Keywords: San Diego, California, assignment of debt, types San Diego California Assignment of Debt refers to the legal process by which a creditor transfers their right to collect a debt to another party or entity. This financial transaction is commonly utilized when a creditor wants to recover outstanding funds owed to them but chooses to delegate the responsibility of collection to a third party. There are several types of Assignment of Debt in San Diego, California, each tailored to specific circumstances: 1. Voluntary Assignment of Debt: This occurs when both the creditor and debtor mutually agree on the transfer of debt. The creditor typically assigns the debt to a collection agency or a debt purchasing company that specializes in debt recovery. From there, the assigned party assumes all rights to collect the debt. 2. Involuntary Assignment of Debt: Also known as a forced assignment, this type occurs when a court orders the assignment of debt. Typically, it happens when a creditor initiates legal proceedings against a debtor, and the court intervenes to enforce the transfer of debt to a specified assignee. 3. Mortgage Assignment: In mortgage-related cases, a lender or mortgage holder may assign the debt to another financial institution or investor. The assigned entity then becomes responsible for collecting mortgage payments and managing the associated loan. 4. Student Loan Assignment: In the context of student loans, lenders may assign the debt to the Department of Education or to a loan servicing company. This assignment often occurs when a borrower defaults on their loan payments, and the lender seeks assistance in debt collection. 5. Credit Card Debt Assignment: Credit card companies may assign the debt owed by a cardholder to a collection agency when the cardholder fails to make timely payments. The collection agency assumes the responsibility of recovering the outstanding balance from the debtor. Assignments of debt play a crucial role in the financial ecosystem of San Diego, California. Creditors utilize these mechanisms to secure their interests and reduce the burden of debt collection efforts. It is important to note that the assignment of debt must comply with state and federal laws governing debt collection practices, ensuring fairness and protecting the rights of all parties involved.

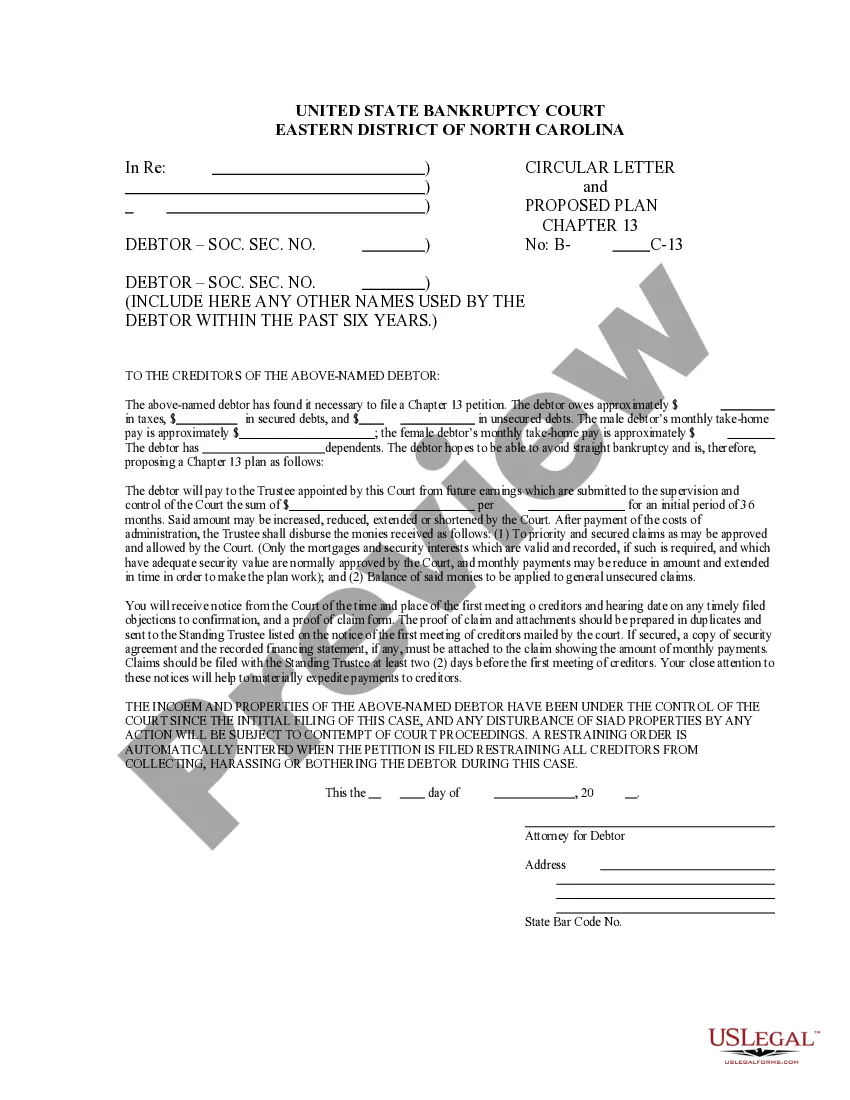

San Diego California Assignment of Debt

Description

How to fill out San Diego California Assignment Of Debt?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and many other life situations require you prepare official paperwork that differs from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal templates. Here, you can easily locate and get a document for any individual or business objective utilized in your county, including the San Diego Assignment of Debt.

Locating forms on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the San Diego Assignment of Debt will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guideline to get the San Diego Assignment of Debt:

- Make sure you have opened the proper page with your regional form.

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Look for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Select the appropriate subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the San Diego Assignment of Debt on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!