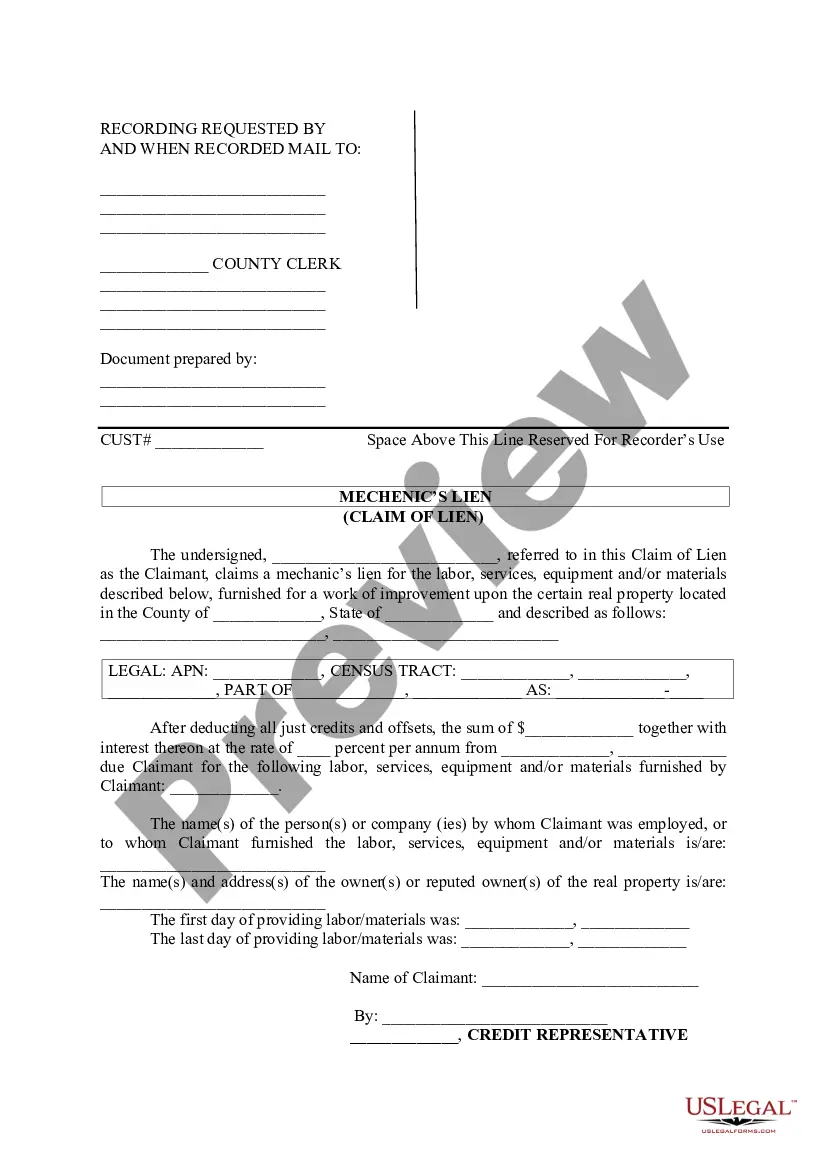

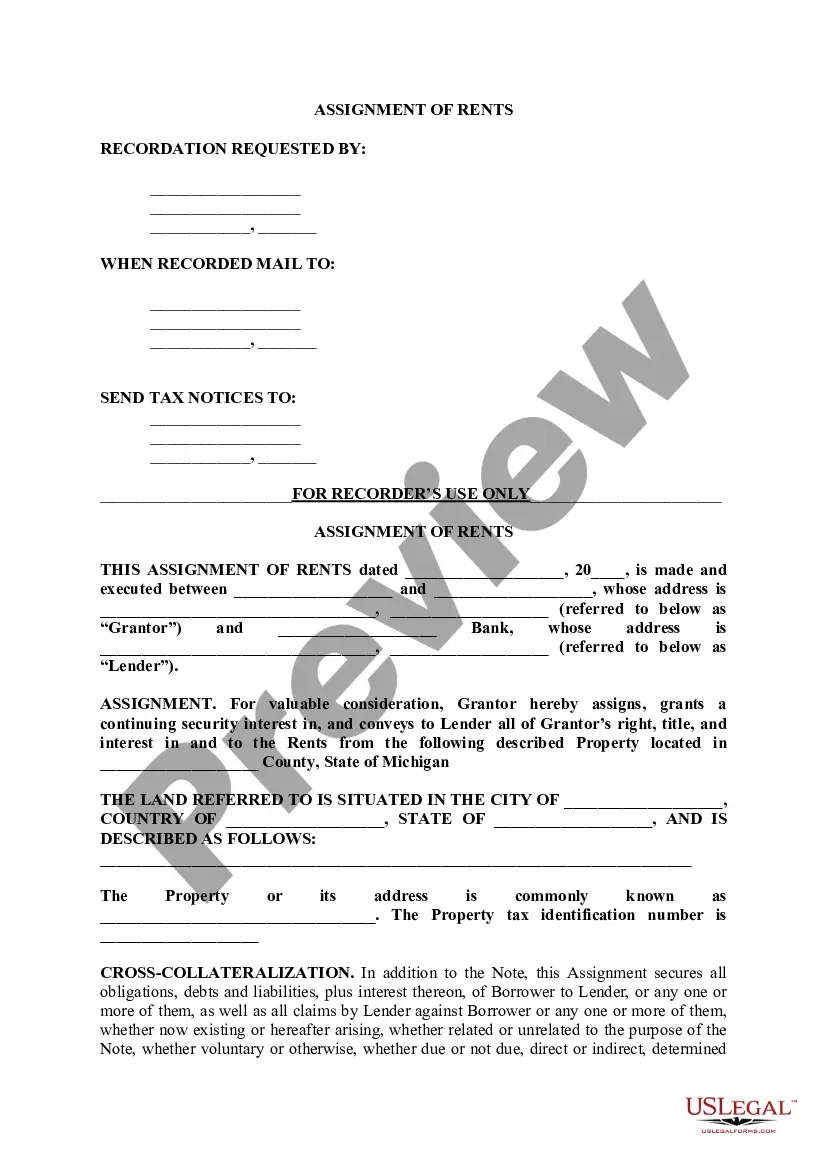

A Montgomery Maryland Prepayment Agreement is a legal contract between a lender and a borrower in Montgomery County, Maryland, that allows the borrower to prepay their mortgage loan before the scheduled maturity date, either partially or in full. This agreement sets forth the conditions, terms, and penalties associated with prepaying the loan. The key purpose of a Montgomery Maryland Prepayment Agreement is to provide the borrower with the flexibility to pay off the mortgage loan early, potentially saving on interest costs and reducing financial obligations over time. However, the terms of the agreement may vary depending on the specific type of prepayment agreement chosen. 1. Soft Prepayment Agreement: In this type of agreement, the borrower can prepay the loan partially or in full without incurring any penalties or fees. Soft prepayment agreements are considered more flexible as they allow borrowers to pay off the mortgage at their own pace. 2. Hard Prepayment Agreement: A hard prepayment agreement imposes penalties or fees on the borrower for prepaying the loan before the scheduled maturity date. These penalties are usually expressed as a percentage of the outstanding loan balance or a specific number of months' worth of interest. Hard prepayment agreements can be less flexible but may offer lower interest rates initially. 3. Prepayment Penalty: This is a specific provision within the prepayment agreement that outlines the penalties or fees applicable to the borrower for paying off the mortgage loan early. Prepayment penalties are typically designed to compensate the lender for potential lost interest income and can be structured as a fixed amount or a declining percentage over a specific period. It's important for borrowers in Montgomery County, Maryland, to carefully review and understand the terms of the Prepayment Agreement before signing. They should consider their financial situation, long-term plans, and the potential implications of prepaying a mortgage loan. Seeking legal advice is recommended to ensure compliance with the agreement and make informed decisions.

Montgomery Maryland Prepayment Agreement

Description

How to fill out Montgomery Maryland Prepayment Agreement?

How much time does it normally take you to draw up a legal document? Given that every state has its laws and regulations for every life sphere, locating a Montgomery Prepayment Agreement suiting all regional requirements can be tiring, and ordering it from a professional attorney is often pricey. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web collection of templates, collected by states and areas of use. Aside from the Montgomery Prepayment Agreement, here you can get any specific form to run your business or individual deeds, complying with your county requirements. Experts check all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can pick the document in your profile at any time in the future. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Montgomery Prepayment Agreement:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Montgomery Prepayment Agreement.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!