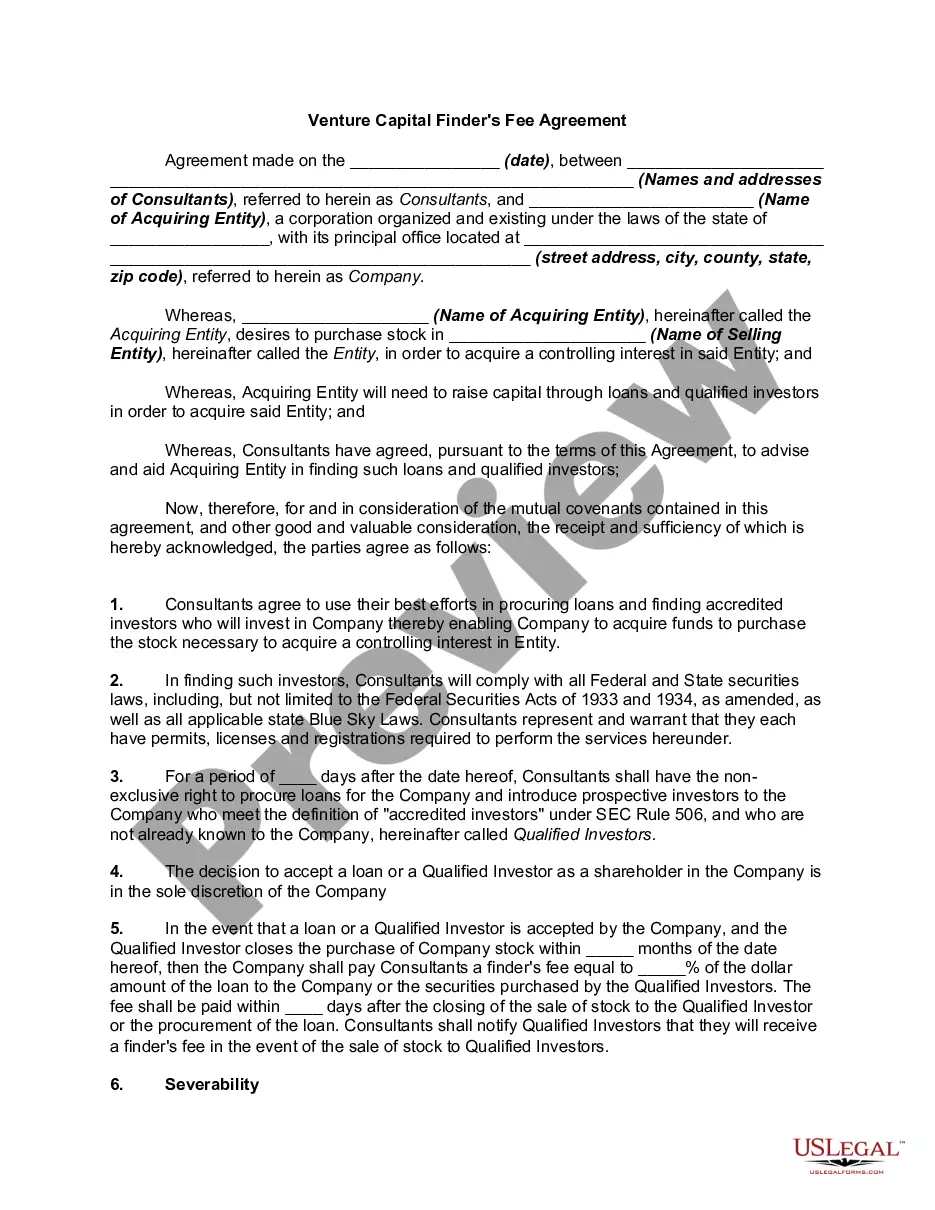

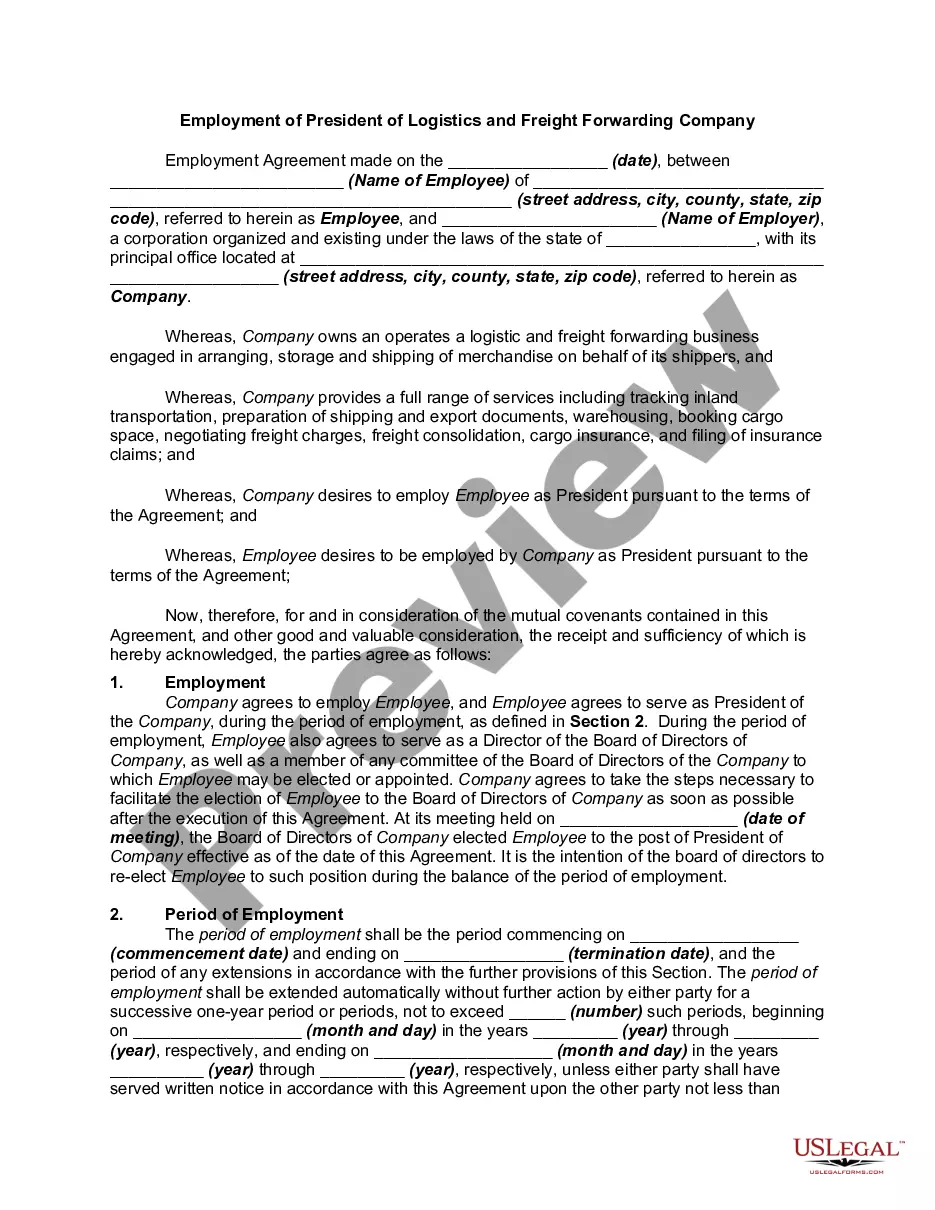

A Palm Beach Florida Venture Capital Finder's Fee Agreement is a legal document that outlines the terms and conditions between a venture capital firm and a finder, who is responsible for identifying and connecting the firm with potential investment opportunities. The purpose of this agreement is to specify the finder's compensation for successfully facilitating a venture capital deal. It ensures that both parties are in mutual agreement regarding the terms of payment and sets the conditions under which the finder is entitled to a fee. Within Palm Beach, Florida’s venture capital industry, there are different types of Finder's Fee Agreements that can be established: 1. Traditional Finder's Fee Agreement: This type of agreement sets a fixed fee as a percentage of the total amount invested by the venture capital firm. It outlines the conditions that need to be met for the finder to receive the fee, such as successful completion of due diligence, signing of legal agreements, or the investment going through. 2. Success Fee Agreement: In this arrangement, the finder's fee is based on the successful funding of the investment opportunity. The fee is usually a percentage of the investment amount and is only payable if the deal is completed successfully. 3. Equity Stake Agreement: Sometimes, instead of a fixed fee or success fee, the finder may negotiate for an equity stake in the investment opportunity or the company being funded. In such cases, the agreement outlines the percentage of equity to be received by the finder upon the completion of the deal. 4. Time-Based Fee Agreement: In rare cases, a finder may negotiate for a fee based on the time and effort invested in identifying potential investment opportunities, irrespective of the outcome. This type of agreement is less common and is usually applicable when the finder is working with the venture capital firm over an extended period. When drafting a Palm Beach Florida Venture Capital Finder's Fee Agreement, essential keywords to include are venture capital, finder, fee agreement, compensation, investment opportunity, Palm Beach Florida, conditions, percentage, due diligence, legal agreements, success fee, equity stake, time-based fee, and mutual agreement.

Palm Beach Florida Venture Capital Finder's Fee Agreement

Description

How to fill out Palm Beach Florida Venture Capital Finder's Fee Agreement?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare official paperwork that differs throughout the country. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any individual or business purpose utilized in your region, including the Palm Beach Venture Capital Finder's Fee Agreement.

Locating templates on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Palm Beach Venture Capital Finder's Fee Agreement will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guide to obtain the Palm Beach Venture Capital Finder's Fee Agreement:

- Ensure you have opened the correct page with your regional form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form meets your requirements.

- Search for another document using the search tab if the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Decide on the suitable subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Palm Beach Venture Capital Finder's Fee Agreement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!