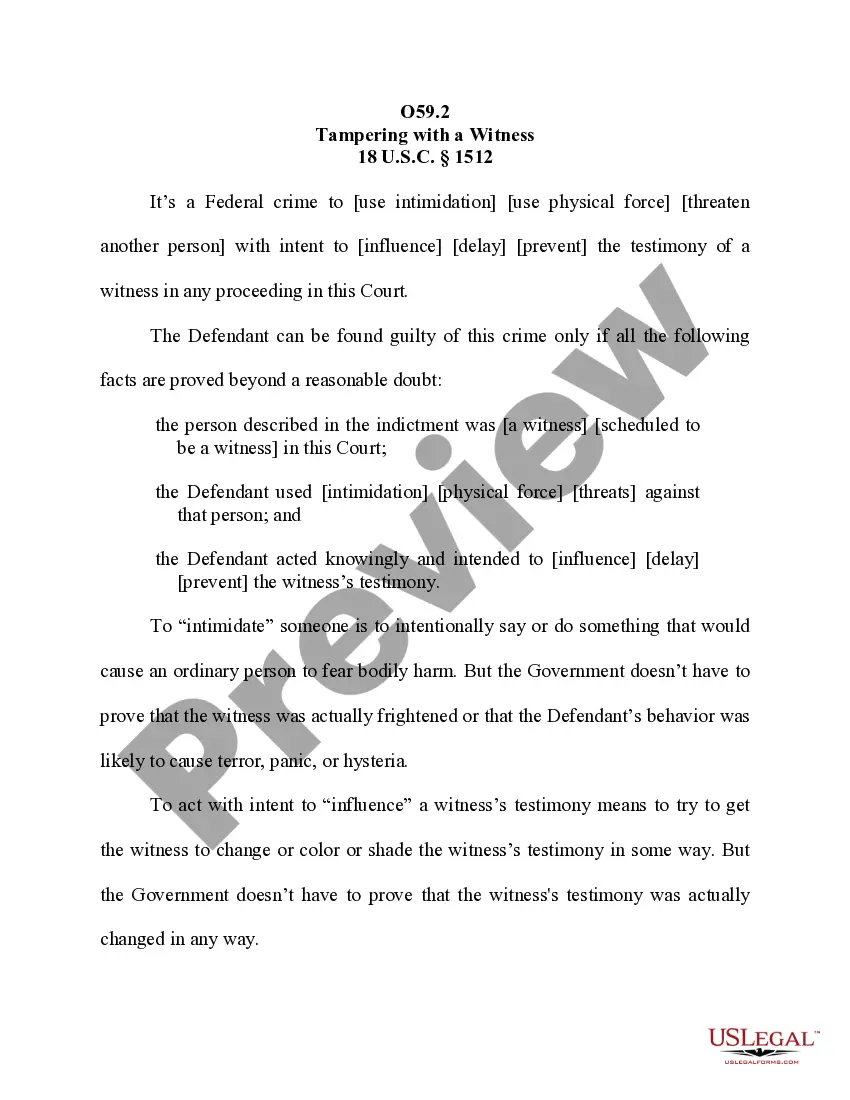

How to fill out Cook Illinois Assignment Of Debt?

Creating forms, like Cook Assignment of Debt, to manage your legal matters is a challenging and time-consumming task. A lot of circumstances require an attorney’s participation, which also makes this task expensive. However, you can take your legal matters into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal forms crafted for different scenarios and life circumstances. We make sure each form is in adherence with the laws of each state, so you don’t have to be concerned about potential legal issues compliance-wise.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Cook Assignment of Debt form. Simply log in to your account, download the form, and personalize it to your needs. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly straightforward! Here’s what you need to do before downloading Cook Assignment of Debt:

- Make sure that your document is compliant with your state/county since the rules for creating legal documents may vary from one state another.

- Discover more information about the form by previewing it or going through a brief description. If the Cook Assignment of Debt isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to begin using our website and get the document.

- Everything looks good on your side? Click the Buy now button and select the subscription option.

- Select the payment gateway and enter your payment information.

- Your template is all set. You can try and download it.

It’s easy to locate and buy the appropriate template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!

Form popularity

FAQ

A Debt Assignment and Assumption Agreement is a very simple document whereby one party assigns their debt to another party, and the other party agrees to take that debt on. The party that is assigning the debt is the original debtor; they are called the assignor.

An assignment for the benefit of creditors (ABC) is a business liquidation device available to an insolvent debtor as an alternative to formal bankruptcy proceedings. In many instances, an ABC can be the most advantageous and graceful exit strategy.

An "assignment" is the document that is the legal record of this transfer from one mortgagee to another. In a typical transaction, when the mortgagee sells the debt to another bank, an assignment is recorded, and the promissory note is endorsed (signed over) to the new bank.

The term debt assignment refers to a transfer of debt, and all the associated rights and obligations, from a creditor to a third party. The assignment is a legal transfer to the other party, who then becomes the owner of the debt.

An assignment of debt is an agreement that transfers a debt owed to one entity, to another. A creditor does not need the consent of the debtor to assign a debt.

The term debt assignment refers to a transfer of debt, and all the associated rights and obligations, from a creditor to a third party. The assignment is a legal transfer to the other party, who then becomes the owner of the debt.

A general assignment is one involving the transfer of all the debtor's property for the benefit of all his or her creditors. A partial assignment is one in which only part of a debtor's property is transferred to benefit all the creditors.

Assignment for the benefit of the creditors (ABC)(also known as general assignment for the benefit of the creditors) is a voluntary alternative to formal bankruptcy proceedings that transfers all of the assets from a debtor to a trust for liquidating and distributing its assets.

As nouns the difference between assignment and assign is that assignment is the act of assigning; the allocation of a job or a set of tasks while assign is an assignee.

A General Assignment is a document that declares that certain property is held and vested in the name of a trust. Since a trust only works when it holds property, this document is crucial for the funding of a Revocable Trust.

Interesting Questions

More info

Keep it warm until ready to use. If required, use a toothpick to remove the browned, cooked meat from the bottom of the pan. Cook 1 ½ pounds of meat in the pan until the beef is well browned on both sides. The meat will have a slight rubbery and rubbery-smooth, semi-glazed appearance. Transfer the meat to the paper cup holder in your oven. Leave the cup holder in the oven at 375 F for an hour. Remove the cup holder and set aside. Set the cup holder on a pan set over medium heat. Sprinkle the meat on all sides with salt. Cook a few minutes. Reduce the heat, cover the pot, and cook 10 minutes. Reduce the heat to 350 F and cook 5 minutes. Transfer the meat to a cutting board. Use tongs or an offset spatula to transfer the beef to a serving platter and cover with foil. Cook an additional 20 minutes under 400 F, turning the beef once each time, until the meat is very tender. Turn off heat, cover the platter with foil and let rest 10 minutes.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.