The Harris County, Texas Escrow Agreement for Sale of Real Property with regard to the Deposit of Earnest Money is a legal agreement that outlines the terms and conditions regarding the earnest money deposit for the sale of real property in Harris County, Texas. This agreement protects both the buyer and the seller by ensuring that the earnest money deposit is handled properly and fairly. The primary purpose of the Harris Texas Escrow Agreement is to establish a neutral third party, known as the escrow agent, who will hold the earnest money deposit until the closing of the real estate transaction. The escrow agent acts as an intermediary to ensure that the earnest money is handled in accordance with the terms agreed upon by the buyer and seller. The agreement typically includes important details such as: 1. Parties Involved: The agreement identifies the buyer, seller, and the escrow agent. It also provides their contact information and the role each party plays in the transaction. 2. Description of Property: The agreement includes a detailed description of the real property being sold. This may include the address, legal description, and any other relevant details necessary for proper identification. 3. Purchase Price and Earnest Money Deposit: The agreement specifies the purchase price for the property, as well as the amount of the earnest money deposit. Earnest money is a good faith deposit made by the buyer to demonstrate their serious intent to purchase the property. 4. Terms and Conditions: The terms and conditions section of the agreement covers various aspects of the earnest money deposit, such as how and when the deposit will be made, any contingencies or conditions for its release, and the consequences in case of default or breach of the agreement by either party. 5. Dispute Resolution: The agreement may include provisions for resolving disputes that may arise during the escrow period, such as mediation or arbitration. There may be different types of Harris Texas Escrow Agreements for Sale of Real Property with regard to Deposit of Earnest Money based on specific circumstances or requirements. Some potential variations include: 1. Residential Escrow Agreement: This type of escrow agreement is used for the sale of residential properties, such as single-family homes or condominiums. 2. Commercial Escrow Agreement: This agreement is designed for commercial real estate transactions involving properties like retail spaces, offices, or industrial buildings. 3. New Construction Escrow Agreement: When purchasing a property that is still under construction, a specialized escrow agreement may be used to address the unique aspects and requirements of new construction projects. 4. Foreign Investor Escrow Agreement: If the buyer or seller is a foreign individual or entity, additional provisions and regulations may be necessary to comply with applicable laws and regulations. In conclusion, the Harris County, Texas Escrow Agreement for Sale of Real Property with regard to the Deposit of Earnest Money is a vital legal document that safeguards the interests of both buyers and sellers during real estate transactions. It ensures that the earnest money deposit is properly handled, setting clear terms and conditions for its release or return in the event of a default or successful completion of the sale. Different variations of the agreement may exist depending on the type of property or specific circumstances involved in the transaction.

Harris Texas Escrow Agreement for Sale of Real Property with regard to Deposit of Earnest Money

Description

How to fill out Harris Texas Escrow Agreement For Sale Of Real Property With Regard To Deposit Of Earnest Money?

Laws and regulations in every area differ throughout the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Harris Escrow Agreement for Sale of Real Property with regard to Deposit of Earnest Money, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the forms can be used many times: once you purchase a sample, it remains available in your profile for further use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Harris Escrow Agreement for Sale of Real Property with regard to Deposit of Earnest Money from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Harris Escrow Agreement for Sale of Real Property with regard to Deposit of Earnest Money:

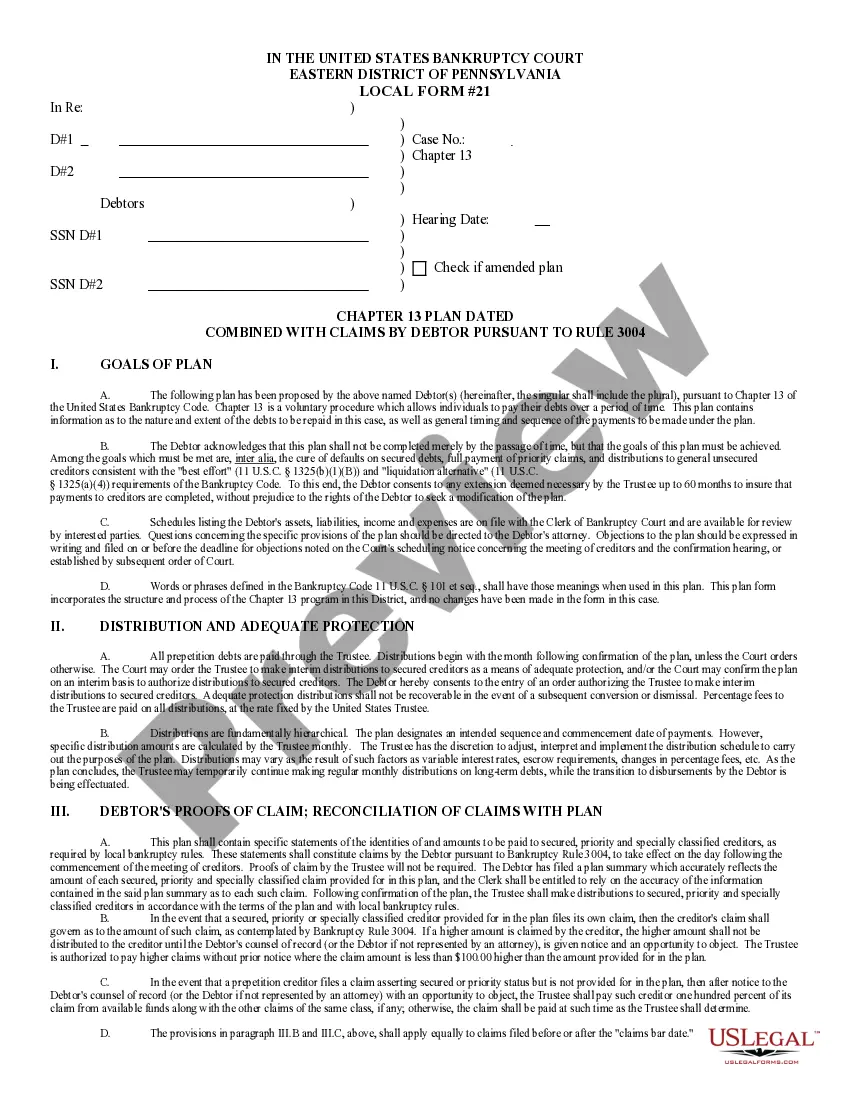

- Take a look at the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the document once you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!