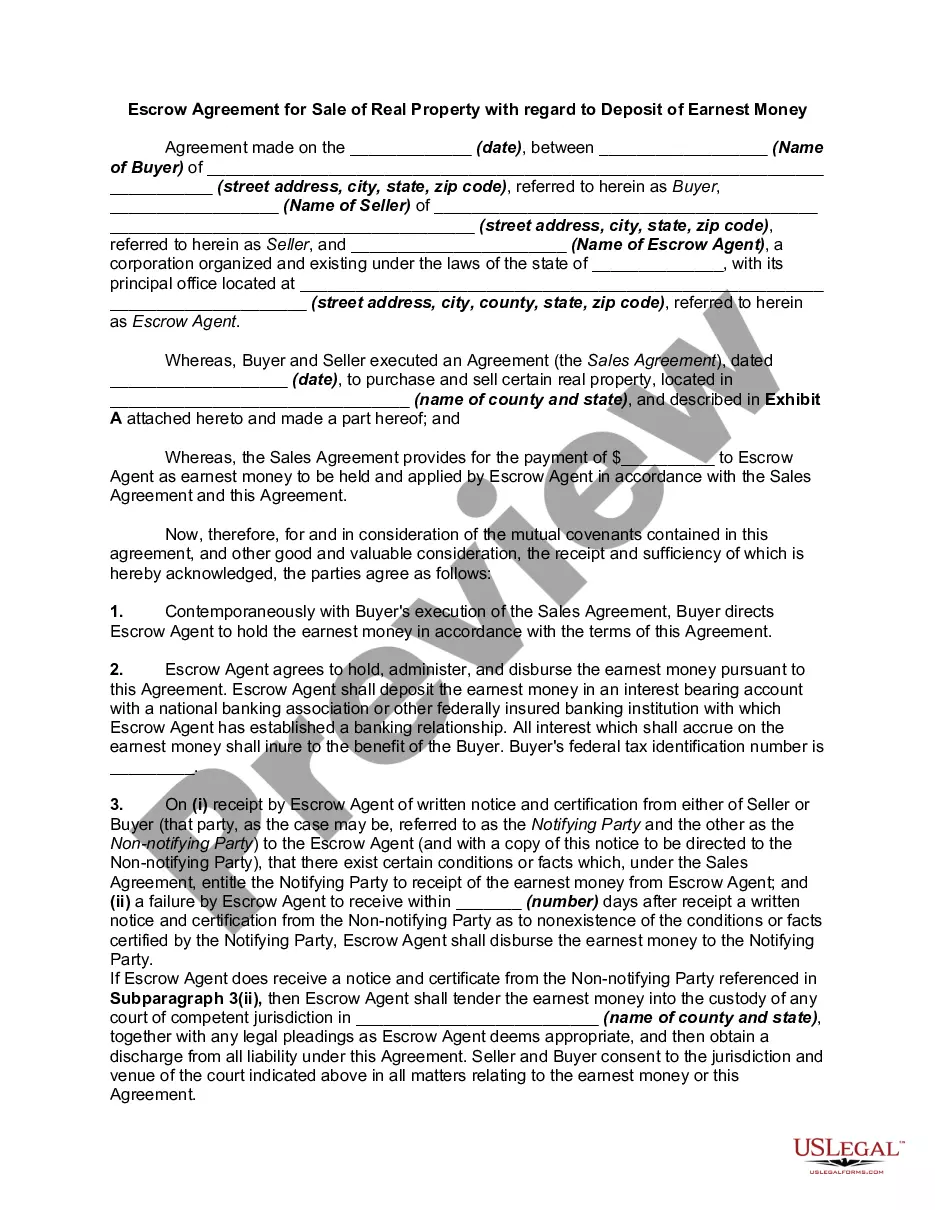

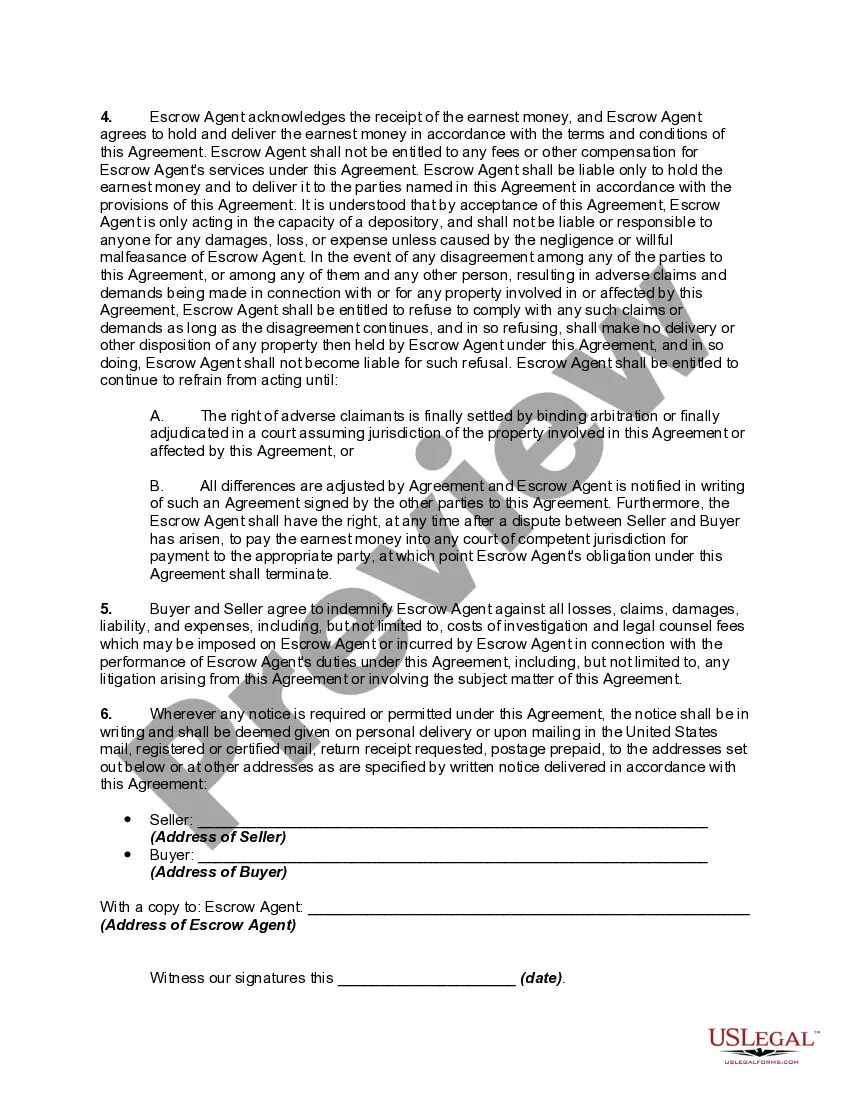

The Bronx, New York Escrow Agreement for Sale of Real Property with regard to Deposit of Earnest Money is a legal document that outlines the terms and conditions related to the deposit of earnest money in the context of a real estate transaction in the Bronx, New York. This agreement serves as a safeguard for both the buyer and the seller, establishing a neutral third party (escrow agent) to hold and manage the funds until the completion of the sale. Keywords: Bronx New York, Escrow Agreement, Sale of Real Property, Deposit of Earnest Money. In the Bronx real estate market, there can be variations of the Escrow Agreement for Sale of Real Property with regard to Deposit of Earnest Money, depending on the specific requirements and preferences of the involved parties. Here are a few common types: 1. Standard Escrow Agreement: This is the most common form of the agreement used in the Bronx, New York. It establishes the general terms and conditions for the deposit of earnest money, including the amount, deadlines, and the conditions for release or forfeiture of the funds. 2. Contingency-based Escrow Agreement: In some cases, the buyer may wish to include contingency clauses in the agreement, allowing them to withdraw from the transaction and retrieve their earnest money under certain predefined conditions (e.g., unsatisfactory inspection results or failure to secure financing). 3. Mutual Consent Escrow Agreement: This type of agreement is used when the buyer and seller have mutually agreed upon specific terms, different from the standard ones. It outlines these unique terms, such as modified deposit amounts, alternative deadlines, or specific release conditions for the earnest money. 4. Non-Refundable Escrow Agreement: In certain situations, the buyer may choose to make the earnest money non-refundable, even if the sale does not proceed. This type of agreement ensures that the seller is compensated if the buyer fails to fulfill their obligations. Regardless of the specific type, a Bronx New York Escrow Agreement for Sale of Real Property with regard to Deposit of Earnest Money is a vital instrument in protecting the interests of both parties involved in a real estate transaction. It provides a transparent and accountable platform for the secure handling of earnest money funds until the completion of the sale.

