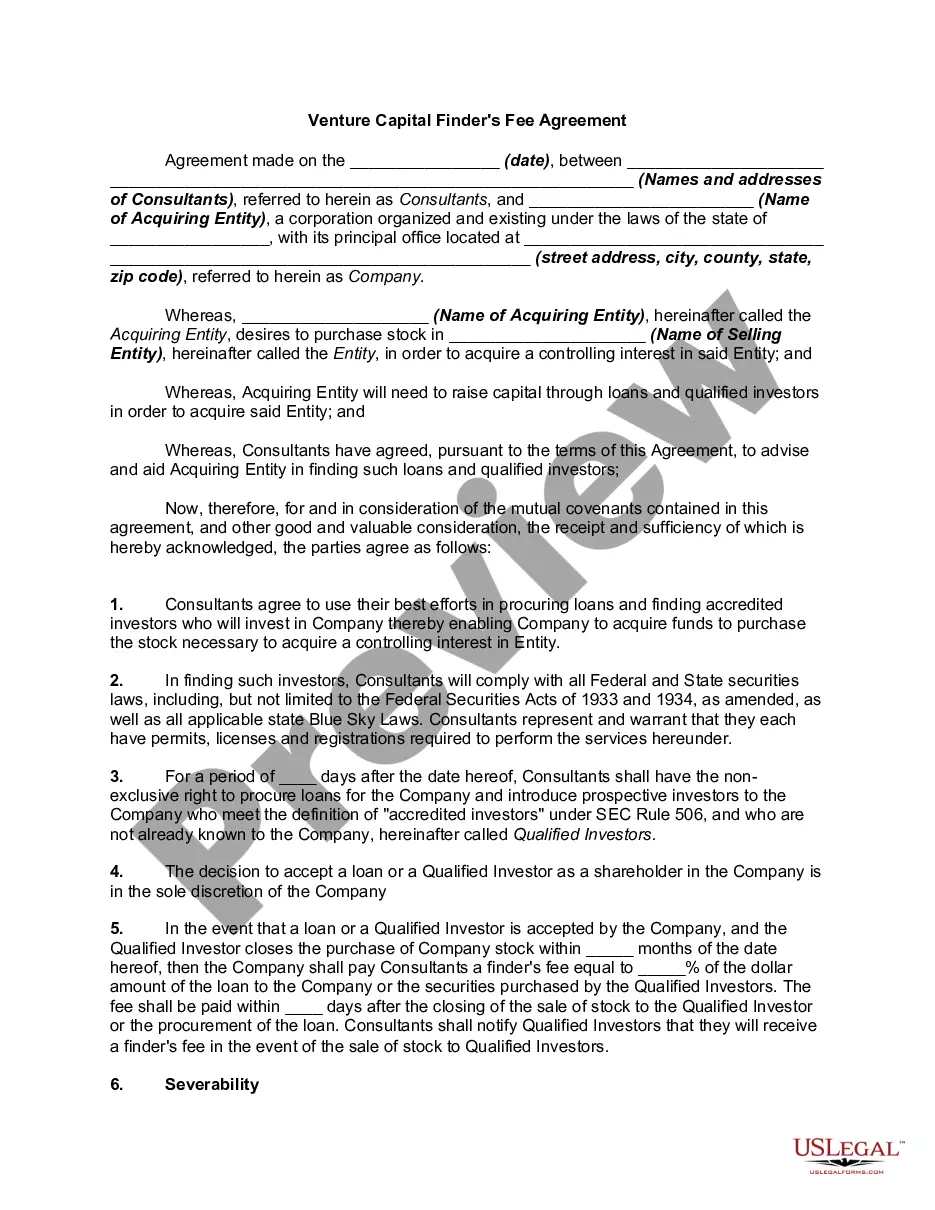

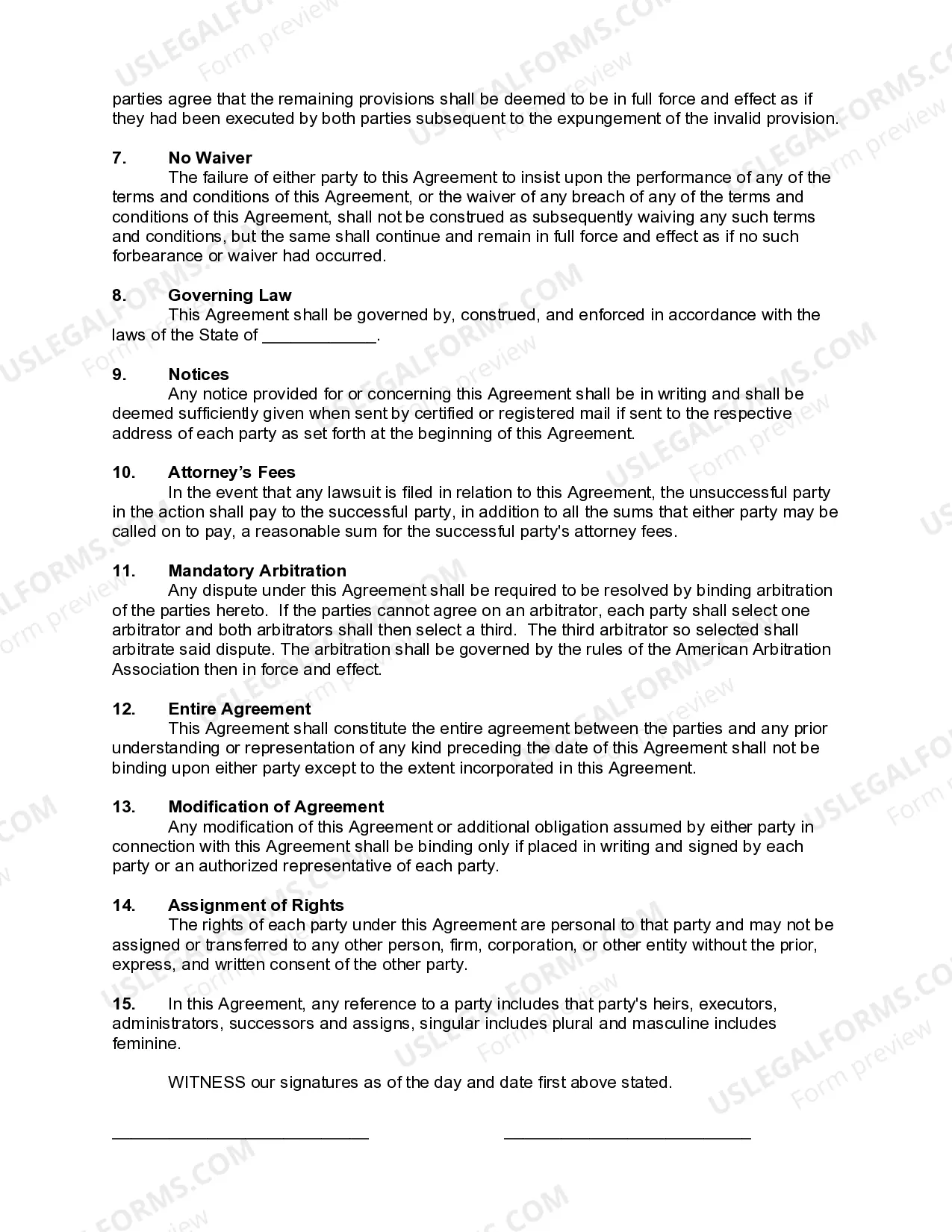

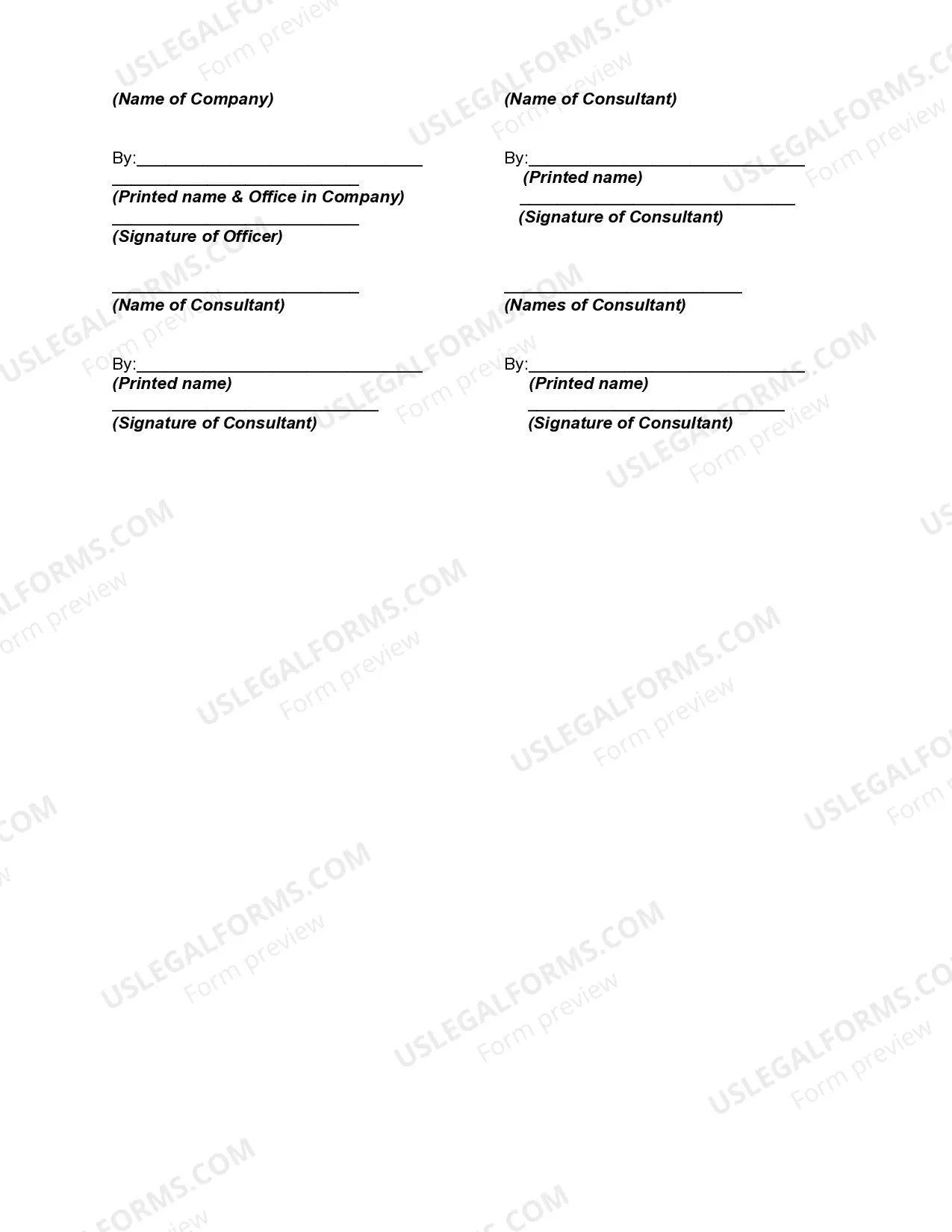

A San Diego California Venture Capital Finder's Fee Agreement refers to a legally binding agreement between a venture capital investor or firm, commonly known as the "capital provider," and an individual or entity acting as a finder or intermediary, referred to as the "finder." This agreement outlines the terms and conditions for compensating the finder for identifying and introducing investment opportunities to the capital provider. The finder's role is crucial as they often possess a network and knowledge of potential investment targets that the capital provider may not have access to. The San Diego California Venture Capital Finder's Fee Agreement typically includes the following essential elements: 1. Introduction of Parties: Identifies the parties involved, providing their legal names, addresses, and contact information. 2. Objectives: Clearly outlines the purpose of the agreement, emphasizing the finder's role in sourcing potential investments. 3. Compensation: Details the compensation structure for the finder and typically stipulates that the finder's fee is contingent upon the successful completion of an investment transaction. 