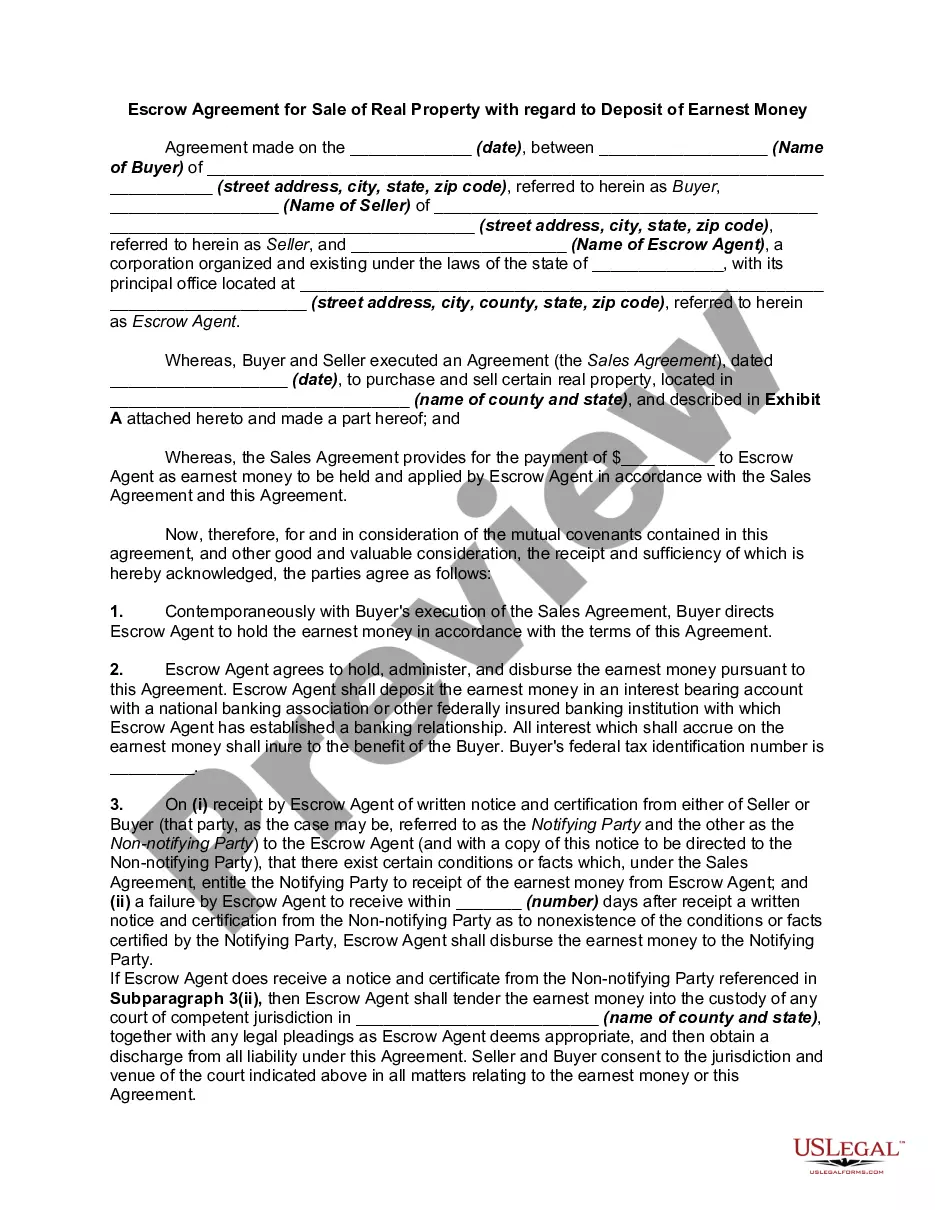

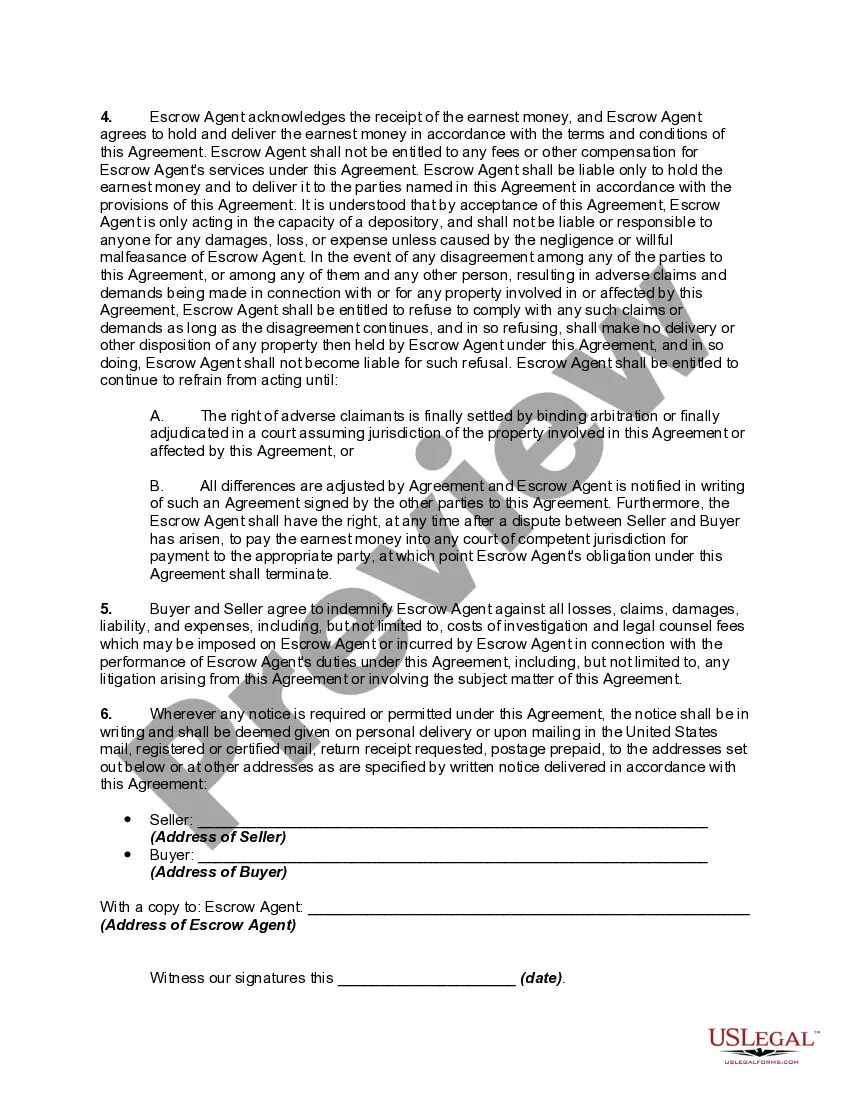

Fulton Georgia Escrow Agreement for Sale of Real Property with regard to Deposit of Earnest Money serves as a legally binding document between the buyer, seller, and escrow agent involved in a real estate transaction. This agreement outlines the terms and conditions regarding the handling and release of the earnest money deposit. The earnest money deposit, which is a sum of money provided by the buyer as a show of good faith, is typically held in an escrow account until the closing of the property purchase. This agreement ensures that the deposit is handled securely and fairly throughout the transaction process. The key elements typically found in a Fulton Georgia Escrow Agreement for Sale of Real Property with regard to Deposit of Earnest Money include: 1. Parties involved: This section identifies the buyer, seller, and escrow agent, including their legal names and contact information. It is crucial to accurately identify all parties involved. 2. Property details: This section provides details about the real property being sold, such as the property address, legal description, and any relevant parcel or tax identification numbers. 3. Earnest money deposit: This part highlights the amount of earnest money being deposited by the buyer, the method of payment, and the deadline for the deposit to be made. It may also specify any conditions or contingencies that must be met for the deposit to be refunded or released. 4. Escrow account: The agreement will outline the specific escrow account where the earnest money will be held, including the name of the financial institution and relevant account details. It may also stipulate whether the funds will accrue any interest during their holding period. 