In Suffolk County, New York, the Assignment of Debt refers to the legal process through which a creditor transfers their rights to collect a debt to another party. This assignment can occur for various reasons, such as when a creditor wants to sell the debt to a debt collection agency or assign it to a third-party entity. The Assignment of Debt in Suffolk, New York involves the creditor (assignor) officially transferring the debt to another party (assignee), who then becomes the new owner and has the right to collect the debt. This process typically requires a written agreement known as an assignment agreement, where the assignor details the terms and conditions of the assignment. There are different types of Assignment of Debt in Suffolk, New York, depending on the nature of the debt and the parties involved. Some common types include: 1. Commercial Debt Assignment: This involves the assignment of debt between businesses, where a company transfers its outstanding invoices or unpaid accounts receivable to another company or debt buyer. 2. Consumer Debt Assignment: In this type of assignment, a creditor assigns the debt owed by an individual consumer to a third-party debt collector or agency. Consumer debt can include credit card debt, personal loans, medical bills, or any other debt incurred by an individual. 3. Mortgage Debt Assignment: This refers to the assignment of a mortgage debt from one lender to another. It often occurs when a mortgage lender wants to sell or transfer a loan to another financial institution. 4. Judgment Debt Assignment: When a creditor obtains a court judgment against a debtor who fails to repay the debt, they can assign the judgment debt to another party. This allows the assignee to take legal action to collect the judgment, such as wage garnishment or property liens. The Assignment of Debt in Suffolk, New York, is subject to state laws and regulations. It is important for both the assignor and assignee to understand their rights and obligations under these laws. Additionally, the assignment should be documented properly to ensure its enforceability in case of any disputes or legal proceedings. Overall, the Assignment of Debt in Suffolk, New York, is a crucial process that allows creditors to transfer their rights to collect a debt to another party. It helps streamline debt collection efforts and provides an opportunity for assignees to recover outstanding debts.

Suffolk New York Assignment of Debt

Description

How to fill out Suffolk New York Assignment Of Debt?

Laws and regulations in every area differ around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Suffolk Assignment of Debt, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals looking for do-it-yourself templates for various life and business occasions. All the documents can be used many times: once you pick a sample, it remains available in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Suffolk Assignment of Debt from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Suffolk Assignment of Debt:

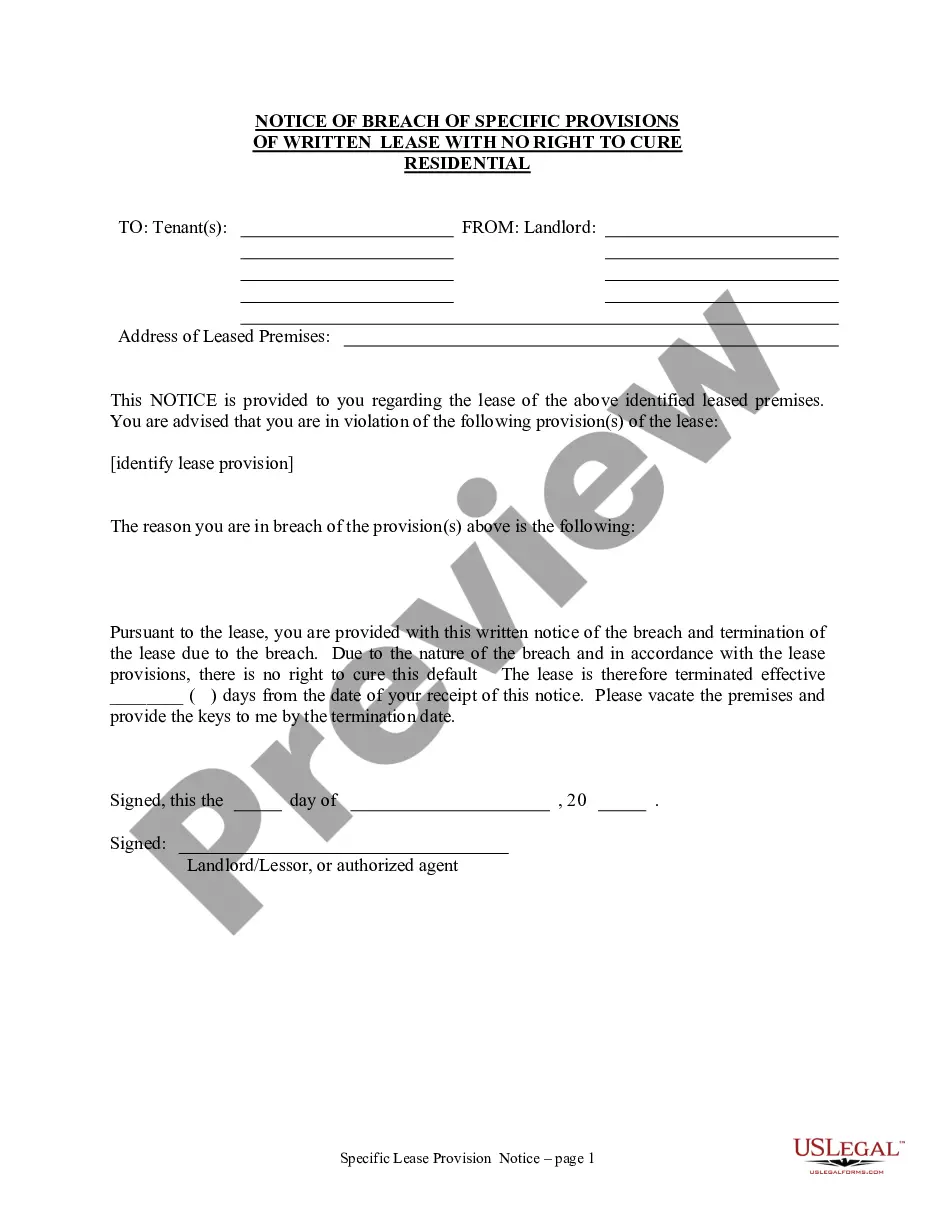

- Examine the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the document once you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!