4. Fee Calculation: Specifies how the finder's fee will be determined, whether it is a percentage of the total investment amount, a fixed fee, or subject to negotiation between the parties. 5. Exclusivity and Non-Circumvention: Includes provisions to ensure that the capital provider will not bypass the finder and directly engage with potential investment targets introduced by the finder. 6. Confidentiality: Establishes an understanding that the finder is exposed to sensitive information during the course of their activities and therefore must maintain strict confidentiality. 7. Representations and Warranties: Addresses the responsibilities and liability of both parties, ensuring that the finder's representations regarding investment opportunities are accurate and that the capital provider is legally permitted to enter into such agreements. There are various types of San Diego California Venture Capital Finder's Fee Agreements, some of which include: 1. Traditional Finder's Fee Agreement: This is the standard agreement, where the finder receives a predetermined fee or a percentage of the total investment amount as compensation. 2. Deal-Specific Finder's Fee Agreement: This agreement is tailored to a particular investment opportunity, outlining specific fee structures, roles, and responsibilities unique to that deal. 3. Exclusive Finder's Fee Agreement: This version restricts the capital provider from engaging any other finders or intermediaries while the agreement is active, usually providing the finder with enhanced compensation. 4. Non-Exclusive Finder's Fee Agreement: This agreement permits the capital provider to engage multiple finders simultaneously, dividing the finder's fees among them accordingly. These agreements play a crucial role in fostering relationships between capital providers and finders, helping drive investment opportunities in San Diego, California's vibrant venture capital ecosystem.

San Diego California Venture Capital Finder's Fee Agreement

Description

How to fill out San Diego California Venture Capital Finder's Fee Agreement?

Laws and regulations in every area differ around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the San Diego Venture Capital Finder's Fee Agreement, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used many times: once you pick a sample, it remains accessible in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the San Diego Venture Capital Finder's Fee Agreement from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the San Diego Venture Capital Finder's Fee Agreement:

- Take a look at the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the document once you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!