5. Release conditions: This section clarifies the circumstances under which the escrow agent can release the earnest money. Common conditions may include the successful completion of inspections, appraisal, financing approvals, or other contingencies outlined in the purchase contract. 6. Dispute resolution: If any disputes arise regarding the earnest money deposit, this agreement establishes the process for resolution, which may include mediation, arbitration, or legal action. It's important to note that while there may be variations of Fulton Georgia Escrow Agreements for Sale of Real Property with regard to Deposit of Earnest Money based on specific circumstances, such as commercial or residential properties, the fundamental elements mentioned above typically remain consistent.

Fulton Georgia Escrow Agreement for Sale of Real Property with regard to Deposit of Earnest Money

Description

How to fill out Fulton Georgia Escrow Agreement For Sale Of Real Property With Regard To Deposit Of Earnest Money?

Drafting documents for the business or personal demands is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state laws of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to create Fulton Escrow Agreement for Sale of Real Property with regard to Deposit of Earnest Money without expert assistance.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Fulton Escrow Agreement for Sale of Real Property with regard to Deposit of Earnest Money by yourself, using the US Legal Forms web library. It is the largest online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary document.

If you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Fulton Escrow Agreement for Sale of Real Property with regard to Deposit of Earnest Money:

- Examine the page you've opened and verify if it has the sample you need.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that satisfies your requirements, utilize the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal templates for any scenario with just a couple of clicks!