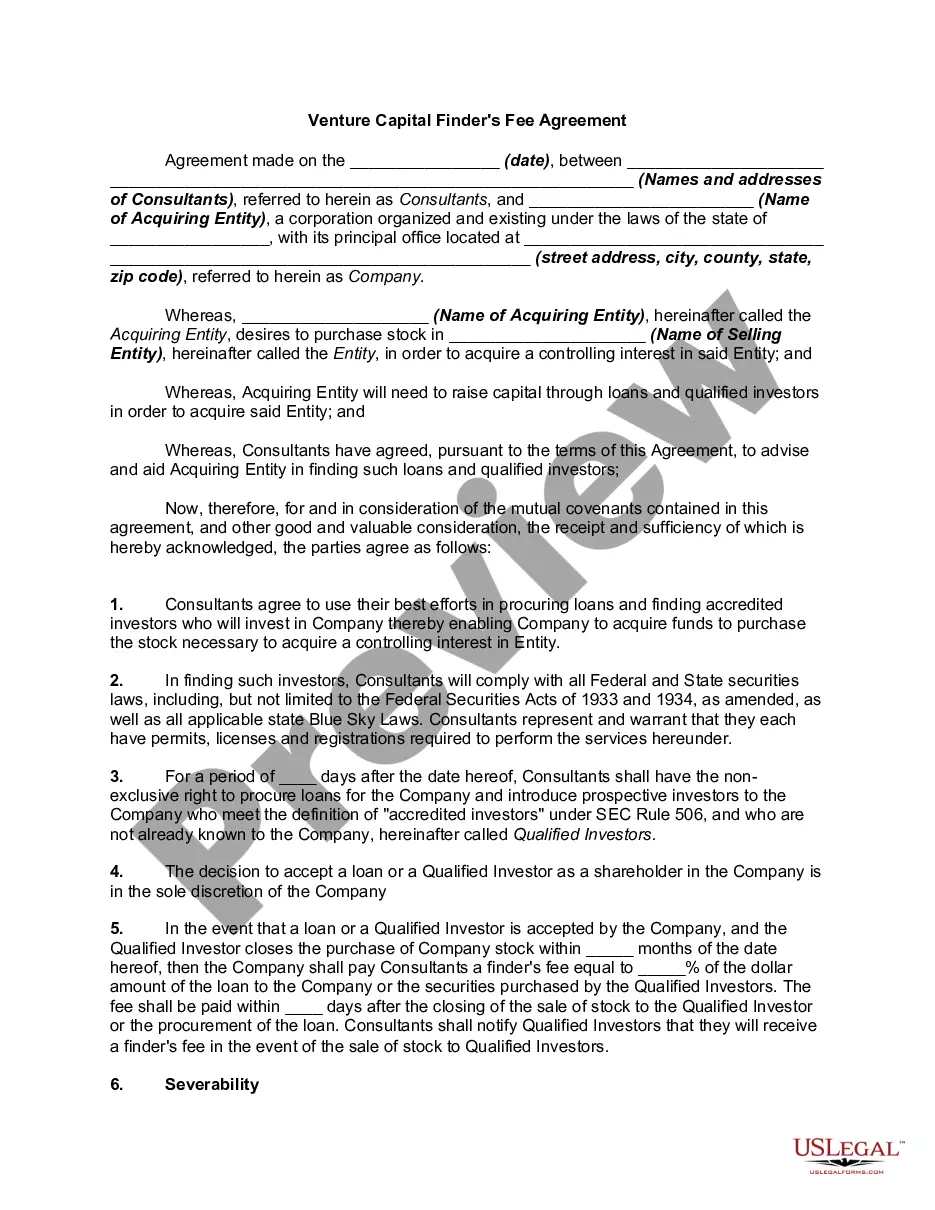

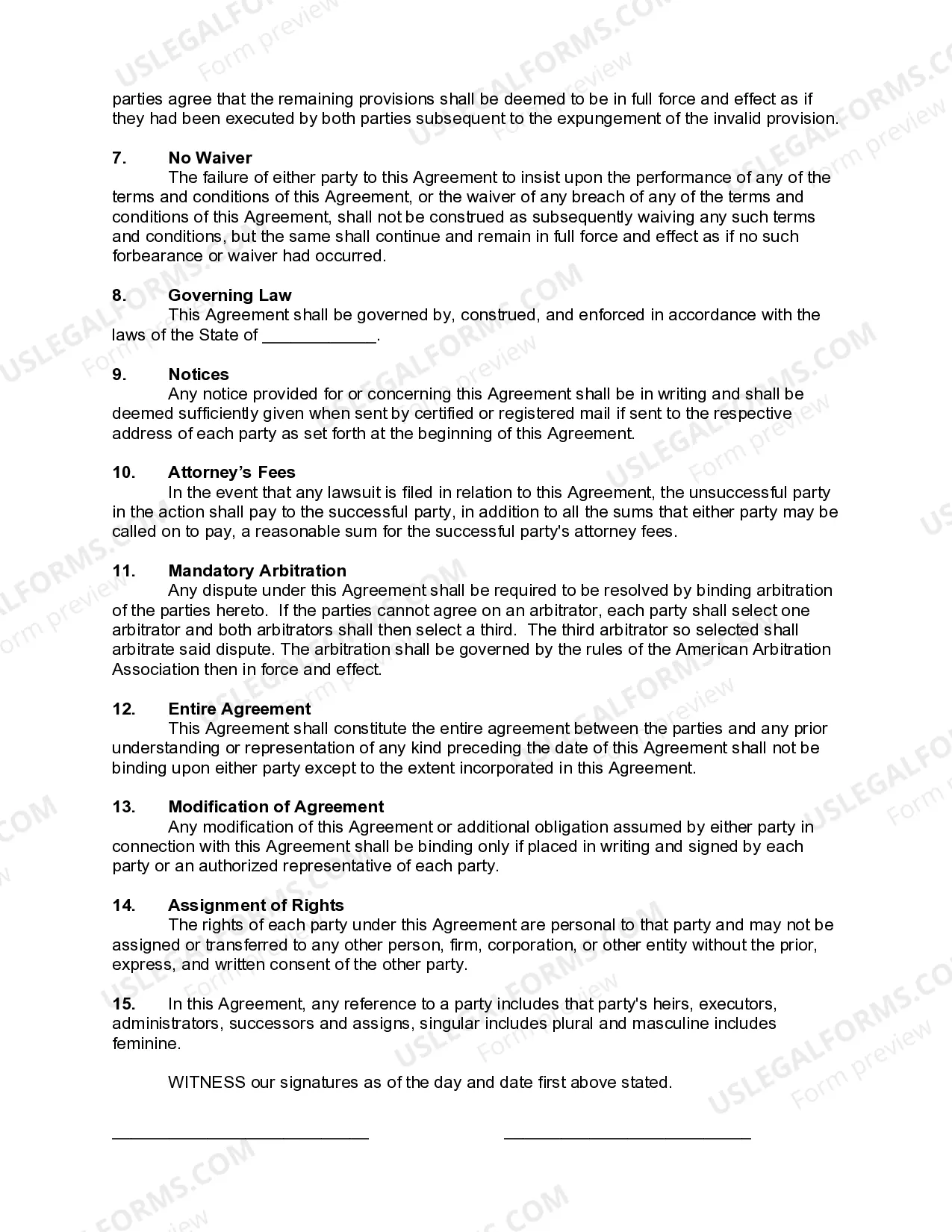

The Maricopa Arizona Venture Capital Finder's Fee Agreement is a legal document that outlines the terms and conditions for a finder's fee in the context of venture capital financing in Maricopa, Arizona. This agreement is crucial in formalizing the relationship between a venture capital firm and a finder who assists in locating potential investment opportunities. The agreement typically consists of several key sections, including: 1. Parties: This section identifies the involved parties, namely the venture capital firm and the finder or intermediary who acts as a connector between the firm and potential invested. 2. Purpose: It clearly defines the purpose of the agreement, which is to establish the terms by which the finder will receive compensation for successfully connecting the venture capital firm with suitable investment prospects. 3. Finder's Fee Terms: This section outlines the specifics of the compensation structure. It may include provisions on the fee percentage the finder is entitled to, the timing of payment (upon successful investment or in installments), and any additional conditions that determine eligibility for the finder's fee. 4. Exclusivity and Non-Circumvention: In some cases, the agreement may incorporate exclusivity clauses, which restrict the finder from engaging with other venture capital firms during the term of the agreement. Additionally, non-circumvention provisions prevent the finder from directly approaching or dealing with invested without involving the venture capital firm. 5. Confidentiality: This section establishes the obligation of both parties to maintain confidentiality regarding any sensitive information shared during the course of the relationship. It ensures the protection of trade secrets, confidential investment opportunities, and business strategies. 