Orange California Subcontractor Agreement for Insurance is a legally binding document that establishes the terms and conditions between an insurance company and a subcontractor in Orange, California. This agreement ensures that both parties have a clear understanding of their rights and obligations, mitigating potential disputes during the course of their working relationship. The Orange California Subcontractor Agreement for Insurance typically covers various aspects, including the subcontractor's role and responsibilities, fees and payment terms, insurance coverage, confidentiality, termination clauses, and dispute resolution procedures. This agreement serves as a crucial tool for managing risk, protecting proprietary information, and maintaining professional standards in the subcontracting relationship. There can be several types of Orange California Subcontractor Agreements for Insurance depending on the specific insurance industry and the scope of work involved. Some common types of subcontractor agreements include: 1. General Liability Subcontractor Agreement: This type of agreement outlines the subcontractor's responsibilities for any damage or injury caused during the course of their work. It also specifies the limits of liability coverage required by the subcontractor and any additional insurance requirements. 2. Professional Liability Subcontractor Agreement: This agreement is necessary when a subcontractor provides professional services, such as consulting or advice, to the insurance company. It outlines the standards of care, professional obligations, and potential liabilities associated with the services rendered. 3. Workers' Compensation Subcontractor Agreement: When a subcontractor employs workers, this agreement ensures that they have appropriate workers' compensation insurance coverage to protect the insurance company from any liability arising out of injuries or accidents that occur on the job. 4. Indemnity Agreement: An indemnity agreement is often included within the subcontractor agreement and states that the subcontractor will indemnify and hold harmless the insurance company from any claims, damages, or losses that may arise due to the subcontractor's actions or negligence. It is essential for both the insurance company and the subcontractor to review and understand the terms of the Orange California Subcontractor Agreement for Insurance carefully before signing. Consulting legal counsel with expertise in insurance law is advisable to ensure that all relevant laws and regulations are observed, and the agreement is tailored to the specific needs of the relationship.

Orange California Subcontractor Agreement for Insurance

Description

How to fill out Orange California Subcontractor Agreement For Insurance?

How much time does it usually take you to draft a legal document? Given that every state has its laws and regulations for every life sphere, locating a Orange Subcontractor Agreement for Insurance meeting all regional requirements can be stressful, and ordering it from a professional attorney is often costly. Numerous web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web collection of templates, grouped by states and areas of use. Apart from the Orange Subcontractor Agreement for Insurance, here you can find any specific form to run your business or personal affairs, complying with your county requirements. Experts check all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed sample, and download it. You can retain the document in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you obtain your Orange Subcontractor Agreement for Insurance:

- Examine the content of the page you’re on.

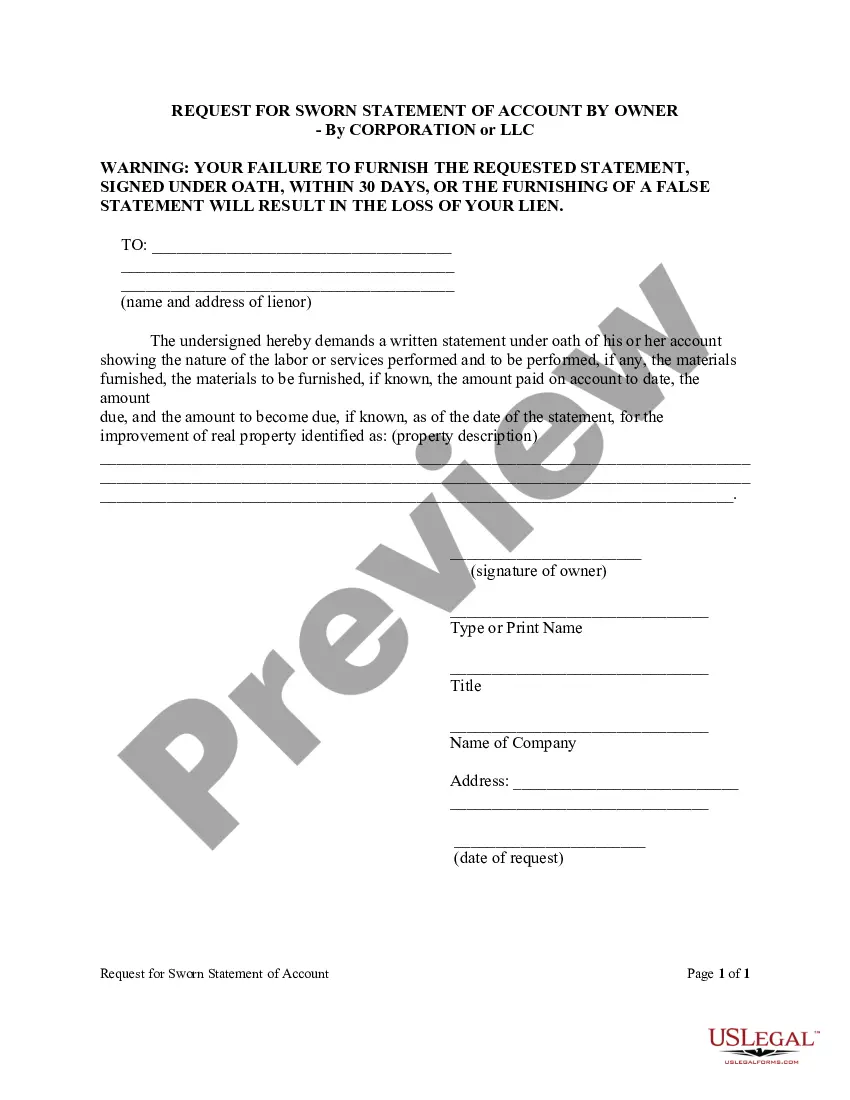

- Read the description of the sample or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Orange Subcontractor Agreement for Insurance.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!