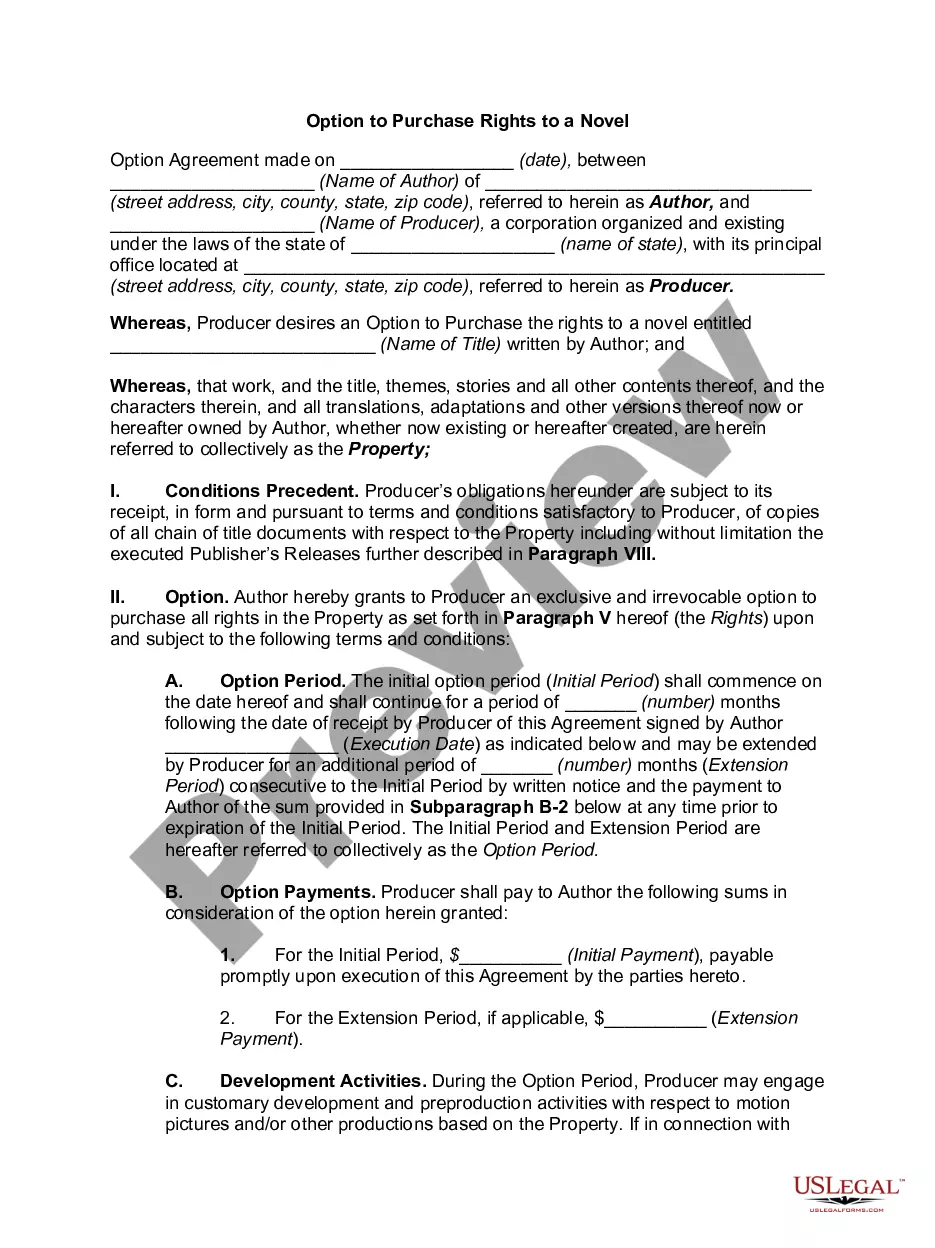

Bronx New York Escrow Agreement for Sale of Real Property with regard to Deposit of Earnest Money

Description

How to fill out Bronx New York Escrow Agreement For Sale Of Real Property With Regard To Deposit Of Earnest Money?

Creating legal forms is a must in today's world. However, you don't always need to look for qualified assistance to create some of them from scratch, including Bronx Escrow Agreement for Sale of Real Property with regard to Deposit of Earnest Money, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to choose from in different types varying from living wills to real estate paperwork to divorce documents. All forms are organized based on their valid state, making the searching experience less overwhelming. You can also find detailed resources and guides on the website to make any activities associated with paperwork execution simple.

Here's how to find and download Bronx Escrow Agreement for Sale of Real Property with regard to Deposit of Earnest Money.

- Take a look at the document's preview and outline (if provided) to get a general idea of what you’ll get after getting the document.

- Ensure that the document of your choice is specific to your state/county/area since state regulations can impact the validity of some documents.

- Examine the related document templates or start the search over to find the right file.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a needed payment method, and purchase Bronx Escrow Agreement for Sale of Real Property with regard to Deposit of Earnest Money.

- Choose to save the form template in any available file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Bronx Escrow Agreement for Sale of Real Property with regard to Deposit of Earnest Money, log in to your account, and download it. Needless to say, our platform can’t take the place of a lawyer completely. If you have to cope with an extremely complicated case, we recommend getting an attorney to check your document before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of users. Join them today and purchase your state-compliant documents effortlessly!