6. Termination: The agreement may outline the circumstances under which either party has the right to terminate the agreement. Common termination conditions include breach of contract, failure to perform obligations, or mutual agreement. In Maricopa, Arizona, specific types of Venture Capital Finder's Fee Agreements may exist, depending on the nature of the venture capital investment and the needs of the parties involved. For example: 1. Early-Stage Venture Capital Finder's Fee Agreement: This type of agreement focuses on identifying and connecting with startup companies seeking initial funding rounds. 2. Growth-Stage Venture Capital Finder's Fee Agreement: Here, the agreement centers around identifying mature businesses with steady growth potential that require subsequent rounds of financing. 3. Industry-Specific Venture Capital Finder's Fee Agreement: This variant caters to specialized sectors where the venture capital firm seeks opportunities within a particular industry, such as technology, biotech, or real estate. In summary, the Maricopa Arizona Venture Capital Finder's Fee Agreement is a contractual framework that establishes the terms of compensation for finders who successfully connect venture capital firms with suitable investment opportunities. The agreement is designed to protect the interests of all parties involved and ensure clear communication about the fee structure, confidentiality, exclusivity, and termination conditions.

Maricopa Arizona Venture Capital Finder's Fee Agreement

Description

How to fill out Maricopa Arizona Venture Capital Finder's Fee Agreement?

Laws and regulations in every area vary throughout the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Maricopa Venture Capital Finder's Fee Agreement, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for various life and business occasions. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for further use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Maricopa Venture Capital Finder's Fee Agreement from the My Forms tab.

For new users, it's necessary to make several more steps to get the Maricopa Venture Capital Finder's Fee Agreement:

- Analyze the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the template once you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!