Phoenix Arizona Venture Capital Finder's Fee Agreement is a legal contract that outlines the terms and conditions for a finder's fee arrangement between a venture capital firm and a finder, who assists in identifying and referring potential investment opportunities. This agreement is designed to protect the interests of both parties involved in the venture capital financing process. It serves as a binding contract that governs the payment of finder's fees and defines the scope of services provided by the finder. The Phoenix Arizona Venture Capital Finder's Fee Agreement typically covers various essential elements, including: 1. Parties Involved: The agreement clearly identifies the venture capital firm (the investor) and the finder (the party seeking out potential investment leads). 2. Finder's Duties and Responsibilities: The agreement outlines the specific tasks and activities the finder must perform, such as sourcing investment opportunities, conducting due diligence, and presenting qualified prospects to the venture capital firm. 3. Exclusivity: This section may state whether the finder has an exclusive or non-exclusive right to refer potential investment opportunities to the venture capital firm. If the agreement is exclusive, the finder may have the sole responsibility to source deals for a specific period. 4. Compensation and Payment Terms: The agreement outlines the finder's fee structure, including the percentage or flat fee payable to the finder upon the successful completion of a funding transaction. It also specifies the mode and frequency of payment. 5. Disclosure and Confidentiality: This section addresses the exchange of sensitive information between the parties and includes provisions to protect confidential data shared during the investment sourcing process. 6. Termination: The agreement may define conditions under which either party can terminate the arrangement, such as breach of contract or failure to perform assigned duties. Additionally, there may be variations of the Phoenix Arizona Venture Capital Finder's Fee Agreement, tailored to different circumstances or investment stages: 1. Early-stage Finder's Fee Agreement: This type may apply to finders specializing in identifying startups and early-stage companies seeking venture capital funding. 2. Growth-stage Finder's Fee Agreement: This variation is intended for finders who source investment opportunities for companies in their growth phase, seeking additional capital to expand operations or explore new markets. 3. Industry-Specific Finder's Fee Agreement: This type may focus on finders working within specific industries or sectors, such as technology, healthcare, or renewable energy. Overall, the Phoenix Arizona Venture Capital Finder's Fee Agreement plays a vital role in facilitating efficient deal sourcing and compensation within the venture capital ecosystem. It ensures transparency, clarifies expectations, and protects the rights of both parties involved in the investment process.

Phoenix Arizona Venture Capital Finder's Fee Agreement

Description

How to fill out Phoenix Arizona Venture Capital Finder's Fee Agreement?

How much time does it usually take you to draw up a legal document? Given that every state has its laws and regulations for every life sphere, finding a Phoenix Venture Capital Finder's Fee Agreement meeting all regional requirements can be tiring, and ordering it from a professional attorney is often pricey. Many online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, gathered by states and areas of use. Aside from the Phoenix Venture Capital Finder's Fee Agreement, here you can get any specific document to run your business or personal deeds, complying with your county requirements. Professionals verify all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed form, and download it. You can pick the document in your profile at any moment in the future. Otherwise, if you are new to the website, there will be a few more steps to complete before you get your Phoenix Venture Capital Finder's Fee Agreement:

- Check the content of the page you’re on.

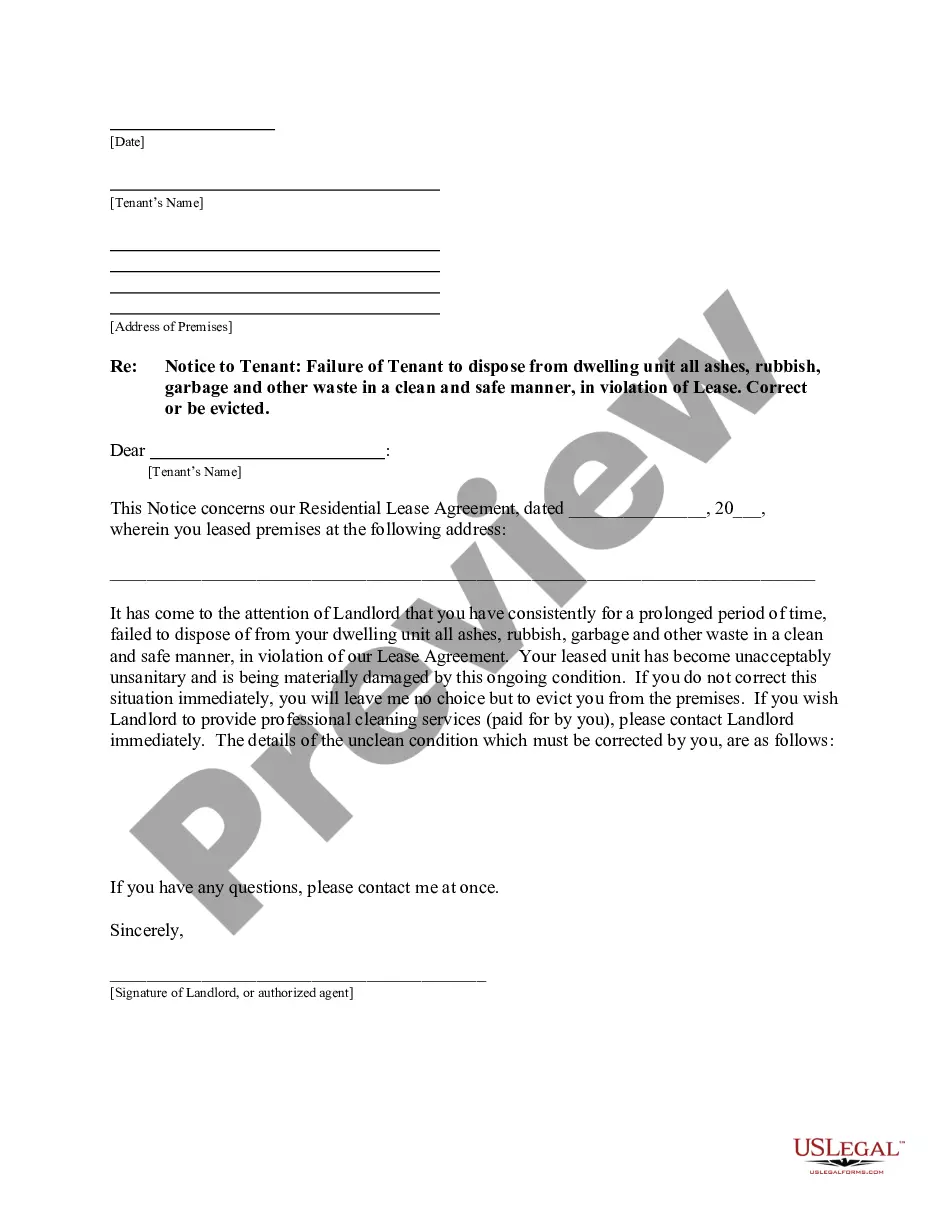

- Read the description of the template or Preview it (if available).

- Search for another document using the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Phoenix Venture Capital Finder's Fee Agreement.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!