Middlesex Massachusetts Prepayment Agreement is a legal contract that outlines the terms and conditions for prepaying a mortgage or loan in the county of Middlesex, Massachusetts. It allows borrowers to make additional payments towards the principal amount of their loans before the due date, which helps to reduce the overall interest paid over the life of the loan. By entering into a Middlesex Massachusetts Prepayment Agreement, borrowers can expedite the repayment process and potentially save a significant amount of money on interest payments. It provides them with the flexibility to make extra payments whenever their financial situation allows, without incurring any penalties or fees. The agreement typically specifies the procedures and requirements for making prepayments, as well as the calculation of interest savings. It may also outline any limitations or restrictions on the amount of extra payments that can be made within a specific time frame. Middlesex Massachusetts Prepayment Agreement ensures that borrowers have a clear understanding of their rights and responsibilities when it comes to prepaying their loans. There are no specific types of Middlesex Massachusetts Prepayment Agreements, as it is generally a standardized contract used by lenders and borrowers in the county. However, the terms and conditions of the agreement may vary depending on the specific mortgage or loan terms, such as fixed-rate mortgages, adjustable-rate mortgages, or personal loans. In conclusion, a Middlesex Massachusetts Prepayment Agreement is a crucial document for borrowers who intend to make early repayments on their loans in the county of Middlesex, Massachusetts. It facilitates the process of prepaying loans, enables borrowers to save money on interest payments, and provides them with the necessary guidance and information to exercise their prepayment rights effectively.

Middlesex Massachusetts Prepayment Agreement

Description

How to fill out Middlesex Massachusetts Prepayment Agreement?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and lots of other life situations require you prepare official paperwork that differs throughout the country. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and get a document for any personal or business purpose utilized in your region, including the Middlesex Prepayment Agreement.

Locating templates on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Middlesex Prepayment Agreement will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guide to obtain the Middlesex Prepayment Agreement:

- Make sure you have opened the correct page with your local form.

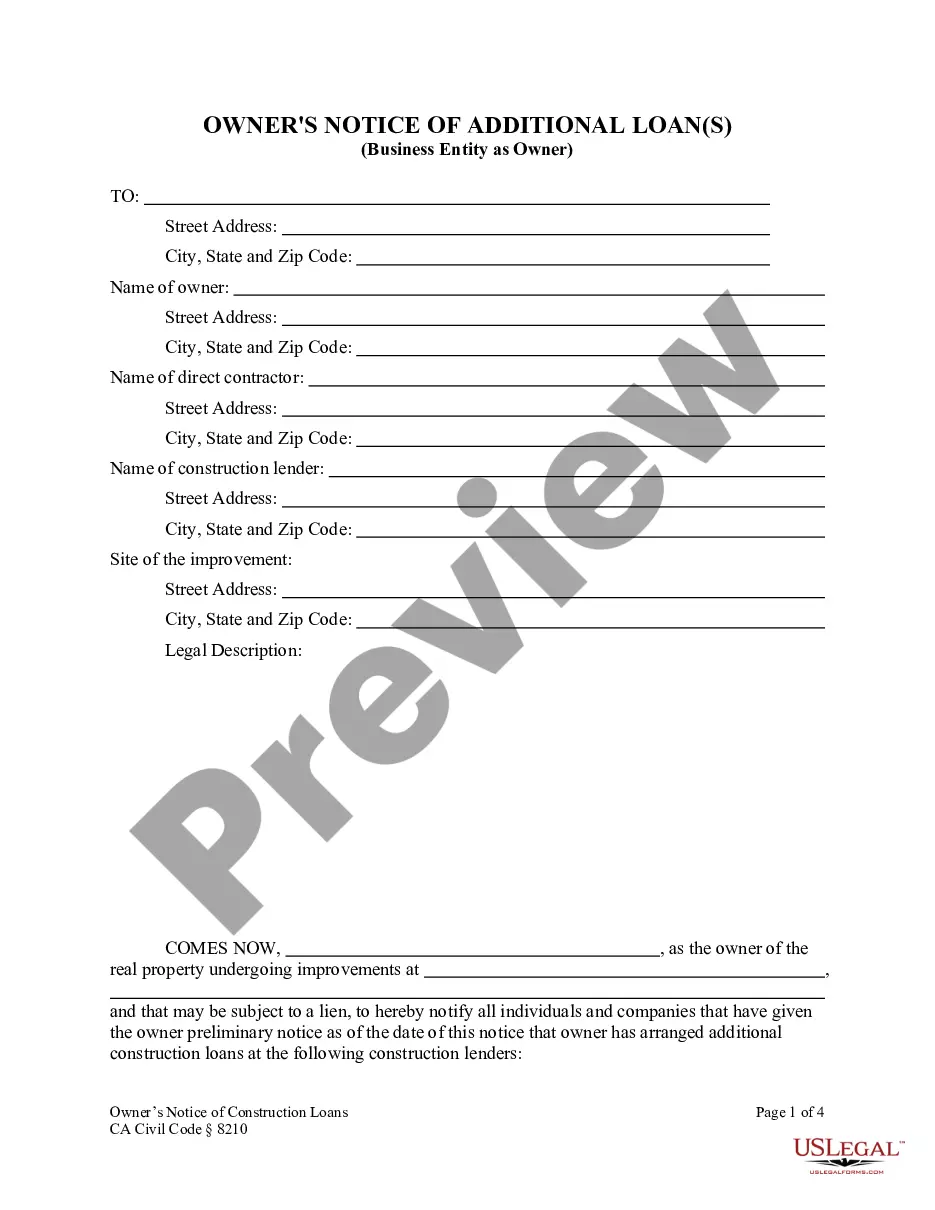

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template satisfies your needs.

- Search for another document via the search tab if the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Decide on the suitable subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Middlesex Prepayment Agreement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!